[pagebreak: 1]

As described earlier this week, the grid edge comprises the technologies, solutions, and business models advancing the transition toward a decentralized, distributed and transactive grid.

Below is an excerpt from our new free report, The Grid Edge: Utility Modernization in the Age of Distributed Generation.

Energy security and environmental sustainability are part of the larger context of grid modernization efforts. However for the following list of eleven market drivers, GTM Research specifically focuses on distribution grid features.

Market Driver 1: Solar Surge

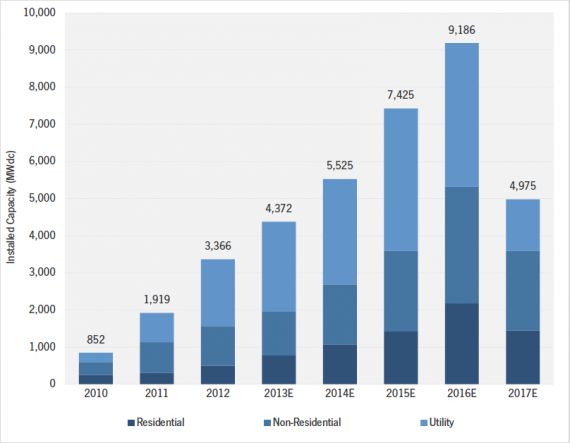

In the second quarter of 2013, more capacity was added in the U.S. residential PV market than ever before (164 MW), up 48% from capacity additions in Q2 2012. In total, GTM Research forecasts that 1,954 MW of distributed generation PV will be installed in the U.S. in 2013, which is more than three times as much as was installed in 2010.

While the utility market still accounts for the majority of installed capacity in 2013, residential and non-residential installations are likely to exhibit the biggest growth between now and 2017, adding many installations connected behind the meter or to the distribution grid. As the price to install solar continues to fall, PV will soon be cost-competitive with retail electricity across several states. In Hawaii and California, distributed generation PV already serves a meaningful portion of customer load, upending the traditional utility model.

Source: GTM Research

Market Driver 2: Decentralization Takes Center Stage

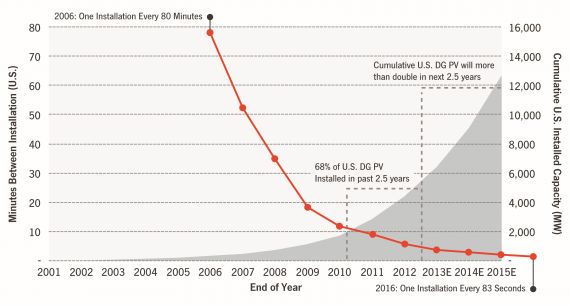

Two-thirds of all distributed PV in the U.S. has been deployed in the last 2.5 years alone, and GTM Research forecasts another doubling in the next 2.5 years. The frequency of distributed PV deployments is increasing rapidly, with one new installation expected every 83 seconds by 2016.

By 2017, residential PV will have doubled its share of total PV installations, increasing from 16% in 2011 to 29% in 2017. On the heels of distributed PV will come other decentralized technologies, including storage, vehicle electrification and microgrids.

Source: GTM Research

Market Driver 3: Sandy Sells

Hurricane Sandy focused attention on the crisis-management capabilities of several major utilities, increasing the pressure for them and other utilities to prepare for extreme weather events in the future. During Sandy’s outage peak, 8.51 million end customers lost power. Concern over past performance is overshadowed only by more disturbing prospects for the future, as the Intergovernmental Panel on Climate Change (IPCC) has concluded that there is a high probability that the intensity and frequency of extreme weather events will increase, and as such, the grid will be forced to endure increasing and more frequent external stress.

The recent trend toward performance-based ratemaking and the expansion of regulatory flexibility reinforces this market driver. GTM Research expects disaster preparedness to engender a major push for distribution automation and grid optimization, analytics, integrated platforms, AMI and microgrid technologies.

Market Driver 4: Smart Value, Smarter Collection

As generation from renewables exceeds local demand and transmission capacity in certain areas, these power sources will increasingly need to be curtailed. This impedes the full recovery of value from distributed energy resources. As investments in renewables continue to grow, so will the incentive to invest in a grid that enables monetization of these benefits. This also includes demand response in the form of “supply response.” Recent FERC initiatives to allow the compensation of fast and accurate ancillary services (e.g., those provided by storage and aggregated automated demand response) mark important steps in that direction, as do regulatory efforts to quantify the exact value of distributed energy.

Market Driver 5: Proving the Post-Stimulus Competitiveness of Renewables

Investment tax credits and feed-in tariffs have limited the risk exposure of renewables so far, but the replacement of government interventions with market forces will drive investments in a smarter grid after 2017, when the U.S. federal Investment Tax Credit for solar systems will fall to 10%. Deutsche Bank Research forecasts that the number of states in which solar PV has achieved grid parity could drop from 47 in 2016 to 36 in 2017, which would still be a 70% share.

With less government support, renewable generators will have to continue to lower costs in order to expand their market position. As for centralized solar PV, renewable portfolio standards have been the backbone of many power-purchase agreements. The next round will likely be driven by cost-competitiveness.

Market Driver 6: The Grid Demands, the Consumer Responds

Demand response growth will be driven by increased standardization and integration possibilities. OpenADR 1.0 laid the foundation for this driver, and its more broadly applicable version 2.0 will allow true value recovery. The Brattle Group forecasts a growth of 56% of peak demand reduction potential between 2010 and 2015, up to 83 GW from 53 GW in 2010.

[pagebreak: 2]

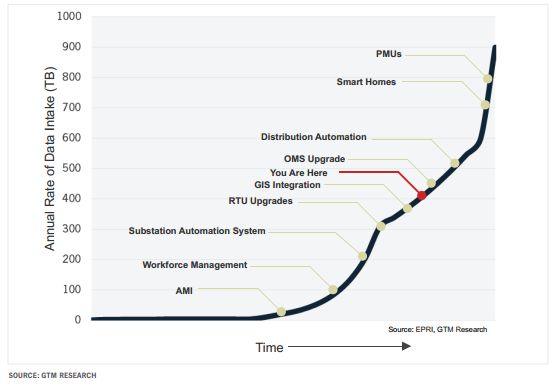

Market Driver 7: Big Data Hits the Big Time

Data pertaining to experiences of success and failure is a major ingredient in the development of future business concepts. Whether at the utility or consumer scale, analytics supply this information as they are increasingly internalizing terabytes of data supplied by the “internet of things” within the power grid.

Market Driver 8: Green Investment Gets Standardized

Third-party financing, green banking, on-bill repayment of distributed energy systems, crowd funding -- many of the finance vehicles for renewables are still new, but every contract signed extends the list of experiences documented by vendors and financial institutions. Standardized investment patterns are bound to emerge, including clear-cut return-on-investment profiles.

Market Driver 9: Soft Grid, Easy Business

Idea-based startup opportunities can capitalize on the many hardware expenditures that have already been made; they represent the next wave of investment in grid modernization. Not only analytics providers, but also consultancies and energy audit companies will profit from the entrepreneurial playground that was created by the power grid investments paid for through ARRA stimulus grants.

Market Driver 10: Smart Upgrades

The U.S. power grid infrastructure is aging rapidly. In New York state alone, 85% of the state’s transmission lines were built before 1980. A total of 4,700 miles of lines are expected to approach the end of their viable lifecycles in the next 30 years. With the price of grid-edge equipment falling, utilities will adopt smart technologies to safely extend asset life, as well as to replace aging infrastructure.

Market Driver 11: Increasing Customer Awareness Around Resiliency

While a minor disaster for football fans, the Super Bowl blackout created public awareness of the need for intelligence at the edge of the grid, reminding consumers and regulators of the vulnerabilities of a legacy power grid. Along with extreme weather events, this type of occurrence raises consumer awareness. Although smart-grid solutions are often thought of as more “green” or “clean” than operationally critical, they enhance the foundations of a truly resilient grid.

For much more on grid edge and the opportunities it brings, download the free report here.