The largest investor-owned utilities in the U.S. tend to receive the most media coverage when it comes to deploying advanced metering infrastructure. Whether it’s due to missteps during deployment or interesting applications leveraging the technology, it’s easy to focus on the big guys as they ink contracts for millions of meters.

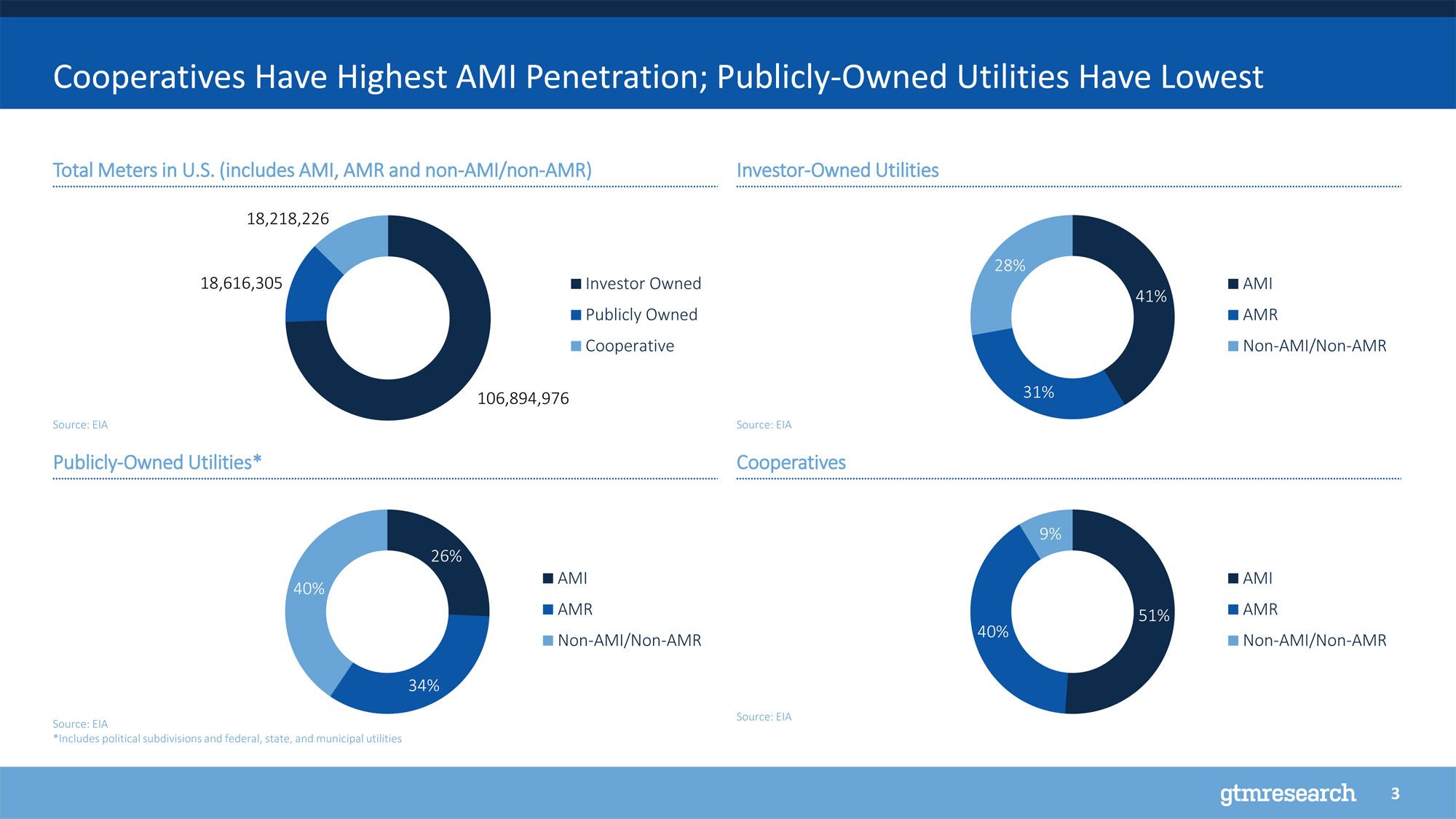

But it's actually cooperative utilities that have the largest penetration of smart meters by percentage of customers, according to GTM Research's analysis of new data from the U.S. Energy Information Administration.

When it comes to sheer volume, investor-owned utilities are still responsible for the largest number of meters deployed. But recent contracts are mostly small ones with cities or cooperatives, a trend that likely will continue until one-way AMR technologies have reached the end of their service lives.

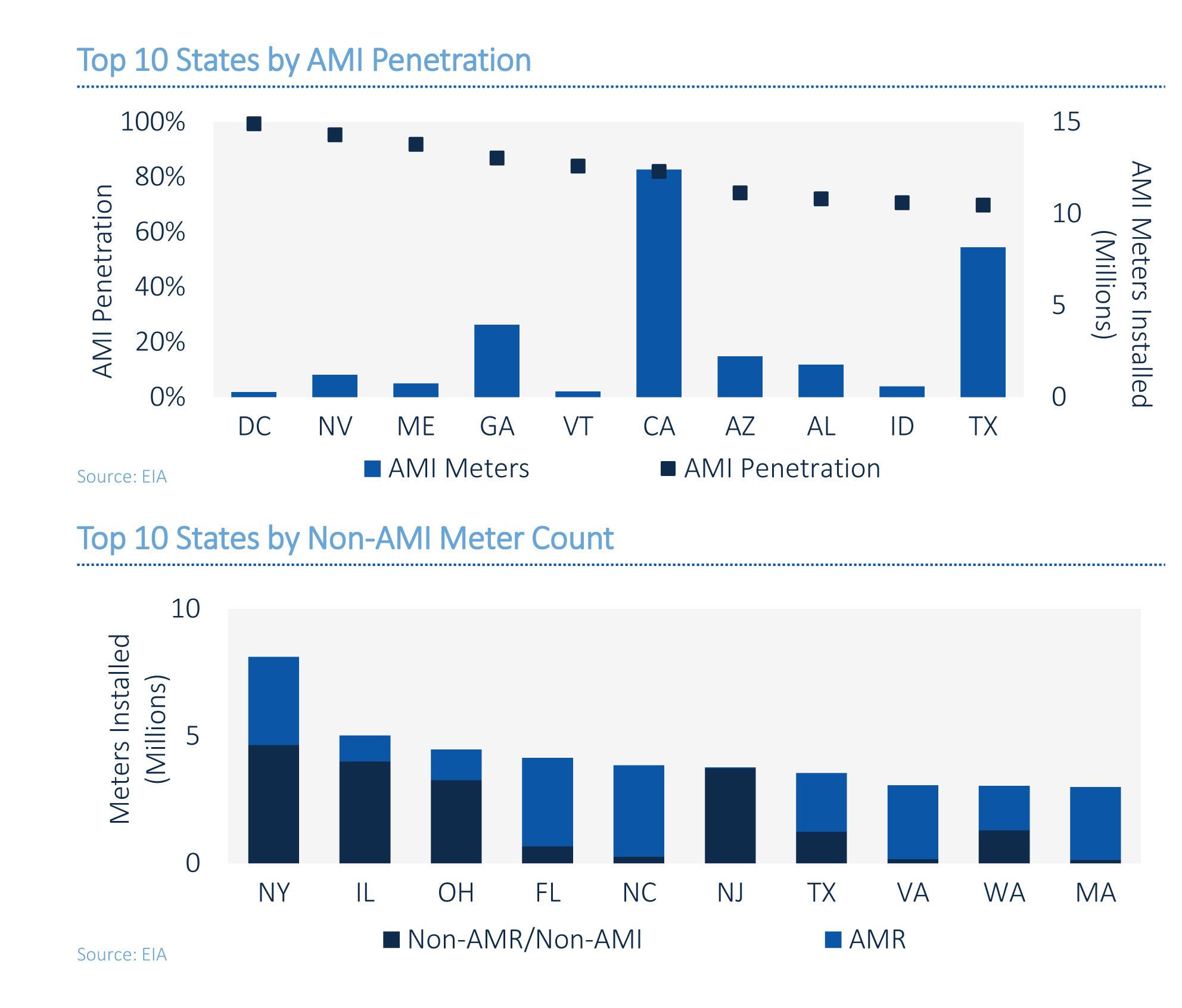

There are nearly 60 million smart meters in the U.S. Many of those were installed with the help of stimulus grants. Last year, only 5 million meters were deployed, the lowest level since before stimulus dollars began to be put to use. This year is also shaping up to be a relatively slow year for installing smart meters.

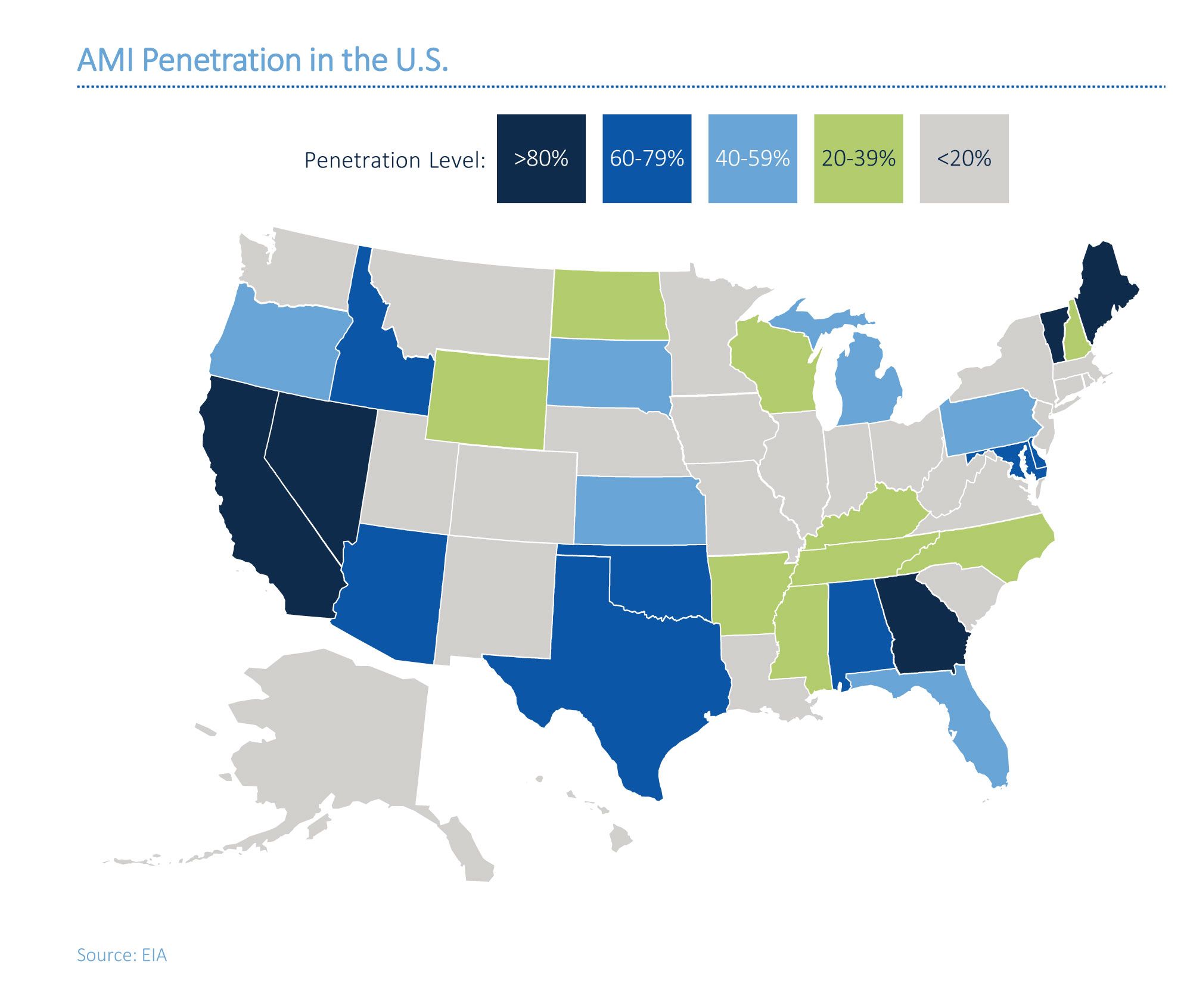

The picture for meters across the U.S. is mixed in terms of technology and regional deployment. States with meter mandates that apply to investor-owned utilities, such as California and Texas, have some of the highest rates of penetration.

Still, approximately half of all U.S. states are only about one-fifth of the way through the deployment process, GTM Research found when examining the data from EIA. Four states are responsible for more than half of all smart meters in the U.S.

For many utilities, that is because they have invested in one-way communicating meters, also known as automatic meter reading (AMR) technology. Since AMR has already cut the need for meter reads, it can be difficult for utilities to make the business case for two-way communicating thermostats if manual meter reads are not part of the cost-benefit analysis. Many utilities are waiting for AMR technology to reach the end of its useful life before investing in the latest technology.

However, the business case could be shifting for some utilities as granular data is increasingly leveraged across a utility operations. As regulators and customers demand more from their energy providers, AMI can be one tool to help deliver more tailored services. For cooperatives in particular, those business benefits can be easier to justify.

To realize the full benefits of the Reforming the Energy Vision initiative currently underway in the state, New York utilities are finding that they will need smart meters for more granular data collection. Con Edison, for example, will start a 4.7-million-meter deployment next year. It will be the first U.S. utility to gather and offer near-real-time data to its customers. Other large utilities in New York have also filed smart meter rate cases.

Smart meter installation figures should start to rebound later this decade as states like New York and Massachusetts enact regulatory changes to encourage uptake of the technology. Some other large deployments, such as at Ameren Illinois, Commonwealth Edison, DTE Energy and FirstEnergy’s Pennsylvania utilities will also finish up large smart meter deployments by the end of the decade.

By then, many AMR systems may reach the end of their useful lives and the case for smart meter systems could grow, especially if regulators allow utilities to leverage them beyond their traditional service model.