BMW is launching its all-electric ActiveE vehicle with a lease program for 700 dedicated customers. The pitch for the upscale car is that it's “100 percent electric and 100 percent BMW.”

The rollout is basically “a field trial” of the U.S. electric vehicle (EV) marketplace for BMW, according to Green Mountain Energy Vice President Scott Martin. The ActiveE is not for sale. Only a two-year lease is available. BMW used a similar, 600-driver field test for its Mini E electric car. Feedback from that program informed preparations for the ActiveE rollout.

This trial is aimed at what BMW calls “Electronauts” and will be limited to Los Angeles, San Diego, San Francisco, Sacramento, New York, Boston, and the state of Connecticut, where EVs are popular.

“BMW electric vehicle drivers,” Martin said, “are affluent, mostly urban individuals who put a high value on social responsibility and environmental friendliness. That’s according to BMW.” And, except perhaps for the term 'affluent,' Martin added, “that description lines up well with Green Mountain Energy’s customer.”

To further appeal to Electronauts’ enthusiasm and concerns, Martin said, they will be given the opportunity, for a one-time fee of $48, to purchase renewable energy certificates (RECs) from Green Mountain Energy that will assure the electricity they are projected to use over the term of the two year lease will be offset by renewable energy.

Green Mountain Energy will obtain “regional wind” RECs from Western and Northeastern power systems. By purchasing from electricity distribution systems where the cars will be marketed, the Electronauts will, to the extent possible, be supporting local renewables.

BMW is also offering its Electronauts the opportunity to install residential rooftop solar systems at a 35 percent discount. “This solar program, along with the new partnership with Green Mountain, demonstrates BMW’s truly holistic approach to sustainable mobility,” the company said.

The renewables add-ons in the ActiveE marketing campaign, BMW said, eliminate critics’ claims that EVs powered from a dirty grid still generate emissions. However, critics may argue that this is only partially true. An electric drivetrain’s increased efficiency can translate to fewer emissions from a coal-powered EV than from a comparable gasoline-powered vehicle. In any case, the Green Mountain Energy partnership raises another question.

With record heat, droughts, and wildfires making climate change increasingly undeniable, Martin was asked, does offsetting matter? In answer, he pointed to markers of Green Mountain Energy’s success.

In the fifteen years Green Mountain Energy has worked to reduce emissions growth, he said, it has funded some 50 renewable energy facilities and seen renewables’ cumulative share of U.S. electricity generation grow to 13 percent. “I can think of no greater proof of our standing and growth potential,” Martin said, “than the fact that NRG Energy bought us for $350 million.” Other markers of success, he added, include its expanding customer base and banner name clients like the Empire State Building and the NFL's Super Bowl.

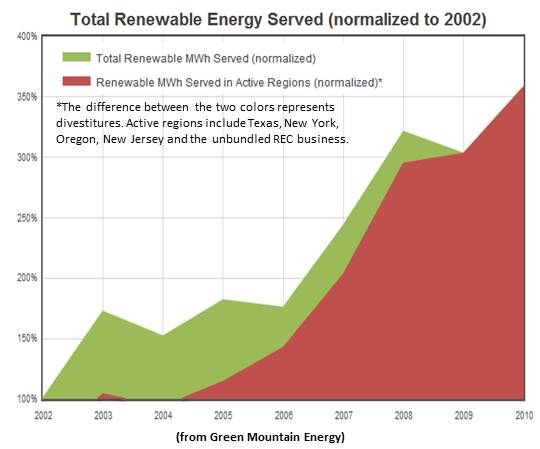

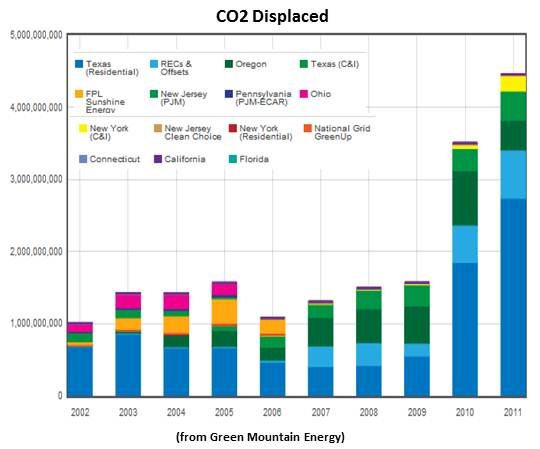

Because Green Mountain is now owned by NRG, Martin explained, numbers that show its customer base and revenues are growing are unavailable. Graphs of “CO2 avoided” and “renewable energy served” in Green Mountain’s sustainability report may substantiate Martin’s claims.

But the numbers aren’t the entire story, said Attorney Jerry Bloom, the Winston & Strawn, LLC Energy Practice Chair. “The market is telling us that the people who are marketing, and here it is BMW, believe there is such a thirst and demand from consumers for green products that it is valuable for them to be able to certify the product is green.”

This demand, Bloom said, “is very grassroots, but at the same time is way at the top, with companies like Google and Wal-Mart and Proctor and Gamble and Dow Chemical. These companies believe that for future growth, for strictly commercial value, they need to be able to certify they are green.”

The new paradigm, Bloom explained, is “the commercial private sector paradigm that says, irrespective of what the government may or may not require, green in itself has a perceived value. And people are chasing that -- and they’re chasing it hard.”

There are still a lot of the unanswered questions, he acknowledged. “What’s the measurement of green? When do you get to claim you’re green? What do you get to say in advertisements? That’s the next step. But the first premise is to say there is a value. BMW obviously believes that.”

Wal-Mart now has a sustainability index, Bloom said. “If you are Proctor & Gamble, who makes more sales to Wal-Mart on a wholesale level than all their other sales put together, and you believe you have to do well on the sustainability index to maintain your sales to Wal-Mart, you are trying to figure out how to become greener. That’s the private sector talking. That’s the commercial market giving value to being green.”

Another example, Bloom added, “is HBSC, a huge British bank. It now has a sustainability index for making commercial loans, strictly because of concerns about potential liability and risk. Companies that want to borrow money may have to bring down their carbon footprint to borrow money from HSBC.”

A huge number of companies, and BMW is a perfect example, Bloom noted, “are saying, ‘We are only going to deal with green companies.’ How you quantify how big the demand is, I don’t know yet. What I do know is that this market is real.”