As a new generation of EVs emerges in today’s uncertain, sluggish marketplace, fleets may act as the initial savior market.

And it’s not just cars with plugs, but the entire range of alternative fuel vehicles for which fleet sales could provide and sustain demand.

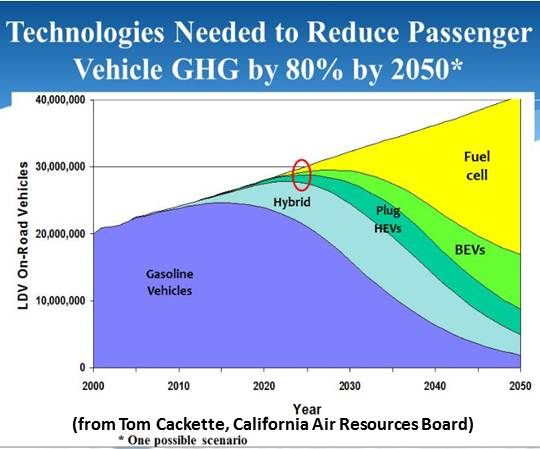

The transition away from petroleum fuels and the internal combustion engine will require “a wide and diverse portfolio” of alternative energy vehicles, each performing the work for which it is best suited, said Peter Ward, Manager of the Alternative Fuel and Vehicle Technology Program for the California Energy Commission (CEC), at Friday's Southern California Alt Car Expo’s fleet conference.

Though fleet managers appreciate their environmental and health benefits, budget constraints are going to be much more crucial than ever before to the continued integration of alternative fuel vehicles, several presenters said. And there are solid, bottom-line reasons for fleet managers to invest in them.

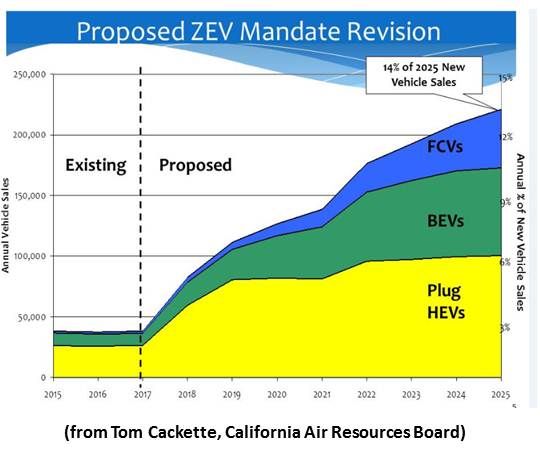

As the state of California moves from the 16 billion gallons of gasoline it presently consumes to the two billion gallons of gasoline it is projected to consume by midcentury, fleet managers can expect new technologies across the full spectrum of alternatives to pay for themselves within two to three years, even as purchase prices rise, Tom Cackette, Chief Deputy Executive Officer for California’s Air Resources Board (ARB) told fleet conference attendees.

“All of the new technology usually comes through a fleet first,” said Rick Sikes, Fleet Superintendent for the City of Santa Monica and co-organizer of the Expo’s fleet conference when explaining why he wanted to set aside a part of the Expo to formally bring together vendors and fleet managers. It is the most efficient way for new technologies to prove themselves, Sikes said, because they can be tested and measured in a more controlled context.

Typifying the diverse portfolio California’s policymakers expect fleets to demonstrate in coming decades, UPS is testing and bringing into service a Green Fleet of vehicles powered by every kind of alternative fuel, according to Dale Morin, western region Automotive Engineering Environmental and Training Manager for UPS.

The Green Fleet’s 1900+ vehicles now being vetted by the vigorous demands of UPS’s competitive marketplace have logged well over 200 million miles from Canada and the U.S. to Hong Kong and from Germany to Brazil. The UPS Green Fleet has completely battery electric and hybrid electric vehicles, liquefied natural gas (LNG) vehicles, liquefied petroleum gas (LPG) vehicles, propane powered vehicles, and compressed natural gas (CNG) vehicles.

They have performed as effectively as their traditionally powered counterparts, Morin said, though the greater expense of the nascent technologies remains a concern to UPS.

The expectation, Santa Monica fleet manager Sikes said, is that as the fleet-driven market expands, “larger numbers” will generate economies of scale that will bring those costs down. Municipalities are using alternative energy to do everything from collect waste and carry commuters to transporting meter-readers and beat police, he added, noting that there isn’t a Southern California city that isn’t adding alternative fuel vehicles to its fleet.

Seven challenges to fleet adoption of alternative energy vehicles, according to Paul Conran, Culver City Fleet Manager, are: (1) integration with existing vehicles, (2) getting the vehicles from the manufacturers, (2) getting state and federal certification, (4) getting long-term, stable state and federal policies that make clear what the terms of adoption will be, (5) finding manufacturer collaborations, (6) getting public and private funding for test programs, and (7) getting increased access to renewable electricity and biofuels sources to power electric and gas vehicles.

Even with all of those conditions met, cities' adoption efforts are unlikely to have the impact of the announced transition to 100 percent EVs and PHEVs made by the U.S. Air Force. From its passenger cars and shuttle buses to its cargo trucks and forklifts, the Air Force is going completely electric, said Camron Gorguinpour, Special Assistant to the Air Force’s Assistant Secretary for Installations, Environment and Logistics.

The debate within the Pentagon over whether to move to alternative energy vehicles is over, Gorguinpour said.

The Air Force will begin at its Los Angeles Air Force Base, where it will invest $750,000 to exchange all its 43 non-tactical vehicles to EVs or PHEVs in January 2012. LA AFB is of particular interest because it has its own 500-kilowatt solar system and is plugged into a grid that uses the most advanced energy market capabilities.

The Air Force will use LA AFB to study two questions it wants to understand completely before it extends its all-electric initiative to its entire vehicle fleet: What are the implications on reliability of having only electric power? And what will the impact of vehicle-to-grid (V2G) technology be on the availability of power from the grid and from renewable sources?

Gorguinpour said the Air Force expects to discover enormous potential from V2G on frequency regulation (i.e., peak demand shaving or smoothing demand during periods of peak use) from keeping even a few fully charged vehicles plugged into the grid when they are not in use.

“The good news,” Sikes said, is that fleet managers are “not waiting for something to happen” in the consumer marketplace. “It’s happening. That’s been proven by the fleets.”