With the 30 percent Federal Business Energy Investment Tax Credit (ITC) set to expire at the end of 2016, GTM Research has begun to assess the state of the U.S. solar market in a world with fewer incentives. In determining the potential for solar deployment, we are looking for a scenario where solar becomes cost-effective even without subsidies. We believe the first tipping point in the distributed generation market will be when developers can offer customers a PPA at less than retail prices. And if the PPA has an escalator, it should be less than historical increases in retail rates. One way to measure this point in time is to compare the levelized cost of energy (LCOE), a measure of the total generation cost in dollars per kilowatt-hour, over the lifetime of a PV system, to retail electricity prices. By looking at energy cost, as opposed to capital cost, we are able to assess the competitiveness of solar versus traditional generation.

Two weeks ago GTM Research published a preliminary study of the U.S. commercial market following the step down of the ITC to 10 percent in 2017. Our ever-thoughtful readership raised a number of good questions, so we have revised the model. The conversation also brought up a discussion worth repeating.

There are four main cost components of an LCOE calculation: 1.) capital cost, 2.) fixed operation and maintenance (O&M) cost, 3.) variable O&M cost, and 4.) fuel cost. Upon undertaking our initial evaluation of the U.S. solar market in a post-ITC world, we calculated a nominal LCOE, not taking into account the impacts of inflation over the 25-year life of the system. We assumed a nominal interest rate when calculating capital cost and compared our LCOE model output to retail grid prices at the time of installation. This presents a problem: we essentially assumed that the rate of electricity stays constant over the lifetime of the system, when in reality it tends to increases annually by at least the rate of inflation, and often more. As pointed out by reader Bob Wallace, this analysis does not capture the entire avoided cost of a PV system and overlooks future savings if you believe that retail prices will continue to rise in the future.

To account for this, our analysis could be adjusted in one of two ways: 1.) we could calculate an expected average retail electricity cost for the lifetime of the system and compare to nominal LCOE, or 2.) we could calculate a real LCOE and compare it to grid price at the time of installation. Per the suggestion of GTM Research alum Travis Bradford, we chose to update our model to represent a real levelized cost while leaving retail rates the same. Specifically, we incorporated a conservative 2 percent discount rate into the calculation.

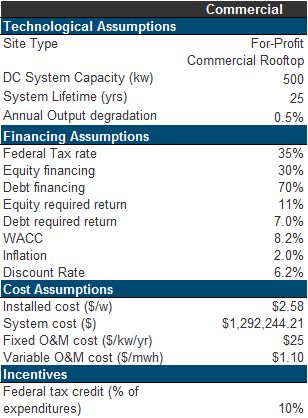

Our updated model assumptions for a commercial system in 2017 are as follows:

Source: GTM Research

WACC was adjusted down for inflation to come up with a real discount rate. Additionally, our 2017 installed cost assumptions have been revised downward based on additional data inclusion.

The goal of this analysis is to determine in which markets developers can offer a PPA to customers at less than retail prices, with an escalator equal to inflation. To that end, we compare the real LCOE for commercial installations to representative state grid prices (selecting a representative utility in each state), increasing annually at the rate of inflation.

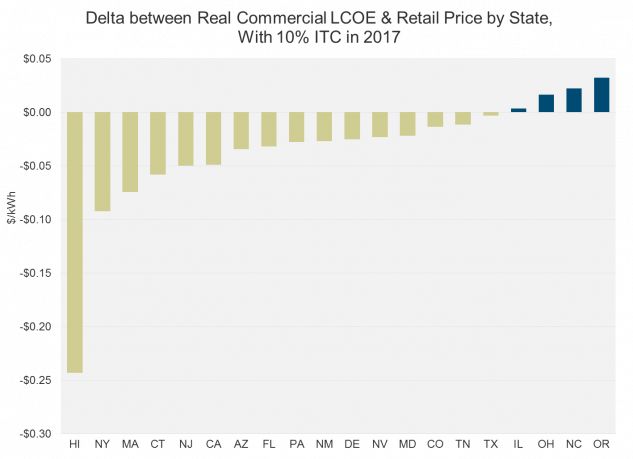

Source: GTM Research

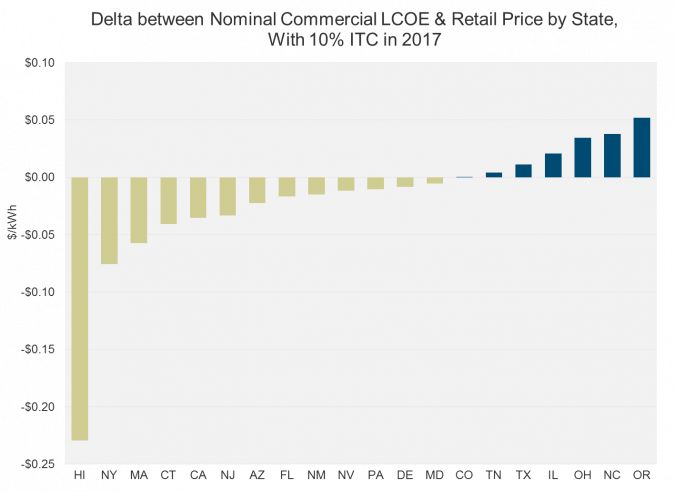

Source: GTM Research

After the ITC is stepped down to 10 percent in 2017, a comparison of real LCOE to retail grid prices reveals solar generation costs below those of traditional energy in sixteen of the twenty state markets analyzed. If nominal LCOE is used, we see price convergence in only thirteen states.

By updating our analysis to correct for inflation over the 25-year system lifetime, we are better able to evaluate the future cost savings potential of solar generation. As anticipated, the quantity of state markets where solar PV will be an economically viable option for commercial customers increases when utilizing real instead of nominal LCOE.

Now we throw it back to the savvy GTM readers: Is real LCOE the right calculation? Are we right in our assumption of the first tipping point for demand? As always, comments are welcome as we continue to build on this early analysis.

Special thanks to Scott Macmurdo for sharing his analysis on the effects of a real discount rate in LCOE calculations.

For more information on GTM Research’s U.S. solar market analysis, contact [email protected].