While Westinghouse Solar is busy going after Zep Solar in a long-standing patent dispute, the Nasdaq has just sent Westinghouse a delisting notice for failure to keep their stock price above $1.00.

Here's the text of the Nasdaq delisting from the Westinghouse Solar 8K form:

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing

On October 4, 2011, Westinghouse Solar, Inc. (the “Company”) received a letter from The NASDAQ Stock Market (“NASDAQ”) indicating that for 30 consecutive business days the Company’s common stock did not maintain a minimum bid price of $1.00 (“Minimum Bid Price Requirement”) per share as required by NASDAQ Listing Rule 5550(a)(2).

The notification of non-compliance has no immediate effect on the listing or trading of the Company’s common stock on The NASDAQ Capital Market. Under the NASDAQ Listing Rules, if during the 180 calendar days following the date of the notification (that is, prior to April 2, 2012) the closing bid price of the Company’s common stock is at or above $1.00 per share for a minimum of 10 consecutive business days, the Company will regain compliance with the Minimum Bid Price Requirement and the matter will be closed.

If the Company does not regain compliance with the Minimum Bid Price Requirement by April 2, 2012, NASDAQ will provide written notification to the Company that its common stock is subject to delisting. The Company may receive an additional 180 day grace period (a total of 360 days from October 4, 2011) to regain compliance with the Minimum Bid Price Requirement provided that the Company is then in compliance with the initial listing standards for The NASDAQ Capital Market, other than the Minimum Bid Price Requirement. Alternatively, the Company may appeal NASDAQ’s determination to a NASDAQ Hearing Panel at such time as it receives any notification that it has no further grace period.

This October 4, 2011 notification of non-compliance, and the timing and other requirements for regaining compliance with the Minimum Bid Price Requirement, is separate from and in addition to the requirements and the time frame under which the Company needs to address compliance with the minimum stockholder equity levels for continued listing, and the related monitoring period, as described in a Current Report on Form 8-K filed with the SEC on September 28, 2011.

Here's a quick take on the Westinghouse financials:

Westinghouse Solar, helmed by CEO Barry Cinnamon, is a public company with revenue of $8.7 million in 2010 and losses of $6.4 million. Westinghouse Solar, claims to have "pioneered the concept of solar panels in which the racking, grounding and wiring is integrated into the solar panel itself." The firm was once a solar installer but is now a designer and manufacturer of the Andalay brand AC solar module. The company gave a 2011 revenue guidance in the range of $25 million to $30 million. Actual revenue for the first two quarters of 2011 was $4.8 million, and 2011 revenue guidance was dialed back to $15 million to $20 million.

It looks like it could be challenging to meet even that dialed-back guidance given the current economic conditions in solar.

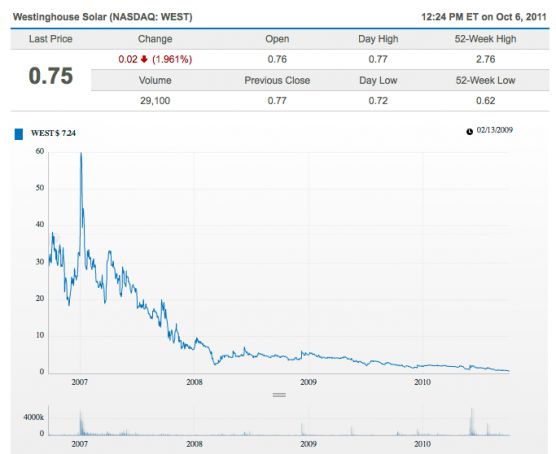

Here's a snapshot of the Westinghouse Solar stock situation:

Regarding the patent dispute, Eric L. Lane, Special Counsel, Intellectual Property Group and Climate Change, Renewable Energy, and Sustainable Technology Practice at Luce, Forward, Hamilton & Scripps LLP, had this to say:

"The ITC complaint is the second chapter in a growing legal battle between Westinghouse and Zep, with an infringement suit Akeena filed based on the same patent family in federal court in San Francisco in 2009 still pending. The new complaint suggests the move to the ITC was prompted by Zep's licensing of the accused technology to foreign manufacturers. Westinghouse may be hoping to take advantage of the ITC remedy of an exclusion order, which stops infringing goods at the U.S. border."

Zep Solar sees the patent timeline like this, according to email correspondence from the company.

2009 to present:

- Akeena sues Zep for infringement of '800 patent

- Zep files complaint with USPTO that '800 patent is invalid

- Judge stays '800 patent lawsuit (ZEP WIN)

- Akeena pleads to unstay case

- USPTO rejects each and every claim of '800 patent (12 total) (ZEP WIN)

- Judge upholds stay of '800 patent lawsuit, referencing USPTO rejections (ZEP WIN)

- Zep files declaratory relief action regarding '641 patent (stating that Zep does not infringe '641 patent and that '641 patent is invalid anyway)

- Zep files complaint with PTO that '641 patent is invalid

- USPTO rejects each and every claim of '641 patent (3 total) (ZEP WIN)

- Judge stays '641 patent lawsuit (ZEP WIN)

- Akeena files complaint with the ITC as last-ditch effort

We have contacted Westinghouse Solar for comment.