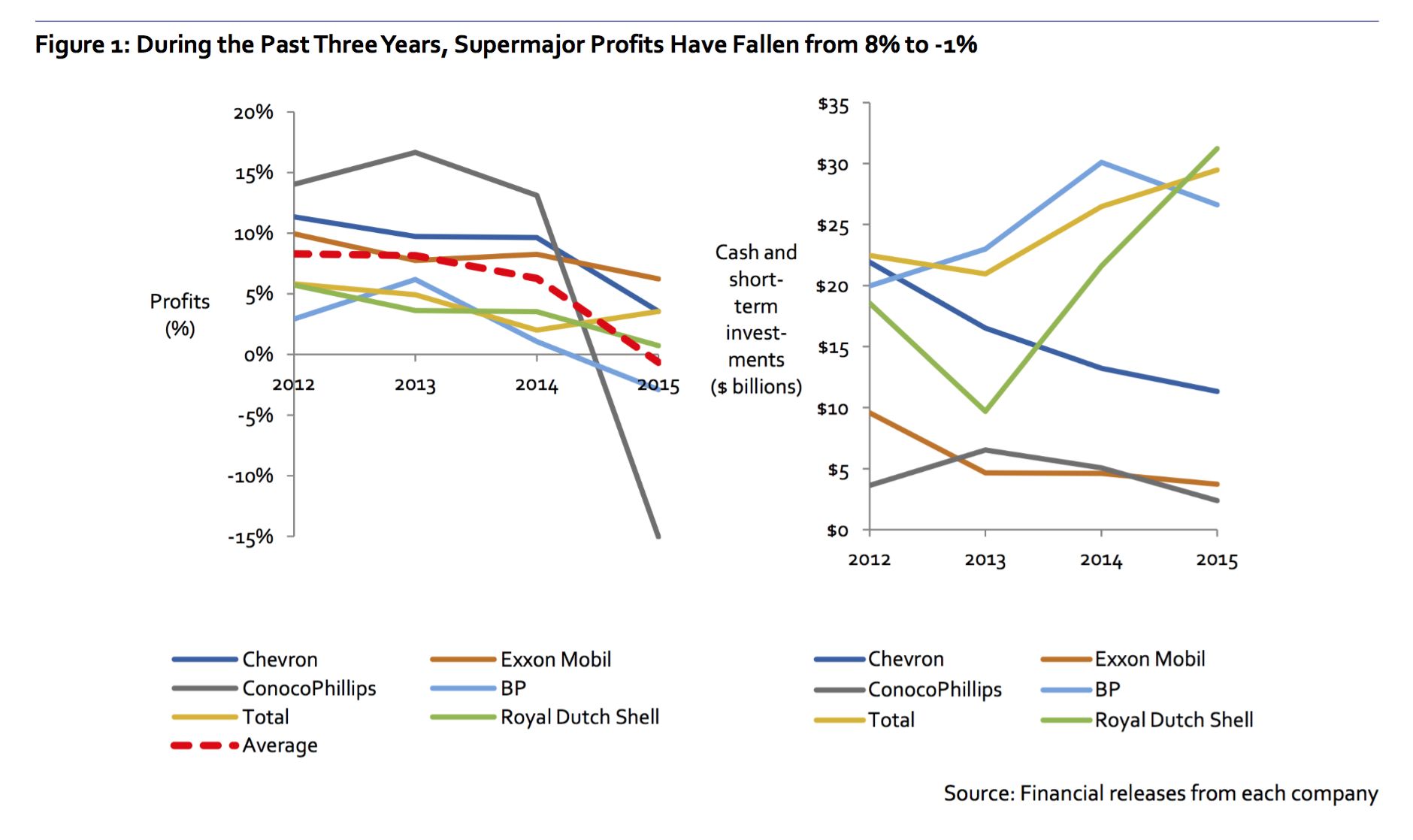

The oil and gas giants have fallen on tough times. We're not talking can’t-afford-a-meal tough -- they still have billions in cash lying around -- but not-raking-in-billions-in-profit tough. Booms and busts have always rocked this industry, so executives could make a case for sitting on their cash until oil prices rebound and prosperous times return.

Or maybe the energy markets are changing and there won’t be a familiar status quo to go back to.

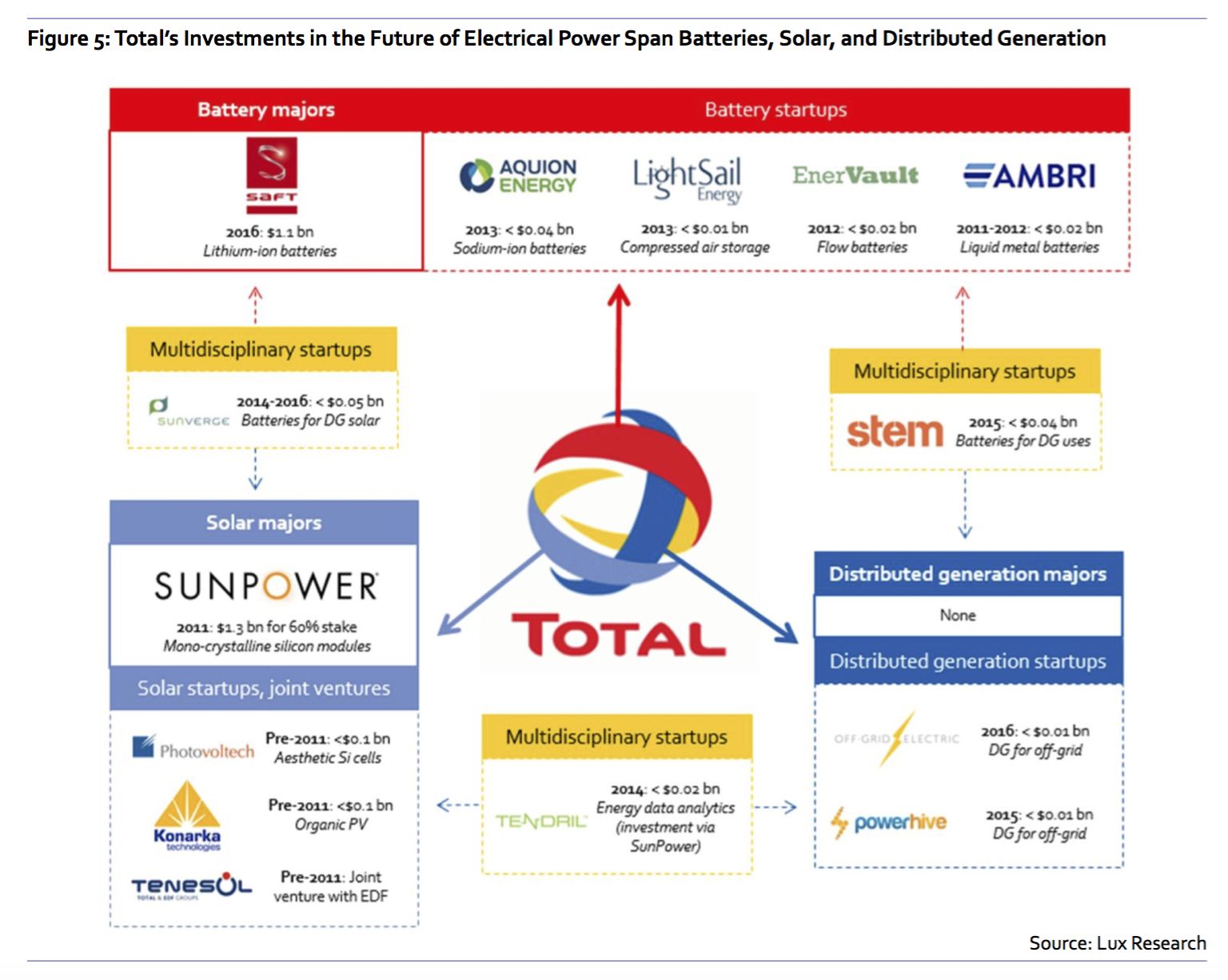

The French oil company Total prepared for that outcome with its purchase of battery maker Saft this spring for $1.1 billion, the largest-ever entry into the battery business by an outside company. That acquisition joins earlier investments in solar and distributed energy to give Total a foothold in the emerging clean energy market, opening new revenue streams in the event that oil and gas become less relevant in the decades to come. As documented in a new report by Lux Research, it might already be too late for Total’s peers to join the party.

The research invokes the phrase “supermajor Darwinism” to describe how the most massive energy conglomerates are grappling with the coming changes in how the world powers itself. As society shifts from burning gas for transportation and power generation to harnessing electrons from clean sources, these dominant players will have to adapt to an ecosystem that doesn’t reward their strengths in the way that it used to.

“The simplest, safest near-term move would be inaction: In an era of falling profits and uncertain futures, oil supermajors can play it safe and preserve their cash piles, avoiding adventures outside their core areas of expertise,” states the report, authored by senior analyst Cosmin Laslau. “But doing nothing misses the bigger long-term threat: The automotive industry is slowly but surely shifting from oil to electrons, and the future of the power grid is shaping up to be much different too.”

Source: Lux Research

To be clear, Laslau does not think the supermajors are going to vanish any time soon. They’ll still have a role a few decades from now -- but if they don’t adapt, they’ll play an increasingly irrelevant one.

As the auto sector starts to shift toward electrification, investing in core battery technology offers one of the “cleanest pivots” for oil giants seeking to maintain revenue, Laslau argues. In that sense, Total’s purchase of Saft provides a model for fellow oil companies.

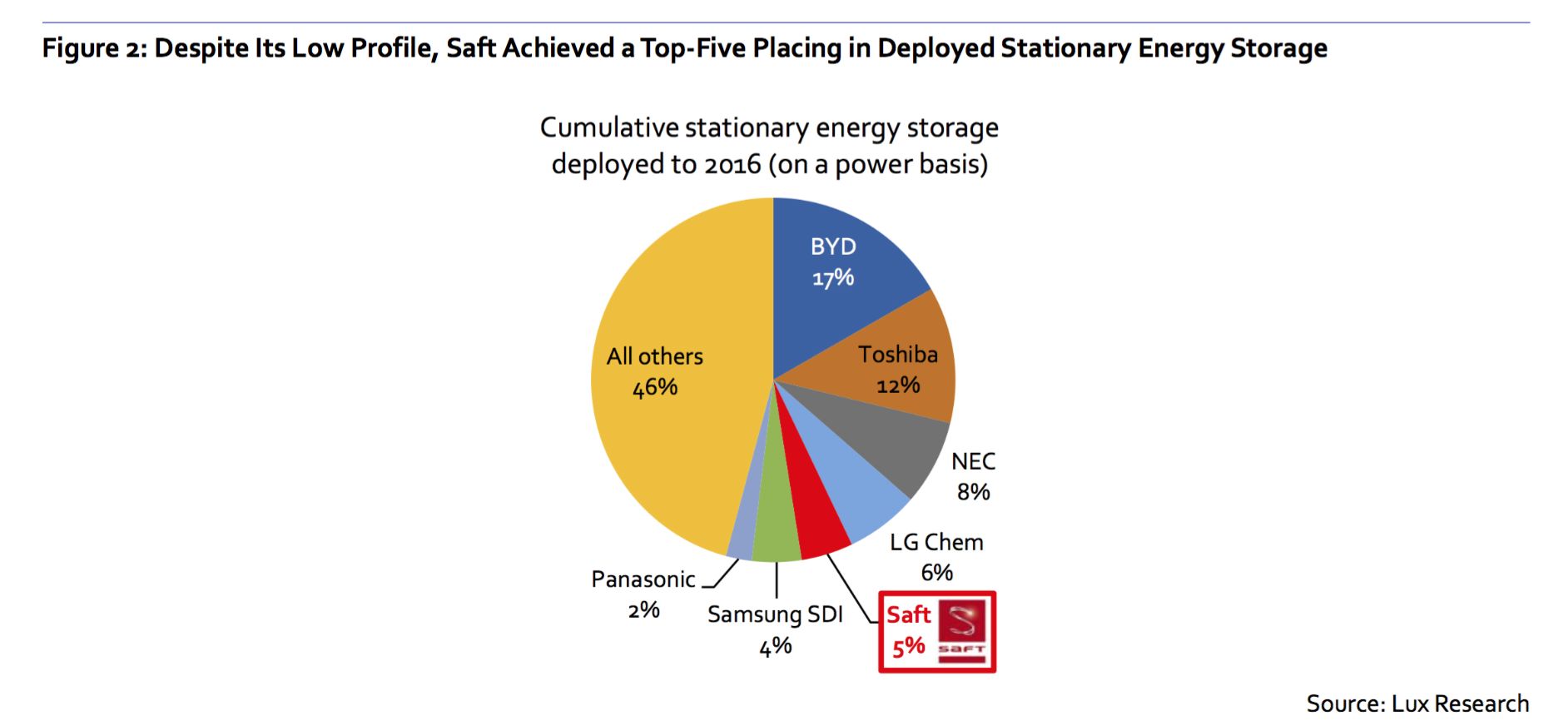

Saft has worked its way to No. 5 in cumulative installed stationary storage capacity, following BYD, Toshiba, NEC and LG Chem. The company comes to Total not just with 153 patent families and a presence in 19 countries -- it also has profits, something of a rarity in the storage sector. On top of that, Saft’s stock value tumbled 30 percent throughout 2015, so Total was able to purchase at a low price.

Source: Lux Research

Unfortunately for Total’s peers, the remaining top storage manufacturers may be too valuable to buy. BP holds $27 billion and Royal Dutch Shell has $31 billion in cash and short-term investments; the American competitors Chevron, ExxonMobil and ConocoPhillips have just a fraction of that.

On the storage side, Panasonic, BYD and Hitachi are probably worth more than $20 billion, Laslau estimates, and that’s before adding the kind of premium that would go into a purchase offer. If the supermajors don’t want to blow all their cash on a storage company, they’ll need to look further down the pecking order to find something cheaper, or see if they can split away the battery section of multifaceted company.

The oil barons may have an opportunity thanks to the supplies of cash they do have. Battery production demands notoriously high amounts of capital. Tesla and Panasonic raised the bar with their $5 billion Gigafactory investment; any group trying to challenge them on production will need a similarly vast cash outlay, and there are only so many entities that can provide that.

If the other supermajors can’t get their hands on a battery manufacturer of their own, they still have a few other options, Laslau noted. They could develop supply partnerships with battery makers, for instance, or look further down the supply chain to battery integration and deployment.

Some might bristle at the idea of fossil fuel companies buying up newer clean energy ventures to appear more sustainable. Laslau doesn’t think the movement toward energy storage is a greenwashing publicity stunt, however.

“We look at this market and energy storage is already generating, as an industry, tens of billions of dollars in revenue,” he told Greentech Media. “This is a real technology that has been around for decades and certainly works.”

Source: Lux Research

Storage serves an energy company’s core mission, but it also opens up new strategies, particularly when matched with renewable energy assets and distributed grid capabilities. Total has been building up just such a portfolio: it’s invested in startups across the solar/storage/distributed energy spectrum and acquired a controlling stake in major solar manufacturer SunPower back in 2011 for $1.3 billion.

That interdisciplinary merging is something Tesla is doing with its proposed acquisition of SolarCity, and BYD has already done it in China. This offers more than cost savings and manufacturing efficiencies, Laslau said.

For one thing, Total earned a front-row seat to the immense changes underway in the clean energy startup world. It’s hard enough for an oil and gas company to invest outside its core expertise; by participating in the development of the pioneers of the new field, Total was able to better read the markets and spot a good deal.

Beyond that, the portfolio gives Total the ability to conceive of clean energy holistically, from generation to consumption

“Right now, a lot of this is two separate spheres of innovation that are kind of clunkily integrated together, sometimes by the end installer and electrician,” Laslau said. “Going right back to the drawing board and rethinking the whole approach to make new products -- that will be really interesting to track.”