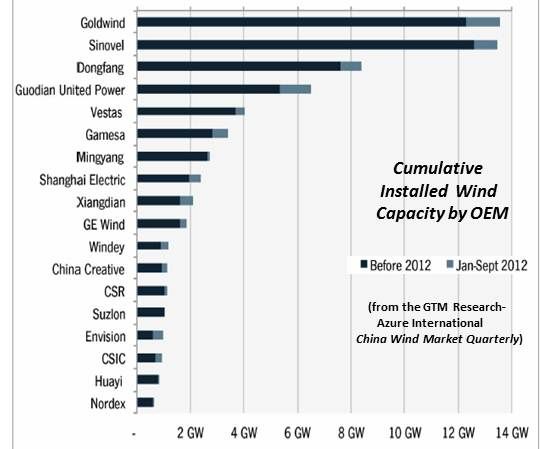

The debut GTM Research and Azure International China Wind Market Quarterly called 2012 “the best of times and the worst of times.”

The industry passed the 50 gigawatt cumulative installed capacity milestone and will likely set a new record for annual installed capacity at more than 12 gigawatts. Yet analysts believe the industry will be lucky to build 3 gigawatts and hold onto two-thirds of its workforce in 2013.

The PTC Bleeding and the Deal

One: “This bleeding must stop!” AWEA CEO Denise Bode declared last spring in calling for renewal of the vital $0.022 per kilowatt-hour production tax credit (PTC). But it has not been renewed and the bleeding has worsened.

Two: Thousands of manufacturing and supply chain jobs have been lost. Sinovel, Goldwind and Ming Yang (NYSE:MY) each recently let hundreds go. Vestas, Gamesa and Iberdrola have cumulatively dismissed thousands. Facilities all over the U.S. have shuttered or moved to other industries.

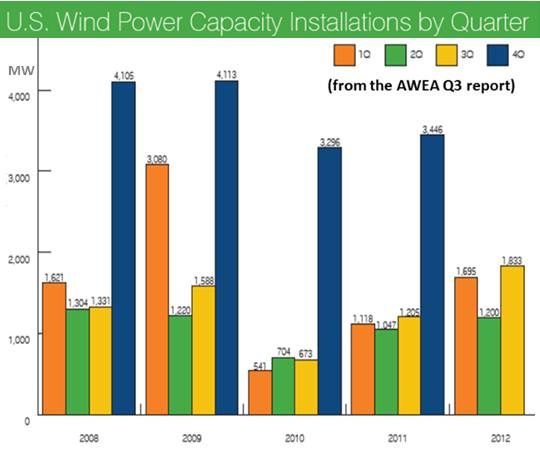

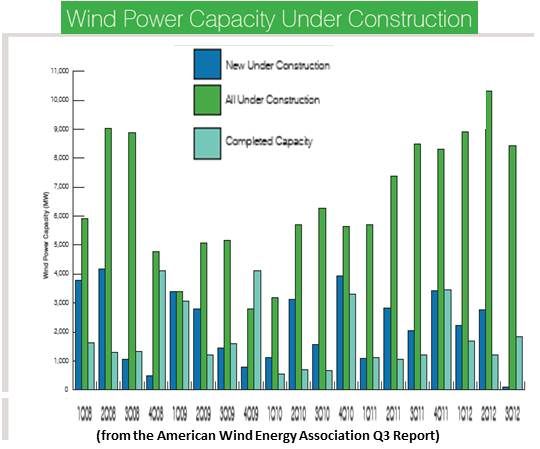

Developers are frantically finishing projects to qualify them for the PTC but there is almost no construction pipeline beyond December 31. Ramping up again will take a year to eighteen months.

Three: In August, the Senate Finance Committee approved a PTC extension but election and fiscal cliff turmoil prevented Congressional ratification. Wind’s leaders believe the negotiated, bipartisan measure will pass in a tax extenders package during the next two to ten weeks.

Too late to salvage the coming year, the committee’s one-year extension will likely provide incentive to projects that begin construction by the end of 2013, making new development viable. It also provides an investment tax credit for offshore and community wind.

Billionaire entrepreneur Philip Anschutz’s Power Company of Wyoming got final DOI approval for its $4 billion to $6 billion, 2,500-megawatt Chokecherry and Sierra Madre Wind megaproject. Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A) subsidiary MidAmerican Energy Holdings now owns 2,000-plus megawatts of wind, much of it acquired in 2012 as a hedge against volatile fossil fuel prices. And Google (NASDAQ:GOOG) continued to invest in wind.

The Wake of the PTC Fight

Four: Wind became a political issue when President Obama endorsed a long-term PTC extension, Romney spokespeople responded that he favored letting it expire and the former Massachusetts Governor said, “You can’t put a windmill on a car.” During the second debate, Romney tempered his position but the damage was done. Post-election polls showed Republicans lost crucial pro-renewables voters.

Five: AWEA expelled multinational giant Exelon, a wind developer, when it opposed a PTC extension because low wind-generated electricity prices make Exelon’s nuclear investments vulnerable. Billionaire oil magnate Charles Koch claimed, however, that federal support to wind has resulted in “five times” higher energy prices.

Governor Sam Brownback (R-Kansas), Senator Chuck Grassley (R-Iowa) and other Republicans responded by calling for a PTC extension and Democratic interest group Citizens for Strength and Security called for “wind and low electricity prices.”

The first real discussion about a PTC phase-out also began.

Six: As hope for a timely PTC extension waned, wind developers turned from the U.S. market. Goldwind, Vestas and GE (NYSE:GE) looked to Latin America, Ming Yang and Suzlon to India, and EDF Renewables to Turkey.

China Falling

Seven: Despite record installations, discouraging 3Q financials from Goldwind, Ming Yang and Sinovel, China’s three biggest players, suggested a period of rationalization may be ahead.

Goldwind’s net profit fell 93.74 percent year-on-year, Ming Yang’s total income dropped 94.4 percent from Q3 2011, and Sinovel had an 82 percent year-on-year drop in operating income.

Issues that impeded growth included inadequate transmission, undispersed government subsidies and the anticipated U.S. market collapse.

Eight: AMSC (NASDAQ:AMSC) got a hearing October 26 in China’s Supreme People’s Court on one of four cases requesting $1.2 billion in losses and damages for Sinovel’s alleged abrogation of contracts and criminal violations of AMSC intellectual property (IP) rights. A verdict is imminent. The legal fight will likely set an historical precedent covering foreign intellectual property protections there.

Nine: The U.S.-based Wind Tower Trade Coalition last year petitioned the U.S. Department of Commerce (DOC) and the International Trade Commission (ITC) to investigate countervailing duties allegations against Chinese tower makers and to investigate anti-dumping allegations against Chinese and Vietnamese tower makers. In June, the DOC preliminarily imposed deposit requirements ranging from 13.74 percent to 26 percent on tower imports.

Final DOC and ITC rulings are expected by February 2013 but the impacts may not be felt immediately because, a U.S. tower manufacturer told GTM, “There probably isn’t going to be much of a wind business here until the PTC passes.”

Offshore

Ten: The 420-megawatt Cape Wind offshore wind project is now fully permitted and on the verge of becoming the first U.S. utility scale offshore installation to go into construction. The project won big victories when its higher than average PPA prices were approved by Massachusetts regulators and validated by the Massachusetts Supreme Court on the grounds that it offers “unique benefits” that justify the prices.

Newly elected Democratic Massachusetts Congressman Joe Kennedy III broke with grandfather Robert F. Kennedy, uncle Robert F. Kennedy, Jr., and great uncle Edward Kennedy during his campaign and became the first Kennedy to endorse Cape Wind.

DOI issued new Eastern Seaboard leases and the success of Principle Power’s two-megawatt WindFloat floating turbines and StatOil’s (NYSE:STO) three-megawatt Hywind floating turbines may soon make harvesting wind off the U.S. and Japanese Pacific coasts economic.