Last week, a group of researchers at the MIT Energy Initiative released a sweeping 332-page study called The Future of Solar Energy. The report projects a grand future for solar as a major long-term driver of greenhouse gas reductions and is bullish on the prospects for centralized solar.

But on the matter of distributed solar, the report has a different view -- calling today’s net energy metering policies a “subsidy” that would be better removed from the market.

This is a controversial issue in both the solar industry and among utilities, and some might be tempted to log this report in along with the many other reports on the costs and benefits of net energy metering for which the findings vary widely. Still, I think it is worth examining this latest research more closely, because it does have something to say about how distributed solar should be compensated and how electricity rates should be structured. But my conclusions are not the same as the report’s headlines might suggest.

Does rooftop solar cost other ratepayers?

Chapter 7 of the MIT study runs a complex Reference Network Model (RNM) to simulate the impacts of distributed solar penetration on grid costs under a variety of scenarios. It finds that, while an increase in distributed PV does reduce line losses (thereby saving network costs), this is more than offset by the added distribution costs associated with investments required to maintain power quality with increasing two-way power flows. In other words, distributed solar costs the grid more than it saves.

This is already a point of contention; other studies have found distributed PV (or net metering) to be a net benefit to the grid, largely by incorporating savings from avoided transmission and distribution infrastructure upgrades, reliability benefits, and/or environmental benefits (see page 9 of this Vermont report or this great RMI meta-study for a comparison of existing research methodologies).

But let’s assume that the MIT study fully accounts for all appropriate costs and benefits. Solar’s costs to the grid would still be very small.

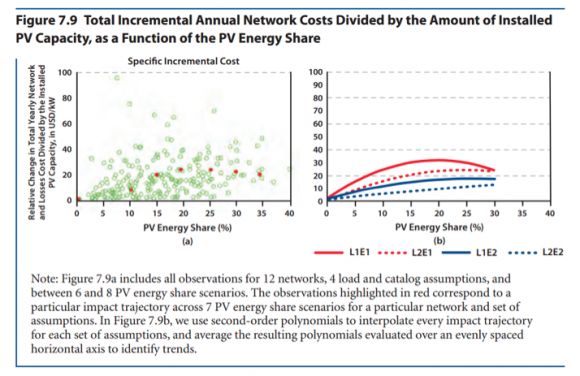

Source: MIT Future of Solar Energy; Note: Scenario E1 refers to a European network design, whereas E2 is a U.S. network.

In the MIT study’s U.S. scenarios, the average incremental cost caused by distributed PV ranges from less than $5/kilowatt/year at below 5 percent penetration to a maximum of around $19/kilowatt/year at 30 percent penetration. These numbers vary (and high-irradiation locations generally see lower costs), but the bulk sit within a relatively small band.

Let’s put this in context. Outside of Hawaii, no major U.S. utility has yet hit 5 percent distributed PV penetration. And the vast majority are still well below 1 percent. So if we were to design a solar-specific fixed charge to cover this cost for most utilities today, it would likely be in the range of $2/kilowatt/year, or $0.17/kilowatt/month. A residential solar customer with a 6-kilowatt system might pay a total of $12/year to cover their incremental system costs.

And even as PV penetration grows, the solar-specific charge would be relatively small. At 25 percent penetration, a distant scenario by today’s standards, the solar surcharge might average $15/kilowatt/year, or $1.25/kilowatt/month, and the 6-kilowatt system owner would pay $90/year.

This is well below the solar surcharges often discussed today. APS in Arizona currently has a $0.70/kW/month charge in place for solar customers and is reportedly planning to propose an increase to $3.00/kilowatt/month. In Wisconsin, We Energies customers who install solar are charged $3.80/kilowatt/month despite solar penetration well under 1 percent.

In other words, today’s solar-specific fixed charges are far out of proportion with the actual network costs imposed by solar customers.

Do solar customers pay their fair share?

So far, we have only addressed the incremental costs that distributed solar may create for the grid. But what about the general costs of service that those same customers also incur? In rate cases and net energy metering discussions, many utilities have argued that solar customers don’t pay their fair share of these costs. By net metering at the full retail rate, the argument goes, solar customers avoid paying their share of fixed distribution network costs.

If all solar customers were to net-meter their bill down to zero, this would be undeniable -- the customer would pay nothing to the utility while still benefiting from the grid’s infrastructure. In reality, this is rarely the case.

As Jon Wellinghoff and James Tong point out in this great piece explaining the distinction between a “cost-shift” and “paying one’s fair share,” a CPUC-commissioned study in California found that NEM customers on the whole “appear to be paying slightly more than their full cost of service.”

Thanks to California’s (admittedly unique) rate structures, many solar customers, who tend to be high energy users, were paying well beyond their fair share prior to installing solar, and only slightly more than their share afterwards.

And in reality, many residential customers do already have fixed charges on their bills to cover some portion of distribution costs. The GTM Research PV Rate Structure Economic Model incorporates a real tariff structure for a representative customer in each of 50 states and finds that residential customers pay a simple average of ~8 percent of their bill through fixed charges today, though the numbers range from zero to nearly 20 percent depending on the tariff.

Some solar customers probably are not covering their relative share of fixed distribution system costs. But to the extent that this is an issue, it is not specific to solar. When the solar-specific network costs are separated out, a solar customer looks just like any other customer. And many customers currently do not pay their “fair share” of distribution network costs -- some energy-efficient homes, many rural homes, and second/vacation residences, to name a few.

Cross-subsidization of distribution costs is an unavoidable result of the way distribution charges are currently calculated, which is by dividing total network costs by total consumption, and spreading those costs equally across all customers on a dollars-per-kilowatt-hour or dollars-per-customer basis.

The MIT study argues strongly against this methodology in favor of a “distribution network use of system” or “DNUoS” charge (see another MIT working paper, WP-2014-006, for a good explanation), which essentially provides a means to charge specific customers based on their individual contribution to network charges, thereby avoiding (or at least exposing) cross-subsidization.

This problem could also largely be addressed without new fixed charges on customer bills, and instead with highly location-specific, customer-specific and time-variable rates -- if you pay what you cost the system at any given moment, you’re not making anyone else pay more.

How should we proceed?

I think most people can agree that electricity pricing should get smarter. As long as we manage the need to maintain affordability and comprehensibility for customers, the entire market will be better off with more dynamic pricing. This would reduce overall cross-subsidization while creating incentives for customers to implement solutions that reduce their system cost, and therefore their bill. Energy storage, load control, and demand response will be among the beneficiaries of such a change.

But there is little reason to single out distributed solar in this endeavor. Apart from what appear to be minimal solar-specific network costs (especially at today’s penetration levels) that can be dealt with individually, solar customers impact the grid just like non-solar customers.

And increasingly, customers are doing more to actively manage their own consumption. The solution is a more intelligent, inclusive electricity distribution market -- like the one being planned in New York -- not a set of piecemeal charges that offer only short-term effects.

***

Shayle Kann is the Senior Vice President of GTM Research. You can reach him at [email protected] or on Twitter: @Shaylekann.