Arizona’s renewables standard requires 15 percent of the state’s power to come from renewable sources by 2025 and 30 percent of that must come from distributed sources like rooftop solar.

To meet the standard’s annually escalating requirements, Arizona’s utilities offer one-time, ratepayer-funded per-watt payments in addition to the 30 percent federal tax credit and $1,000 state incentive. The utility-regulating Arizona Corporation Commission (ACC) sets those per-watt amounts yearly, according to anticipated market dynamics.

As a result, demand has skyrocketed. Arizona Public Service (APS), Arizona’s biggest utility, is about to exhaust its incentive fund. Smaller utilities such Salt River Project (SRP) and Tucson Electric Power (TEP) still have incentive money to allot but industry watchers expect those funds to be used quickly.

“They’ve basically burned through all four quarters of the 2011 standard allotment for the residential incentives even though it’s only July,” said 10-year solar industry veteran Mark Holohan, Solar Division Manager for Wilson Electric, Arizona’s biggest commercial electrical contractor.

APS “started the year paying $1.75 per watt,” Holohan said. “Those funds were exhausted by January 16. Then it dropped to $1.60 per watt. That was exhausted by March 25. On March 25, it dropped to $1.45 per watt. That was exhausted on June 10. By that point, it had exhausted a total budget for the year of $27.9 million.” Barely two million dollars remain. “What’s left is only the budget for rapid reservations and only a dollar per watt,” Holohan said.

Some solar insiders say demand is now compromised. And solar installers, Holohan said, “have an interruption of their ability to sell and an interruption to their cash flow. And they will have idle people. That’s a difficult position for them to recover from.”

SolarCity is one of the biggest solar providers in Arizona. Though the situation is "not ideal," said Director of Communications Jonathan Bass, his company has been able to “manage around” the quarter-to-quarter starting and stopping. A lower incentive “makes a purchase more expensive,” Bass said, but SolarCity can still provide “affordable solar options” in Arizona, where “a solar system generates more electricity than almost anyplace else in the U.S.”

Commercial incentives from APS are structured differently and are largely based on auctions in which installers bid for jobs.

“Two years ago, when we first started, anybody who wanted could bid the limit of eighteen cents per kilowatt-hour and get it,” Holohan said. “Last year, approximately three-quarters of the submissions in any given auction did not win. So they had to come back for a second auction, or a third, or a fourth.”

This has driven the price for commercial-scale systems down so low, he said, that utilities could be “above compliance” for 2012, with no short term need for capacity to meet the standard, putting next year’s incentives in doubt. That would be a further blow to installers.

It is the way the program was designed, APS renewable energy spokesperson Steven Gotfried said in response to installers’ concerns. “The starting-and-stopping of the solar industry was addressed last year,” he explained. “We have pools of funds released each quarter” so that “throughout the year the market is still moving and there are still installations.”

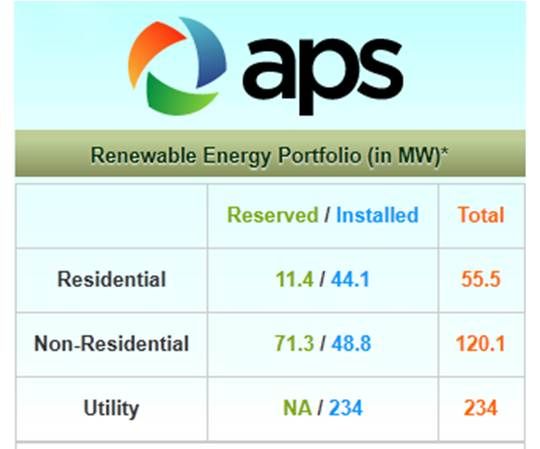

“We have 81 megawatts of solar right now and another 495 being developed,” Gotfried said. “The market is just exploding.”

APS is on track, Gotfried said, to meet not only the state’s renewables standard and distributed energy requirement but to meet its own higher solar targets and to provide “more and more solar using fewer and fewer dollars.”

Being “a market-based approach,” Gotfried said, “if the incentives were used up too fast, it could mean they were too high.” Most installers, Gotfried thought, understood that “as demand increased, the incentives would decrease and, at some point, would go away as the market became self-sustaining.”

“They’ve been upfront with us throughout this last year about how they were going to handle their incentives,” agreed Gary Held, Harmon Electric’s Sales and Marketing manager. The process, including the stepped reductions, was entirely transparent. “They did what they said they were going to do.”

And, Held added, “there is still money available and, yes, we’re still selling at a dollar per watt. It still makes good financial sense for a consumer to purchase solar.” It changes the payback, Held said, but “return on investment is still double-digit, even with a dollar a watt.”

There are, Held admitted, consumers who “are scrutinizing and evaluating solar a lot more carefully because the incentive went from $1.45 to a dollar. But will people still go forward at a dollar a watt? Absolutely.”

Furthermore, Held insisted, “we are continuing to hire and add to our installation team.”

Arizona went from having 15 to 300 solar installers as it developed its incentives. However, newer and smaller companies could easily find the current situation is as challenging as Holohan described.

But because the incentives are funded by ratepayers, Gotfried pointed out, the utility has “a fiduciary responsibility to get the most amount of solar for our solar customers for the amount of money our other customers are investing.”

Undertaking greater expenditure of ratepayer funds to bring higher levels of renewables on line, Gotfried suggested, can only come from more demanding state policy.

Two employees with a major Arizona solar provider who did not want to be quoted giving policy advice pointed out that California’s solar initiative, a ten-year program that progressively lowers the incentive amount but continues the funding uninterrupted, offers more stability.