We all know that corporations find every way possible not to pay income tax -- but who knew so many utilities were on the dole as well?

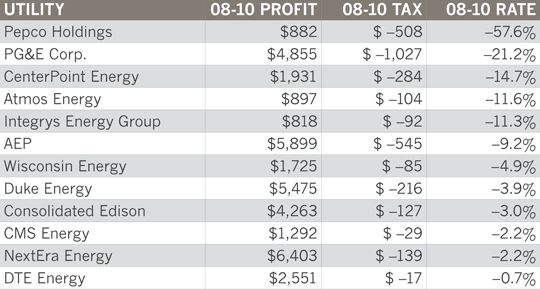

According to a Thursday report by Citizens for Tax Justice (PDF), there are 12 gas and electric utilities on the list of 30 U.S. corporations that reported negative taxes or tax rebates from the U.S. Treasury from 2008 to 2010.

The top-30 list included some well-known corporate income tax avoiders, including General Electric, which famously reported 2010 profits of $14.2 billion with $5.1 billion of that coming from U.S. operations, and yet landed a tax benefit of $3.2 billion for that year. Others on the list included Verizon, Honeywell, Tenet Health Care, DuPont, Boeing and Wells Fargo.

But the inclusion of so many utilities on the list raises eyebrows. In fact, the utility sector is the most-represented industry on the list, even if utilities weren't the biggest taker of tax rebates. That dubious distinction went to Wells Fargo, with $17.9 billion in negative taxes, followed by AT&T, Verizon, GE, IBM, Exxon Mobil, Boeing, PNC Financial Services, Goldman Sachs, Procter & Gamble and Merck.

Pacific Gas & Electric came in a relatively distant 12th place, with $2.73 billion in 2008-2010 tax breaks, the report stated. All told, the 12 utilities on the list received $3.17 billion in negative taxes, out of the total of $21.8 billion on the top-30 corporations list.

Taken as a whole, the utility industry paid the equivalent of a 3.7 percent corporate income tax rate over the three years, the report found -- not as bad as the effective negative tax rate of 13.5 percent paid by industrial machinery companies like GE, but way below the nominal 35 percent rate.

Gas and electric utilities also enjoyed one of the highest rates of tax subsidies from 2008 to 2010, with an industry-wide tax subsidy bill of $31.2 billion -- just under the financial industry’s top-ranking $37.45 billion subsidy haul, and actually beating out the much-maligned oil, gas and pipelines industry’s subsidy haul of $24.18 billion.

So what’s the utility industry’s secret to writing off so many billions of profits and enjoying such a low effective corporate income tax rate? We are asking around for details.

Electric Utilities Paying No Total Income Tax in 2008-2010 ($ millions)

(Data courtesy of Citizens for Tax Justice)