For years, Greentech Media has been writing about the various players in the home energy management market. Many of the non-utility players have always seemed better positioned than the utilities to own the customer relationship inside of a smart(er) home.

In the past two years, that has started to come to fruition as security companies, big-box stores and telecoms have begun to bring connected home offerings, which include energy management, to market.

Utilities are not left out, but are rather relishing the options to leverage other brands’ expertise in managing customer relationships. Austin Energy is using AutoGrid’s platform to leverage up to fifteen different thermostat companies for residential demand response. Southern California Edison has a pilot that brings together Alarm.com, Radio Thermostat Company of America, Vivint, Ingersoll Rand's Nexia Home Intelligence, Trane, American Standard and Nest.

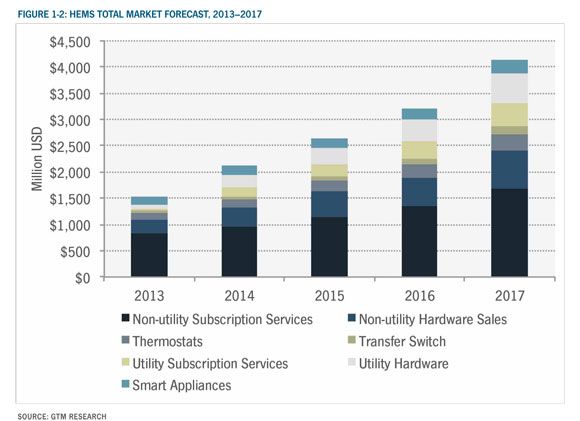

A new report from GTM Research, Home Energy Management Systems: Vendors, Technologies and Opportunities, 2013-2017, confirms the shift. Utilities are less likely to buy and install proprietary energy management systems. They are instead leveraging the hardware and subscription services that are proliferating in the open market.

By 2017, the market for home energy management systems will top $4 billion, and most of that will be non-utility subscription services, thermostats, smart appliances and hardware sales. Utility subscription services will remain a small piece of the market.

Although utilities will not own the relationship with the customer, the companies that do are happy to leverage utilities as another revenue stream. The question now is not whether it will be utilities or another entity, but rather which entity will have the most compelling connected home offering in coming years.

In particular, keep an eye on telecoms for subscription services, said report author Kamil Bojanczyk.

“Telecom firms may be interested in subsidizing [home energy management system] purchases, much like what is done today with cell phones,” he says in the report. “The telecom lowers the barrier to entry by subsidizing 50 percent the cost of installation but then recoups its investments handsomely through the subscription revenue model.”