The U.S. wind industry’s third quarter report shows the sector continuing to build and adapt to political and economic turmoil -- and something more.

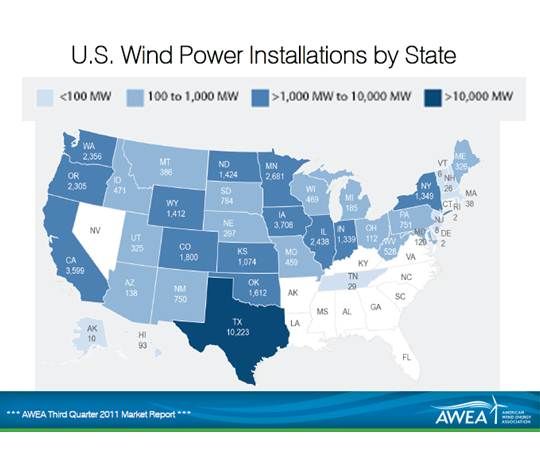

Cumulatively, the most mature of the renewable industries has built 43,461 megawatts of installed capacity, enough to supply electricity to 10 million U.S. homes. As of July 2011, wind power was producing three percent of the nation’s electricity.

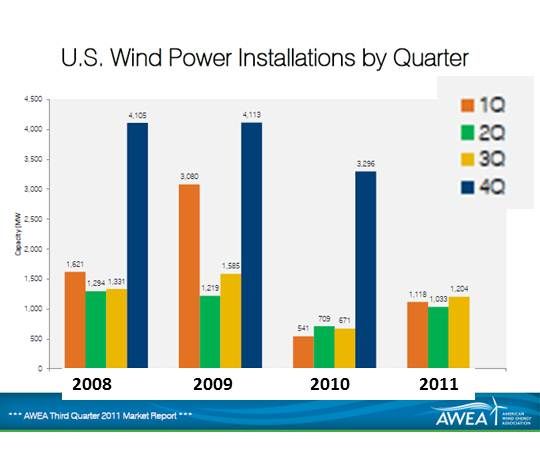

The wind industry built 1,204 megawatts in Q3 2011, bringing the year’s total to 3,355 megawatts. But growth is not news for wind. It has grown regularly for more than a decade -- except when the politicians pull its production tax credit (PTC).

Unlike the fossil and nuclear industries’ multiple and fixed federal incentives, the industry relies largely on the one tax incentive. When Congress has in the past threatened to withhold renewal of it, developers were forced to put one of the nation’s most effective emerging sources of blue collar jobs and local revenues on hold until the politicians came to their senses.

The most important of this quarter’s numbers is the 8,482 megawatts presently under construction. That’s the busiest quarter the U.S. wind industry has had since 2008 and its third busiest quarter on record. There are more than 90 projects in the works across 29 states. In the third quarter of 2011 alone, the industry started construction on 2,130 megawatts.

Developers are pretty certain that the current Congress will not renew the Recovery Act’s 1603 Treasury Grant Program that saw all the renewables through the worst of the recession. And they believe this Congress might once again withhold the PTC, despite a long track record proving how unwise that course of action could be.

There are four possible scenarios in which the PTC could be renewed, according to American Wind Energy Association (AWEA) Senior Vice President for Public Policy Rob Gramlich:

1) In a tax extenders package similar to the one the President negotiated with the lame duck Congress at the end of 2010 (but don’t count on it because this bunch is too lame to be negotiators);

2) In the package from the super-committee appointed to settle the budget crisis (but don’t count on it because lawmakers haven’t shown much interest in tax credits or energy and most insiders expect compromise to be Kryptonite to the super-committee);

3) In a March tax extenders package (but it will be the same lame-duck Congress in March);

4) In a 2012-ending tax extenders package (same Congress but with an election behind them and their terms expiring, they might be differently inclined -- or even lamer).

So wind builders are getting everything they can into the ground as soon as they can. They are scrambling to make equipment and components deals and sign any power purchase agreement (PPA) possible. Whatever they don’t get started this year (in time to take advantage of the 1603 Program), they want to get started early enough in 2012 to be sure they at least qualify for the PTC before it expires at year-end, according to Liz Salerno, AWEA’s Director of industry data and analysis.

The question, however, is this: If Congress believes wind isn’t worth funding, who is going to buy all the capacity the industry is building?

Anybody who can, it turns out. Ohio is building several 0.75-megawatt turbines for its schools; the University of Minnesota is building a 1.65-megawatt turbine for itself; the Hawaii Electric Company (HECO) will buy the 30 megawatts generated by a project on Oahu; and Oregon’s 845-megawatt Shepherd’s Flat, the biggest onshore project in the world, will sell its electricity to California mega-utility Southern California Edison.

The variety of states that want wind is expanding. In the third quarter of 2011, Colorado installed the most new capacity (501 megawatts), followed by Minnesota (163), Oklahoma (130), West Virginia (98), and Texas (88).

The list of utilities buying in is long and distinguished: AEP, Xcel Energy, Consumers Energy, MidAmerican Energy and Nebraska Public Power District (NPPD), among many others.

Perhaps most noteworthy, Alabama Power, a subsidiary of long-time coal advocate and renewables opponent Southern Company, recently signed a PPA for the electricity generated by TradeWind Energy’s 202-megawatt Chisholm Wind project in Oklahoma. According to the Alabama Public Service Commission, “The delivered price of energy from the wind facility is expected to be lower than the cost the Company would incur to produce that energy from its own resource,” resulting in “energy savings flowing directly to the Company’s customers.”

An especially interesting number is the percentage of new wind being purchased by utilities. In the third quarter of 2011, this figure went from the 15 percent level it had been at for the last few years to 21 percent. Utilities are increasingly aware, Salerno said, of wind’s economic benefits. “If you’re thinking about building new gas, new coal, new nuclear,” Salerno said, “wind is a pretty affordable option.”

“This is what a successful business looks like with stable tax policy,” AWEA CEO Denise Bode noted. “Utilities are locking in a great deal for their electric customers while it’s available. We’re keeping rates down all across the U.S., even in the heart of the South.”

Only the U.S. Southeast has no operating wind projects, Salerno added, but more reliable, efficient, productive wind turbines, with higher hub heights, bigger rotors, better blades and other advanced technologies that make even modest winds economically harvestable mean that “the Southeast will be on the map very soon.”