A recent story in Business Insider looked across all of the results from the latest American Customer Satisfaction Index and found that the two most-disliked companies in America were utilities.

Unsurprisingly, cable companies, airlines and banks brought up the rear.

The dissatisfaction with two utilities in particular, Long Island Power Authority and Northeast Utilities, underscores how far some power companies have to go to build goodwill amongst their customers.

But what the article doesn’t show is that many utilities have made strides. In another report specifically about the power industry, the American Customer Satisfaction Index found that satisfaction with energy utilities overall has surged to an 18-year high.

Pepco had some of the biggest gains of any industry, with a 28 percent rise. That gain could be short-lived given the severe damage and power outages in the mid-Atlantic, which includes some of Pepco’s territory.

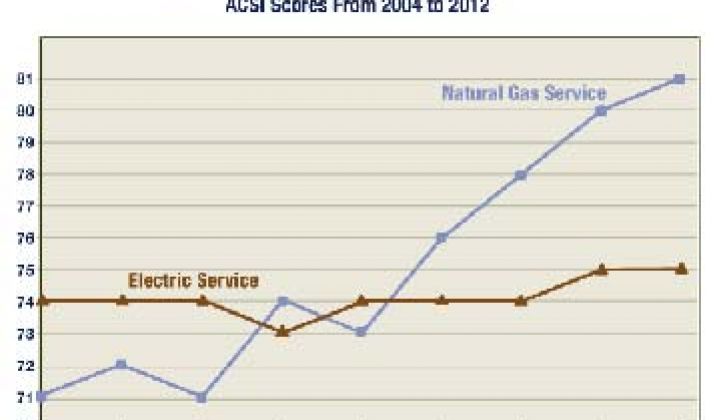

The improvements in utility scores are coming mostly from gas utilities and not necessarily from electric services. Natural gas saw gains from the low 70s (out of 100) in 2008 to 81 percent satisfaction in 2012. Electric service, however, has only gained about one point, up to 75 percent.

Loss of power drove dissatisfaction in the electric sector, while cheap prices and reliability gave a boost to gas utilities. Cooperatives and municipalities continue to have the best scores, as they have a business case that makes it easier to answer to customer needs, rather than shareholders. Salt River Project in Arizona, for example, has always topped lists for the most liked utility.

"Where companies have little or no competition or where customers encounter barriers to switching among competitors in terms of cost and/or convenience, companies may not need to satisfy their customers to the same degree in order to keep them," ACSI's David VanAmburg told Business Insider.

One of the most improved scores went to Ameren, which gained nearly 10 percent. Despite the fact that Ameren has had continued rate increases, many of its customers can choose other electricity suppliers through their municipality.

In the case of Northeast Utilities, extended outages in Connecticut Light & Power’s territory created many enemies last year. Northeast Utilities is also merging with NStar, which could change its score significantly next year. Pepco, on the other hand, recovered from its precipitous decline the year before, and made a strong bounce back.

The scores are heavily weighted in areas that saw significant storms, but there are hints that smart grid -- specifically better outage management and customer choice -- are making a difference.

Fault location isolation and service restoration, commonly known as FLISR, can cut an hour-long outage to just a few minutes, for example. The FLISR market is expected to be worth more than $1 billion by 2016, according to GTM Research.

Many utilities are undergoing large-scale implementations, including NSTAR, EPB Chattanooga, and San Diego Gas & Electric and planned projects in the works at Pacific Gas & Electric and Southern California Edison. The cost of FLISR, which isolates faults automatically, can be high, but compared to CL&P’s outage that cost nearly $163 million, the cost of not having it can be far higher.

At PG&E, a $360 million project to add intelligence to 400 distribution grid circuits has already started to pay off. Last fall, an early-stage deployment of the system of high-speed communications, smart grid switches and control software was able to detect an outage near the town of Rio Vista, isolate the section of line where the outage happened, and direct repair crews to the spot in record time. The entire system will reduce outages by an expected 77 percent.

The new way of doing business will contrast with utilities that don’t have the systems in place. LIPA’s dissatisfaction rating in 2012, for instance, stemmed from outages during Hurricane Irene, some of which lasted more than a month.

But Pepco’s goodwill comeback in 2012 shows that utilities can regain lost trust, or at least the average consumer eventually forgets. Pepco’s score dropped significantly last year after serious outages, but its 28 percent comeback put it back nearly to where it was in consumer satisfaction in 2010, although it will be interesting to see if the utility can keep its gains after this current outage.

One utility that was not part of the index is Vermont Electric Cooperative, which started focusing on reducing outages and restoration time and went from endless complaint calls to more than 100 thank-you emails, notes and Facebook messages during a 2011 outage.

For VEC, there was technical improvement on the back-end, but also smart meters, a Facebook page and new customers platforms that set up two-way dialog and provided information and alerts through various outlets.

As smart grid projects, from smart meters to distribution automation, are put into place, there will increasingly be stories of shorter outages and more efficient restoration. Even more importantly, meters will allow for utilities to offer various pricing programs to their customers to better match their energy use patterns.

But quantifying to customers the outage that did not happen, or the costs that weren’t as high as they would have been without the technology, continues to be a nearly impossible task for the majority of utilities. Until there is a critical mass of utilities with stories like VEC's, or a contrast between two utilities that suffer very different outages from the same major storm, smart grid and utility satisfaction will continue to be a hard sell.