Why doesn’t every building energy control system come with a demand response option?

German building control systems giant Siemens has been putting together a U.S. business based on this premise -- and now the technology being used by utilities and grid operators may be evolving to a point where it can be put to effective use.

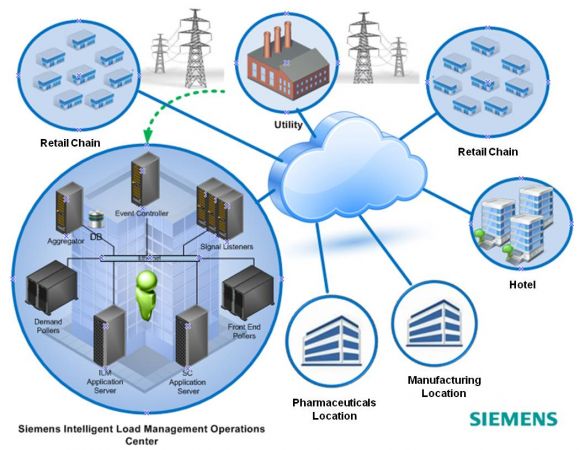

Back in 2010, Siemens acquired two Texas-based companies: Site Controls, a demand response aggregator for retail chains, and its subsidiary SureGrid, which provides a cloud-based platform for fine-tuning HVAC and lighting systems energy use for retailers.

Since then, Siemens has integrated the companies’ intelligent load management software into more than 1,000 sites, according to Dan Kubala, director of business development for Siemens Retail & Commercial Systems (RCS). That’s done either through a site controls interface for buildings too small to need their own building automation system (BAS), through already-installed BAS products like Siemens’ APOGEE platform, or competing products from the likes of Honeywell and Johnson Controls.

The company’s current portfolio, including named customers like craft store chain Michaels and discount chain Big Lots, adds up to controllable, aggregated loads at the “megawatts-scale,” Kubala said in an interview last week. That’s a respectable amount, though not necessarily huge compared to the portfolios of big demand response providers like EnerNOC, NRG’s Energy Curtailment Specialists or Constellation Energy and Comverge.

But with the emergence of OpenADR 2.0, the open-standards-based technology for grid operators and utilities to communicate their needs to technology-enabled buildings, Siemens’ addressable market for demand-response-embedded building controls could start expanding quickly, he said.

Siemens announced last month that SureGrid has landed certification for OpenADR 2.0 compliance, joining the ranks of DR providers like EnerNOC, building systems vendors like Honeywell, grid giants like Alstom, and partners like Schneider Electric and IPKeys in using the standard.

OpenADR 2.0 compliance is “required in the California market to participate,” Kubala noted -- not only for new utility demand response programs, but also from the state’s building codes that require demand response capability from new buildings or major building retrofits. While California’s demand response programs have lagged behind others in the country, it’s engaged in a broad reworking of its regulations and programs, aimed at bringing far more demand-side resources into play to manage its grid-balancing challenges.

OpenADR 2.0 also “allows you to have price signals embedded in the signals coming down from the utility,” he noted. That’s not really something that most utility demand response programs are supporting today.

“Most demand response is a binary -- you’re either in an event or not in an event,” said Kubala. But “the SureGrid technology platform, in its auction engine, has the ability to react to real-time prices.”

Many of today’s demand response providers are providing more real-time, price-responsive levels of load control, at least in the relatively few markets that allow it. Startups like Blue Pillar, Enbala and Tangent Energy are enabling their partners to manage lots of fast-responding building systems and devices at the aggregated levels that can make a big difference to the grid.

But unlike utilities, retail energy providers, or demand response aggregators that have to enable commercial buildings with some level of additional hardware, the SureGrid approach “combines the energy management hardware tightly with demand response,” Kubala said.

“There’s no cost to the customer -- it’s part of the technology they buy for energy management. Once they have the technology, this is icing on the cake, if you will. It’s an additional benefit they can choose to enroll in,” he said.

Siemens is far from the only large-scale building control systems player taking on embedded demand response in this fashion. Energy services rivals are acquiring companies that provide OpenADR technology, as Honeywell has, or engage in energy markets on behalf of their customers, as Schneider Electric has.

At the same time, demand response providers are getting deeper into broader building energy management. EnerNOC, for one, is investing heavily in “energy intelligence” software and services to expand beyond traditional demand response, as well as acquiring and partnering with companies that specialize in the same small to medium-size commercial buildings that SureGrid is targeting.

There are good reasons why demand response hasn’t been an integral part of BAS vendors’ technology to date. It’s hard for companies that specialize in building controls to compete with DR providers, in terms of getting enough customers signed up to wield their collective energy capabilities at the volumes needed to make money at it.

That’s particularly challenging in a field that requires different business model and technology approaches for each different market region, from multi-state markets run by mid-Atlantic grid operator PJM, to state-specific programs in California and Texas. Like many other demand response providers, Siemens RCS takes on the financial risk of being penalized if it fails to meet the energy reductions that demand response programs require.

But “as we get more buildings on-line, and get them OpenADR-compatible, we can make sure the technology will be ready for when the regulations and the markets catch up,” Kubala said. “Frankly, it’s more about future capabilities.”