The wind industry could be celebrating. The Department of Commerce (DOC) decided to protect it by moving ahead on an investigation of allegations against China for dumping and unfair pricing on turbine towers. But major players, gathered here in Atlanta at the industry’s big annual conclave, showed little inclination to rejoice.

Their celebratory mood is compromised by Congress’ unwillingness to extend the industry’s 2.2 cent per kilowatt-hour production tax credit (PTC).

“People aren’t going to build towers in the U.S., because without the PTC, nobody is going to put the farm up,” an independent tower maker recently opined to GTM. Orders, he said, have stopped coming into his shop. “It’s really great that they’ve put the tariff on to keep the Chinese and Vietnamese [firms] out of here, but unfortunately, there probably isn’t going to be much of a wind business in the United States until the PTC passes.”

Wind watchers have seen this moment coming since the 2010 election. Congress once regarded renewables -- and wind in particular -- as bipartisan. That ended soon afterwards.

_540_449_80.jpg)

The American Wind Energy Association (AWEA), the wind industry trade organization, has been working for more than a year to turn the political tide. But Congress has done little since early in this election year, and those on the Atlanta convention floor at AWEA’s WINDPOWER 2012 don’t really expect that to change until after November. By then, it will be too late to save 2013 for project builders whose turbines are heavy manufacturing and whose developments require eighteen-month lead times.

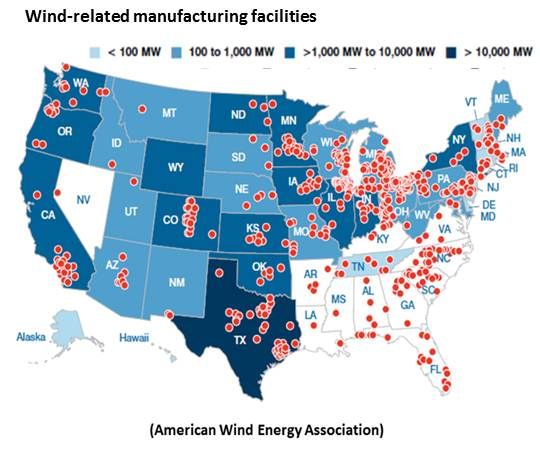

As several CEOs observed in private conversations, it is truly strange for a conservative Congress to allow to this to happen because there are 30,000 manufacturing jobs at stake.

Ted Turner, speaking at the convention’s opening session, recounted his experience founding CNN. The big three networks first laughed at him, he remembered, then ignored him, then tried to keep him off the air and then lobbied to put him out of business. But, he said, the idea of a news network was too powerful to stop -- and so is the idea of clean, renewable energy. “I’ve never seen anything clearer,” he said, “than the case for wind and solar.”

The wind industry, he said, is just reaching the point where its competitors are being forced to take notice. “That’s when it starts to get hard,” he said, “but that’s also when it starts to get to be fun.”

Noting that 500 U.S. manufacturing facilities and 30,000 manufacturing jobs are in jeopardy, AWEA CEO Denise Bode said wind is no longer a mere alternative energy and “is only going to get more and more attractive.”

Republican Kansas Governor Sam Brownback, Democratic Arkansas Governor Mike Beebe and Obama administration energy advisor Heather Zichal all spoke and called for the PTC’s extension. But the substance of their remarks was overshadowed by their very presence. It testified to the bipartisan and state-federal agreement on the issue.

In welcoming Microsoft, Hewlett Packard and Sprint to the industry’s Pass the PTC coalition, Bode noted the incentive “has the highest level of bipartisan support of any U.S. energy policy” and demanded that Congress save the wind industry by extending it. “This bleeding has to stop.”

Bode also vowed to fight on and quoted Winston Churchill from World War II’s dark, early days. “It’s the courage to continue that counts.”

_540_449_80.jpg)

The most likely scenario is, insiders say, the PTC will be renewed in a lame duck session tax extenders package after the presidential election. A best-case scenario sees it being a two-year extension. Another one year extension could be as bad as no extension at all because getting a turbine from order to erection takes at least eighteen months.

The big players are making plans to play outside the United States. GE announced turbine deals in Turkey, Brazil and Canada. Suzlon, which manufactures in India and could be a big beneficiary of the DOC decision against Chinese imports, unveiled a new, low-wind-regime turbine.

There is also some buzz around a pair of potential substitute incentives floated in a recent New York Times op-ed piece

Both the real estate investment trusts (REIT) and master limited partnerships (MLPs) can be publicly traded and give investors an ownership interest, and thus could potentially leverage more private investment than the tax equity that flows to wind through the PTC. But getting the IRS and Congress to make renewables projects eligible for REIT and MLP financing is a potentially challenging political undertaking.

As a policy analyst confided, “You might be able to explain them to a Senator in six years, but getting them across to a Congressman in only two years? No.”