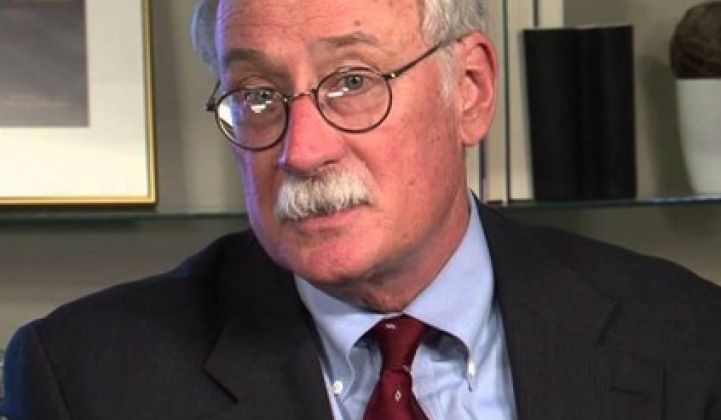

Most people find it tough to get excited about regulators. But President Obama’s nomination of Ron Binz to head the Federal Energy Regulatory Commission (FERC) is reason to sit up and take notice.

FERC oversees the nation’s electricity and natural gas networks, and the grid is badly in need of upgrades -- up to $2 trillion worth by 2030. Binz has the track record to ensure that money is well spent.

As chair of Colorado’s Public Utilities Commission between 2007 and 2011, Binz guided the state through a set of important energy policy decisions, including implementation of the state’s bipartisan Clean Air-Clean Jobs Act. The bill phases out 900 megawatts of some of Colorado’s dirtiest power sources, replacing it with cleaner alternatives over a twelve-year period. At the same time, it sets stronger pollution standards for plants that continue to operate. The result is an estimated $200 million per year in public health benefits, paid for by a minor 2 percent annual rate increase.

This remarkable energy transition has little to do with any plot against Colorado’s coal-fired power plants. It has a lot more to do with economics, smart planning, and prudent risk management.

The average U.S. power plant is more than 30 years old; some are more than twice that age. Xcel’s Valmont Generating Station in Boulder, for example, dates back to 1921. Power plants across the country are, like Valmont, reaching the end of their lives and must be retired, retrofitted or replaced. Under Binz’s leadership, Colorado developed a proactive approach to fixing its aging power plant fleet. Other states -- and the federal government -- can learn from this example.

Fortunately, Binz left them a blueprint.

In 2012, Ceres published a report called Practicing Risk-Aware Electricity Regulation. Binz was the lead author, along with Richard Sedano of the Regulatory Assistance Project; Denise Furey, a former utility analyst at Citigroup and Fitch Ratings; and Ceres’ Dan Mullen. Using comprehensive analysis, the report ranked energy resources in terms of relative cost and risk. The analysis spans the range of energy sources, from coal to gas to solar to energy efficiency, and it serves as a guide for any electricity regulator grappling with the challenges of retire-retrofit-replace decisions.

The key is getting smarter about managing risks, in addition to costs.

When it comes to building power plants, often long-term risks -- like construction delays, fuel price increases or future air regulations -- aren’t fully examined upfront. That can lead to some costly outcomes for ratepayers and utility shareholders alike. Within the past month alone, not only has Duke Energy abandoned plans for a new nuclear power plant in Florida at a ratepayer cost of $1.5 billion, but the Associated Press has also reported, “If Georgia was starting from scratch, it could not financially justify the Vogtle nuclear power plant now under construction [in eastern Georgia].”

How can utilities and regulators avoid these outcomes and reduce risk for customers? The Risk-Aware report provides several strategies. One of the most important is diversifying the range of resources used to provide power. Big bets on nuclear and fossil-fuel-fired generation are getting riskier, but different energy resources will behave independently in future scenarios. A diverse resource mix can enable utilities to limit their exposure to changes in fuel costs, new emissions regulations or restrictions on water availability, for example.

Indeed, the Risk-Aware report finds that the energy option with the lowest level of cost and risk is energy efficiency. As Binz said upon the report’s release, “The cheapest, least risky power plant is the one a utility doesn’t have to build, and ratepayers don’t have to underwrite. But utilities can only invest in energy efficiency when regulators make it financially worthwhile -- for example, by adding performance-based financial incentives for efficiency and by eliminating the financial reward for selling more electricity.”

Regulators have an important role to play in creating conditions that reward performance, not just kilowatt-hours sold. And if the report’s risk-aware approach is any indication of what a Binz FERC chairmanship might look like, it’s likely to have bipartisan appeal. Neither party wants energy costs to spiral out of control, nor should they support big bets on single resources that put ratepayer dollars at risk.

Over his 34-year career in energy policy, Binz has developed the skills and the experience to guide the U.S. electric power sector. As for his record in Colorado, “The results speak for themselves,” wrote Ben Fowke, Chairman, President and CEO of Xcel Energy this month in the Wall Street Journal. “Customer costs remain well below national averages, emissions were reduced by more than 80 percent and fuel diversity -- critical for managing customer costs going forward -- was significantly enhanced. The Colorado electrical system is well poised for the future as a result of this plan.”

The Senate would be well served to confirm Binz quickly -- and to put the future of the U.S. electrical system on equally sound footing.

***

Mindy S. Lubber is the president of Ceres and a founding board member of the organization. She also directs Ceres’ Investor Network on Climate Risk (INCR), a group of 100 institutional investors managing nearly $10 trillion in assets focused on the business risks and opportunities of climate change. This piece was originally published at Ceres and was republished with permission.