The smart grid industry has seen its fair share of mergers and acquisitions -- more than $30 billion of them over the past two years, to be exact.

Much of this activity is driven by the desire for new technology, whether it’s in core areas like transmission gear, distribution automation and smart meters, communications, sensors and software, or more grid edge applications like demand response, plug-in vehicle charging and distributed solar PV.

Patents are one way to measure a company’s technological value, although it’s hard to calculate ownership of IP across the broad swath of technologies that could be considered to fall into the "smart grid" category. Patent analytics provider Relecura has taken a crack at it with a new analysis (PDF) that identifies the firms that hold the most smart-grid patents, as well as those that could be potential acquisitions targets based on their patent holdings.

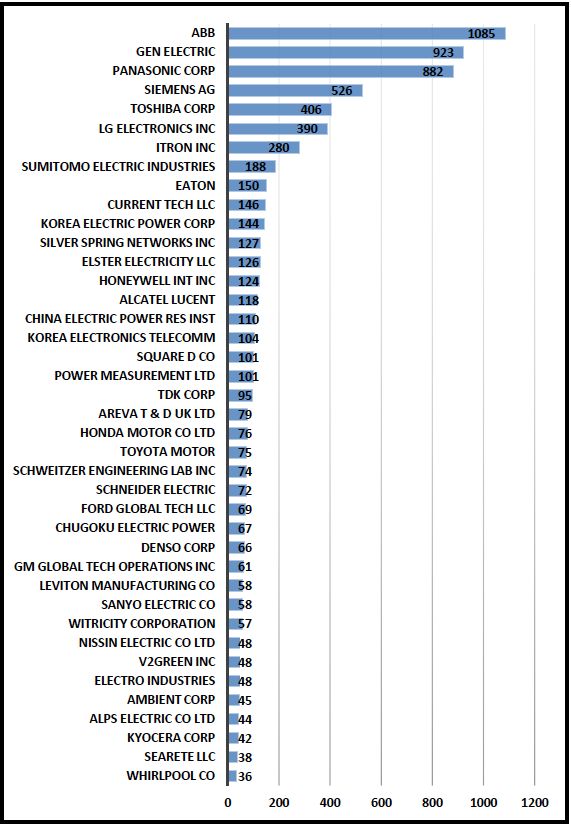

Not surprisingly, Relecura found that ABB, General Electric, Panasonic, Siemens and Toshiba topped the list of international patent holders, with ABB holding 1,085 patents and Toshiba holding 406.

LG Electronics, Itron, Sumitomo Electric, Eaton and Current Tech round out the top ten. Patent holders that rank among the top twenty include Silver Spring Networks, Elster, Honeywell, Alcatel Lucent, and the national utilities of Korea (KEPCO) and China (SGCC), all with more than 100 patents.

It’s important to remember that Relecura’s figures are “indicative” only, based on the firm's own definitions and methods of searching for patents, and may not match an individual company’s own tally. Still, it’s a useful metric to apply to the report’s next level of analysis: sorting out companies into groups of potential licensers of technology and those more likely to be acquired for it.

In simple terms, potential licensees tend to be larger companies with active patent filing histories. Most patents were filed after 2008, indicating a readiness to license technology rather than sell it. Potential acquisition targets are smaller companies with a preponderance of patent applications filed in 2008 or earlier, providing the time to bring a new technology to commercial scale.

Relecura’s report breaks out companies in both categories across technology sectors including transmission, smart meters, demand response, distribution and substation automation, communications and sensors, software, vehicle-to-grid charging infrastructure, and integration of power generation technologies.

Across each technology, the list of likely licensees tends to feature the same big names we saw in the top ten patent-holder list, with exceptions for areas like EV charging, where automakers are well represented, and demand response, where companies like LG and Whirlpool sit alongside names like General Electric and IBM.

As for acquisition targets, they ranged from the plausible to the hard to imagine. For example, Current, a company that shows up as a target in multiple technologies, is itself a collection of disparate smart grid technologies that have been acquired by Spanish grid tech maker Ormazabal, including a powerline carrier tech used as a standard in Spain that could be of value to bigger smart grid acquirers. Another comms vendor on Relecura’s list, Ambient, has reported that it’s considering a sale as one of its options amidst ongoing financial struggles.

Other companies on Relecura’s list seem like bigger stretches in terms of real-world acquisition potential. Its smart meter networking targets include Silver Spring Networks, Elster Electricity and Landis+Gyr, the Toshiba-owned grid communications conglomerate that also holds IP from acquisitions like Consert and GRIDiant. Substation automation targets include long-time independent tech provider Schweitzer Engineering Labs and RuggedCom, the grid router company owned by Siemens.

For demand response, the top acquisition target is GridPoint, a startup that raised hundreds of millions of dollars in VC funding to acquire a half-dozen greentech companies, only to refocus on commercial building energy management. One of those GridPoint acquisitions, Overseeing, is also on Relecura’s list of potential vehicle-to-grid technology acquisitions.

Patents don’t equate to profitable economic applications for any given technology -- witness the overwhelming number of fuel cell patents in the automotive industry and compare it to the number of hydrogen-fueled vehicles on the road. Still, one would expect a few gems to emerge from the thousands of patents represented in this survey.

Take a look at the list of top 40 patent holders and let us know what companies aren’t on the list that ought to be.