The Obama administration has big expectations for the American wind industry.

According to a new report by the Department of Energy, with continued technological advancements, cost reductions and improvements in siting and transmission, wind could economically provide 35 percent of the U.S. electricity supply by 2050.

“Every year, wind becomes cost-competitive in more states, and this report shows that all 50 states could have utility-scale energy by 2050,” said Dan Utech, White House Deputy Assistant to the President for Energy and Climate Change, in a statement. “The United States is uniquely poised to accelerate development of this important resource and technology, and the report will help us continue to build on the strong progress we’ve already made.”

The United States is currently the world leader in wind power generation, with wind accounting for more than 4.5 percent of the nation’s electricity mix.

Between 2008 and 2013, wind represented approximately 30 percent of new electricity generation in the United States. At the end of 2013, there were more than 61 gigawatts of wind energy installed across 39 states in the U.S.

The Energy Department’s historical analysis of wind installation and operation experience found that the industry has proven its ability to scale and satisfy rapid build-out demands. Environmental and social concerns associated with wind have also been effectively managed with stakeholder inclusion, and wind generation variability has had a minimal and manageable effect on grid reliability to date.

The new report -- entitled Wind Vision: A New Era of Wind Power in the United States -- builds on findings from a 2008 DOE report that analyzed a scenario in which 20 percent of U.S. annual energy consumption came from wind.

Since then, there have been substantial changes in existing and projected fossil fuel and wind costs. Wind energy is now on the cusp of cost parity with other forms of energy used to power the country, according to DOE officials. In some areas of the Midwest, wind is already cost-competitive.

How wind gets to one-third of the energy mix

To arrive at 35 percent wind penetration by 2050, the DOE considered an array of market forces that could affect wind production. The report only considered policies as of January 1, 2014 and does not assume any federal or state-level policy changes in the future.

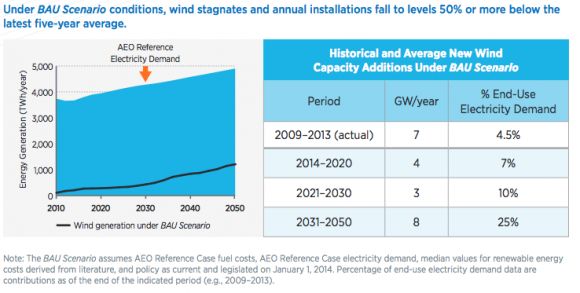

In the business-as-usual scenario, the report finds that growth in wind generation and capacity will be limited through 2030, with the number of annual installations falling by half compared to the latest five-year average. Wind generation is expected to settle at about 7 percent of the total U.S. electricity mix in 2016 after projects currently in the pipeline -- projects that qualify for the federal Production Tax Credit -- come on-line.

Wind production is expected to pick up in 2030, however, as the industry sees continued cost improvements and the price of fossil fuels increases. In the business-as-usual scenario, wind still reaches a 25 percent share of U.S. electricity demand in 2050.

Figure 1: Wind Generation and Average New Capacity Additions, Business-as-Usual Scenario

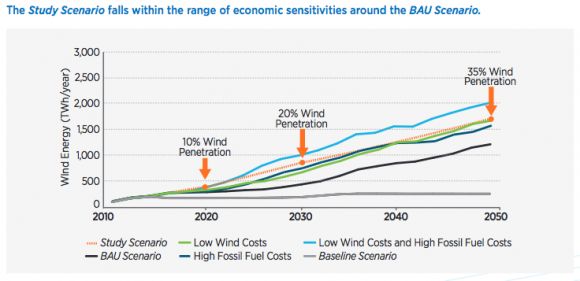

In a more aggressive scenario, in which the wind sector sees rapid cost reductions, fossil fuel prices spike and electricity demand significantly increases, wind could come to make up 40 percent of the U.S. electricity mix by 2050.

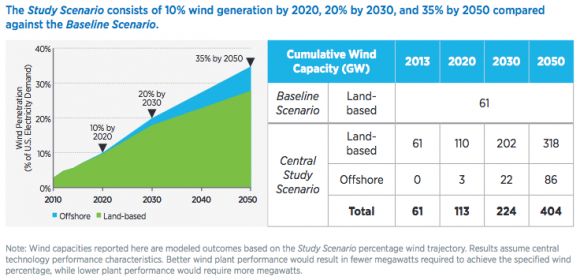

The DOE’s “Wind Vision Study Scenario” evaluates a future in which wind reaches 10 percent of U.S. electricity generation by 2020, 20 percent by 2030 and 35 percent by 2050. On this trajectory, cumulative wind capacity would reach 404 gigawatts by mid-century.

The report concludes this target is not only achievable, but will also produce a range of societal benefits and reduce energy costs for consumers.

Figure 2: Wind Vision Study Scenario Relative to BAU and Sensitivities

The report anticipates that wind will provide nearly $280 billion in consumer savings by 2050, due to reduced demand for natural gas, which is subject to price swings. Also, because wind generation agreements typically provide 20-year fixed pricing, wind is also expected to reduce rate volatility.

The “Wind Vision” scenario also shows a 23 percent reduction in water consumed by the electric sector through 2050. Cumulative benefits for avoided emissions of fine particulate matter, nitrogen oxides and sulfur dioxides will total $108 billion in 2050. And cumulative benefits for avoided damage from greenhouse gas emissions will total $400 billion.

By 2050, the industry could also support more than 600,000 wind-related jobs across the country.

“This report documents how wind energy already provides major economic and environmental benefits to America, including protecting consumers against energy price spikes, and making deep cuts in pollution and water use,” said John Kostyack, executive director of the Wind Energy Foundation, in a statement. “As wind becomes one of the country’s top sources of electricity, Wind Vision promises even bigger benefits for decades to come.”

Big opportunity -- with a bumpy road ahead

The “Wind Vision” scenario assumes aggressive growth in the near term due to relatively high fossil fuel costs. It also assumes significant long-term reductions in wind costs, with the levelized cost of electricity for land-based wind estimated to fall 24 percent by 2020, 33 percent by 2030 and 37 percent by 2050.

“If we keep our nose to the grindstone and work hard on the research side, we expect wind to be competitive with no subsidy in the 2030 timeframe across the country,” said Under Secretary for Science and Energy Lynn Orr on a call with reporters.

The DOE expects the LCOE for offshore wind will also fall dramatically -- by 22 percent by 2020, 43 percent by 2030 and 51 percent by 2050. Offshore wind reached 6.5 gigawatts globally in 2013. Projections for U.S. market growth show offshore wind providing 2 percent of U.S. electricity demand in 2020 and 7 percent in 2050.

Figure 3: The Wind Vision Study Scenario and Baseline Scenario

All of this projected growth in wind is in addition to growth from other alternative and renewable energy resources, according DOE officials. Each resource is developing on a different timeline and will compete in the market as it makes progress.

“We don’t mean to say [wind] is the only important renewable resource in the mix,” said Orr. “It’s true that the cost of solar cells has been coming down rapidly, but [solar is] still more expensive than wind in many kinds of applications.”

While the report does not factor in any policies that do not already exist, policy is key to meeting the administration’s ambitious goals. The Energy Department report comes as the wind industry faces uncertainty around the future of the Production Tax Credit.

The federal PTC provides a 2.3-cent per kilowatt-hour incentive for the first 10 years of a wind farm’s operation. Capacity additions for wind fell off a cliff when the incentive lapsed in 2013, declining by more than 90 percent from 2012.

The PTC currently applies only to products under construction by the end of 2014. Many in the industry and government are lobbying for another extension. Some are lobbying to make them permanent.

“We’re going to be working hard to get the PTC done,” said the White House’s Utech on the press call.

“We’re going to be doing everything we can over the next two years to put a strong framework in place for the coming years and decades,” he added.