The economic impacts are large enough to have repercussions on state, regional and national economies. If the PTC is not extended, Navigant found it will likely cost the country nearly 40,000 of today’s jobs and drain nearly ten billion dollars out of the current economy. If the PTC is extended through 2016, it will add more than 25,000 new jobs and grow the wind industry to the extent of an additional billion dollars.

“The PTC extension,” according to Navigant Director and Project Manager Bruce Hamilton, "would provide a net benefit to taxpayers of some $25.6 billion at a net cost of $13.6 billion. [...] This amounts to a return on investment of 87 percent,” he said.

The 2008 stimulus bill and 2009 Recovery Act infused the renewables industries with $65 billion, according to a recent Reznick Group report. With the special benefits in that legislation ending this year, only the PTC would be left to the wind industry.

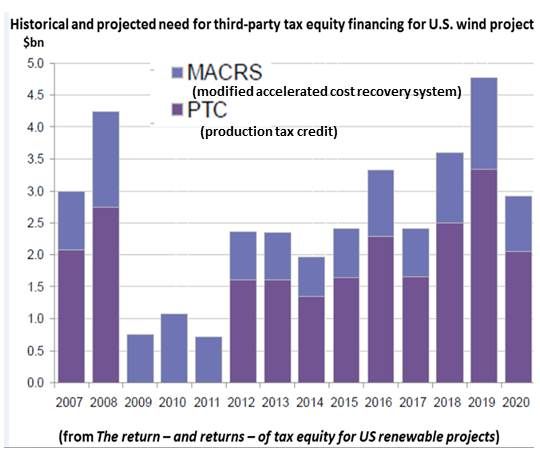

The Reznick report estimated the wind industry will need over seven billion dollars in tax equity to sustain it. The money is there: Over $137 billion was paid in taxes last year by the 500 biggest U.S. public companies. The inclination is there: Historically, such companies invested in the PTC at about the seven-billion-dollar level, according to Reznick.

The question is whether the current penny-pinching Congress will be willing to continue returning 2.3 cents per kilowatt-hour as a tax credit to investors.

_540_449_80.jpg)

Congress has used the PTC as a political football in the past. When the tax credit was allowed to lapse in 1999, the wind industry’s installed capacity fell 93 percent. When it lapsed in 2001, the drop was 73 percent. The 2003 lapse produced a 77 percent drop.

But this time is different because “the wind manufacturing sector has really grown over the last four or five years,” according to American Wind Energy Association (AWEA) CEO Denise Bode, from “25 percent of our component parts being manufactured in the U.S. to over 60 percent. You have not had the PTC expire at a time when you had such significant [numbers of] manufacturing jobs at stake.”

The uncertain fate of the PTC already has the industry’s supply chain near a turning point, said John Purcell, Vice President for Wind at LeedCo Steel, a provider of steel plating for wind turbines. “I would say by July or August of next year there will be a tremendous amount of uncertainty on what the build schedule will be.” There already is, he added, “a tremendous amount of investment bottled up and manufacturing jobs that could be started quickly to support what would be very good outlook for that 2013-to-2016 timeframe” on hold. “We need to have this done sooner rather than later.”

A bill was recently introduced in the House, H.R. 3307, which would extend the PTC four years. It has bipartisan support, including, Bode said, “12 Republican co-sponsors as well as Democratic sponsors.” In the Senate, she added, “both Senator Grassley (R-IA) and Senator Harkin (D-IA) are taking the lead, because Iowa is one of the top wind manufacturing states in the country and gets over 20 percent of its electricity from wind.”

The bill is also, Bode said, backed by 30 governors, representing both parties. Allies totaling over 370 groups, including the National Association of Manufacturers, the Farm Bureau, the Edison Electric Institute and the United Steelworkers, Bode said, are lobbying hard for it.

But Congress watchers do not expect any such standalone legislation to survive such volatile political times. Normally, an issue with such bipartisan backing could be folded into an end-of-the-year tax extenders package. But this year is not normal.

Many expect the current bickering over the payroll tax, the Keystone XL pipeline and ancillary issues to block progress on more substantive issues. Some say a tax extenders package containing the PTC could be brought up early next spring. But there is no reason to think partisanship will ease before the November Presidential election.

Realistically, the PTC is most likely to be extended, if at all, at the very end of 2012, in a lame duck session similar to the one at the end of 2010 that led to landmark compromises.

Navigant did not account for what might happen if the industry goes the entire year with the PTC on hold. Industry insiders expect a year of frantic early activity with the industry slowing toward numbers in the study’s “no-extension” scenario in 2013. Navigant makes chillingly clear what 2013 and beyond will look like if the PTC does not make the December 2012 cut.

“It’s different this time,” Bode stressed, “because we are scaling up right now to a point that we’re actually reducing the cost of wind energy. It is one of the most competitive sources of energy out there. If we are allowed to finish the job, then we can produce on a very competitive basis. We’re not asking for permanent support forever. We just want to finish the job.”