The U.S. solar industry market grew 76 percent in 2012 and added 3.3 gigawatts of installed capacity, while Pennsylvania solar advocates describe the state’s industry as “moribund” and “a disaster area.”

“The only major state residential market to shrink year-over-year was Pennsylvania," reported the U.S. Solar Market Insight: Year-in-Review 2012 from GTM Research and Solar Energy Industries Association (SEIA), "which fell from 17 megawatts in 2011 to 7 megawatts in 2012.”

“This is a negative case of economics 101: a glut in the marketplace and very low demand,” explained PennEnvironment Executive Director David Masur.

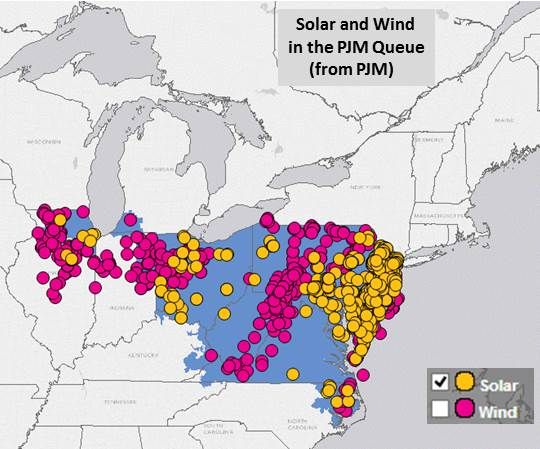

Pennsylvania’s 2004 Alternative Energy Portfolio Standard, requiring state utilities to obtain 18 percent of their power from renewable and alternative sources by 2021, included a 0.5 percent carve-out for solar. But, Masur explained, it was too small and the mandate allowed it to be met from solar electricity generated anywhere on the thirteen-state PJM transmission system.

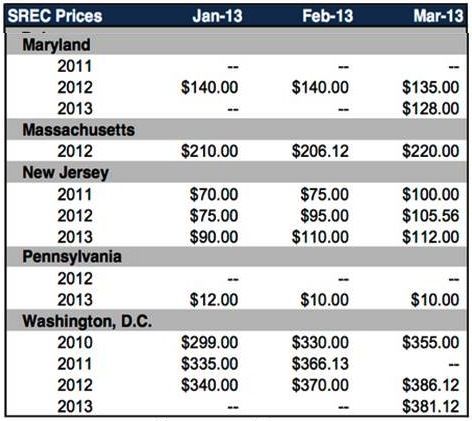

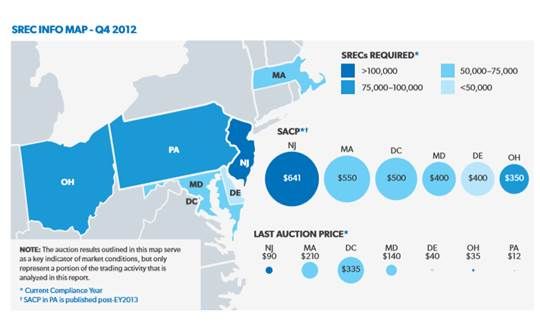

One important financial support for solar growth are Solar Renewable Energy Credits (SRECs), paid per megawatt-hour by utilities required to meet state standards, according to GTM Research partner SRECTrade.

The Pennsylvania Sunshine Solar Rebate Program, funded through state bonds, is the second financial incentive. The $180 million program was put in place in 2009. It proved too popular. Designed to drive growth for five years, it was largely expended in three years.

With its demise, better-funded programs in neighboring states became more attractive, especially since solar installers who migrated elsewhere could still earn Pennsylvania SRECs for selling into the market via PJM.

The price of SRECs plunged from over $400 to $12, according Pennsylvania Solar Energy Industries Association (PSEIA) policy expert Maureen Mulligan. The state solar industry, she said, "is a disaster area."

Retired solar installer Charlie Reichner called the state’s solar industry “moribund.” Before the Sunshine Program, he said, there were probably fewer than 50 solar installers. After it was implemented, there were 500 installers, he said. “General contractors, electrical contractors and roofing contractors got into the business. Now most have left.”

With the Sunshine Program, Reichner’s solar installation business went from four installers to twelve installers -- young people making $50,000 per year. That soon ended.

Source: SRECTrade

“The fix is really easy,” Masur said. “Close the out-of-state production loophole, which would clamp down on the supply side. And ramp up the timeline to get to the 0.5 percent, which would give a little jolt on the demand side.”

In the last state legislative session, he said, a bill supported by the environmental and business communities with the bipartisan support of over 100 legislators was blocked from reaching a vote by the open opposition of the governor and a few power players aligned with fossil and nuclear industry interests like Exelon (NYSE:EXC).

It may be brought up again in the current session, Masur explained, but right now its sponsors are demoralized. “Those powerful lobbies have convinced legislators that even 0.5 percent of solar is not acceptable. They do not support clean energy in any way, shape, or form.”

“The Sunshine Program was funded by a bond. It did not cost ratepayers anything,” Reichner said. “Opponents stopped the change to the state’s renewables standard because it could cause ratepayers’ utility bills to go up between $0.05 and $0.25 per month.”

Some companies have begun marketing third-party ownership lease and PPA opportunities, but not aggressively, Reichner added, because without the SREC value to add to the ITC return, even with high utility prices, “the return on the investment is just not there.”

But there is one possibility that could turn things around, PSEIA VP Ron Celentano said. The open borders policy that allowed solar generated electricity to flood Pennsylvania’s market through the PJM system and move a third of the state’s SRECs out of state was kept in place because closing the borders was concluded to be a violation of the interstate commerce clause. But the current attorney general is on record stating that it is not. It is possible that will open the door to a legislative fix.

Source: The GTM Research/SRECTrade Q4 2012 SREC Market Monitor