During the 1990s, a new category of enterprise software called enterprise resource planning (ERP for short) spawned several multi-billion-dollar stalwarts, including SAP, PeopleSoft and Salesforce.com. Early on, the market was fragmented, with several vendors fighting for dominance. Over time, the market consolidated as Oracle and SAP emerged as market leaders that bought competitors, integrated product lines and merged workforces.

The same thing is about to happen in the soft grid (Editor's note: 'soft grid' is GTM's terminology for the software layer of the smart grid) -- specifically, in meter data management, which pertains to software that automates billing by collecting and cleaning time interval power consumption data from millions of households, as frequently as every 15 minutes. All of this data must be processed daily within tight time windows. It's a keenly competitive software game where the ability to scale is assumed, and backup and security are table stakes.

Keep in mind, though, that with advanced meter data management we are talking about one vertical industry, specifically utilities. ERP, on the other hand, applies to just about every industry and organization under the sun. Nonetheless, meter data management systems sit at an important strategic intersection of the smart grid.

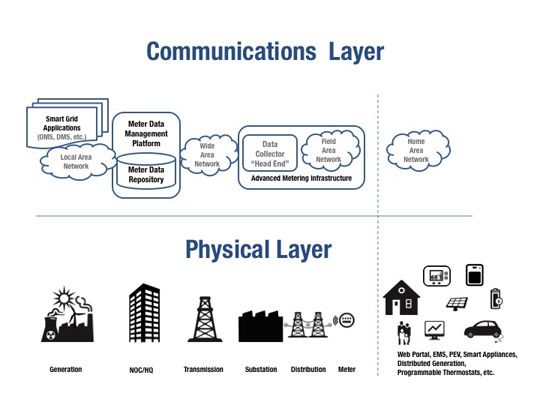

Utilities must do a top-notch job of managing meter data in order to realize their smart grid hopes and dreams. In its ideal form, meter data management is more than just a database -- rather, it's an organization-wide, technology-enabled business process. The meter data management process makes data beyond the sub-station available to any person or application within a utility that needs it, as well as to the customers themselves. But doing this isn't easy. A sophisticated and robust technology infrastructure is critical. Technology wonks use the term 'service-oriented architecture' (SOA) as shorthand for a modular, distributed architecture that hides locations, packages functions, and provides powerful application-level communications. Utilities are late to the smart-grid party, and MDMS offers a way for them to catch up.

Several of the more sophisticated MDMS vendors profiled in GTM's recent Meter Data Management

Research Report (to which I contributed as chief researcher and analyst) offer sophisticated middleware and data management services. This gives utilities a way to build smart applications and turbo-charge their IT infrastructure at the same time. Examples of this approach include enhanced outage management, more accurate market settlement, and residential demand response.

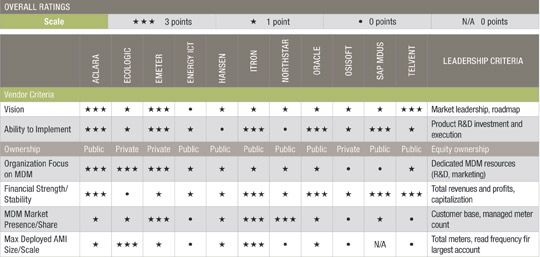

Established vendors include in this space include Oracle, Ecologic Analytics, Hansen Technologies, NorthStar Utilities, eMeter, Aclara, and Itron. Interesting up-and-comers include Energy ICT, Telvent, and OSISoft. Interestingly, SAP has jumped into the fray, as well -- but with a de facto marketplace standards initiative called the Lighthouse Council and a framework for transporting meter data called meter data unification standard (MDUS). Collecting, cleaning, and fixing meter data is a basic process that all support, though in different flavors and at varying levels of abstraction (translation: graphical consoles for building business rules). Look beneath the covers, though, and significant differences emerge. Turns out that the MDM platform that a utility chooses -- and MDM should be considered a platform, as opposed to a mere application or database -- will go a long way toward determining, how, what, when (and whether) a utility will be able to rollout that oh-so-interesting smart grid application they've been dreaming about.

Here is a partial chart from the report.

Looking for slick market settlement? Consider Aclara. How about scalability to tens of millions of meters? Ecologic Analytics and Itron are worth a closer look. Sophisticated middleware tools and utility frameworks? Put Oracle and eMeter on your list. Pulling a mish-mash of data from different meter brands and collection schedules and protecting and enhancing SAP utility applications? Find some friendlies on the Lighthouse Council to talk to. Are you pondering real-time data management and distribution operations integration? OSISoft or Telvent might be your ticket. Are you a mid-market or municipal utility looking for an all-in-one solution and having trouble getting MDM hotshots to answer the phone? Try NorthStar Utilities. Looking to package commercial demand response and energy management sophistication for the residential world? EnergyICT provides some interesting possibilities. A global company that can jump through market-specific hoops, hit tight timeframes and process data every hour? Place a call down under to Hansen Technologies.

We haven't even started talking about meter brands like Elster, Landis + Gyr, Itron, and so forth. Each has its own wrinkles. Better ask about that too, since each requires its own quirky data and function mapping layer to plug into -- another MDM Day 1 job.

By the way, none of this is probably going to work without a friendly integration team - either from the vendor, or more likely, a third-party expert like Accenture, Enspiria or Bridge Energy Solutions.

What's the bottom line?

1. There are no turnkey smart grid solutions

2. There are as many different flavors of MDM as there are vendors selling systems

3. If you do MDM right, a world of opportunities await you, but, if you do it wrong, you'll have a hard time preparing a billing statement, let alone a fancy new smart grid application.

4. Most importantly, the winners of the MDMS wars will have their solution in the heart of their client's smart-grid IT infrastructure. Not a bad place to be, especially if you want to provide more value-add and sell more stuff.

Which vendors will win? At this point, the only sure bet is Oracle. Turns out that almost every vendor uses Oracle as their database engine (save Telvent and OSISoft, both of which use OSISoft's PI real-time database; Itron offers your choice of Oracle or SQLServer). So for Oracle, it's not a question of whether the cash register will ring with the next MDMS sale -- it's a question of how much money they'll make.