This morning, SolarCity announced a $10 million acquisition (and up to $20 million with earn-outs) of ILIOSS, a top 20 EPC firm in Mexico according to the Q2 Latin America PV Playbook. This marks a significant milestone for SolarCity, which joins Sungevity and SunEdison in the international market, but also represents a potentially market-moving event in the Mexican solar sector.

We explained last year why this move makes sense for SolarCity. The company plans to maintain an aggressive growth strategy in the context of a potential ITC step-down in the United States, while Mexico boasts strong fundamentals and is one of the most accessible growth markets in the world. Acquiring ILIOSS enables SolarCity to leverage local expertise and pipeline in a complex market rather than starting from scratch, and the company (rightly) noted that Mexico was a good “jumping-off point” for further expansion into Latin America.

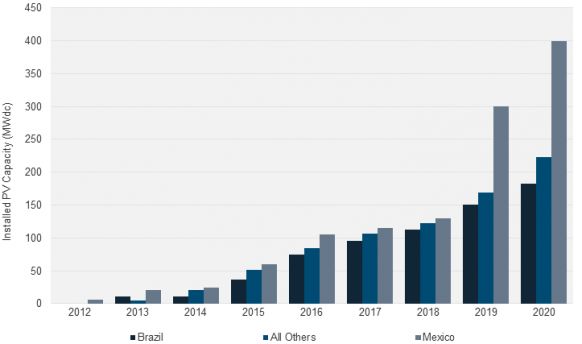

Mexico’s annual PV market will reach 2.6 gigawatts in 2020 under GTM Research's base-case forecast, for a cumulative market of 7.6 gigawatts. Mexico is also the No. 1 ranked country for distributed generation in the Latin America region, and at 2.2 gigawatts, the commercial and industrial segment is expected to account for 15 percent of the Mexican market out to 2020.

Bringing Mexico’s C&I solar market to scale

SolarCity clearly believes that the commercial and industrial market is the best opportunity to reach scale quickly, and I agree. That segment has high electricity tariffs, ranging from $0.09 per kilowatt-hour to $0.17 per kilowatt-hour, net metering, and creditworthy counterparties.

FIGURE: Commercial and Industrial PV Installations in Latin America

Source: GTM Research Q2 Latin America PV Playbook

Of course, there are some challenges. Electricity prices have dropped over the past few months, exacerbating offtaker concerns about signing long-term power-purchase agreements. Many customers expect electricity prices to continue to fall due to energy reform (although we think that’s unlikely, given the national utility’s mounting losses). Currency volatility has made locking in solid quotes and financing terms challenging for developers, with pricing on imported components changing from week to week. Demand charges for large customers decrease solar paybacks. What's more, lending rates for small and medium-sized enterprises are often in the double digits with tenors under five years.

However, tackling these kinds of challenges is precisely SolarCity’s core competency. Providing a standardized leasing model would help shore up consumer confidence. SolarCity has the clout to bring international investors into the market and offer financing at more competitive rates than are currently available through commercial finance. The entry of a large company with big aspirations could also spur consolidation of the largest and best regional installers. While it’s true that a healthy number of companies encourages competition, Mexico has struggled with quality control -- and a nationally recognized brand would raise the bar for all the players in the market.

All things considered, these factors create a hugely scalable opportunity for SolarCity in the commercial and industrial segment -- which accounts for almost 70 percent of the total end market in Mexico, with over 170 gigawatt-hours of annual electricity consumption. In addition, its entry could buoy the market to higher levels than we anticipated earlier this year.

One last point to make: why isn’t SolarCity pursuing residential in Mexico? While I do think the company will move into this space eventually, the residential market is less scalable at the moment, despite having some highly attractive elements. The tariff structure in the residential market is much more fragmented: while about 500,000 high-consumption customers pay rates as high as $0.21 per kilowatt-hour, most of the middle class pays closer to $0.11 per kilowatt-hour, and then a huge portion of customers pay about $0.06 per kilowatt-hour. Financing is harder to get off the ground, as a large swath of residential customers do not have credit. The currency volatility against the U.S. dollar and the tax on imported PV modules lowers margins for residential installations, particularly outside of that high consumption tier.

However, despite those factors, there are several very strong regional players in the residential market who are doing great work, including launching some new leasing products, and we expect that SolarCity and others will be looking for acquisitions in the Mexican residential market over the next year.

***

Adam James is a senior solar analyst with GTM Research and the lead author of the Latin America PV Playbook.