This year’s Solar Power International conference came at a time when the vast majority of U.S. states are contemplating how to restructure policies and rates for distributed energy resources. Recent actions range from tweaking existing practices, to throwing them out entirely, to spearheading new solutions.

In this complex environment, clean energy experts are calling for greater collaboration in order for solar and other distributed energy resources (DERs) to continue seeing exponential growth.

“The solar industry has seen some big wins, but also a wake-up call that there will be fights for rates design and net metering,” said Nat Kreamer, CEO of Spruce Finance and chairman of the Solar Energy Industries Association, speaking at SPI last week in Las Vegas. In that policy context, “How do our business models evolve?” he asked.

“The utility is facing the same uncertainty, and we want it to be largely successful for both businesses,” Kreamer added. Right now, many utilities hold the position that they want to stop disruptive technology like distributed solar -- “and it’s not working out so well.”

There are a lot of states with less than 1 percent solar penetration that are afraid to go higher when looking at the challenges other states face, said Steve Malnight, senior vice president of regulatory affairs at Pacific Gas & Electric. “We have to build roads to demonstrate that this is a good path to go on...and that’s only going to happen if utilities and the solar industry come together.”

There’s a growing consensus in the electricity industry that customer-owned energy devices need to be installed strategically in order to serve the grid. The concept of putting a value on those services and creating a market to compensate DERs is also gaining traction.

The SoCal Edison plan

In a new strategy paper released during SPI, Southern California Edison laid out its vision for what a distributed energy future could look like. A central piece of SCE’s plan is to connect DERs to markets that expand customer choice and offer new revenue opportunities -- putting an end to contentious net metering debates.

SCE laid out three potential ways to connect DERs to markets: the wholesale level, where DERs can sell services that reduce the need for large-scale generation; the distribution level, where DERs provide location-specific services to the grid; and third-party markets, where the distribution grid platform could enable markets for energy transactions between customers or marketplaces for new products and services.

“Coupled with declining prices of DERs, these markets could eventually eliminate the need for subsidies and administratively-determined tariffs,” the paper says.

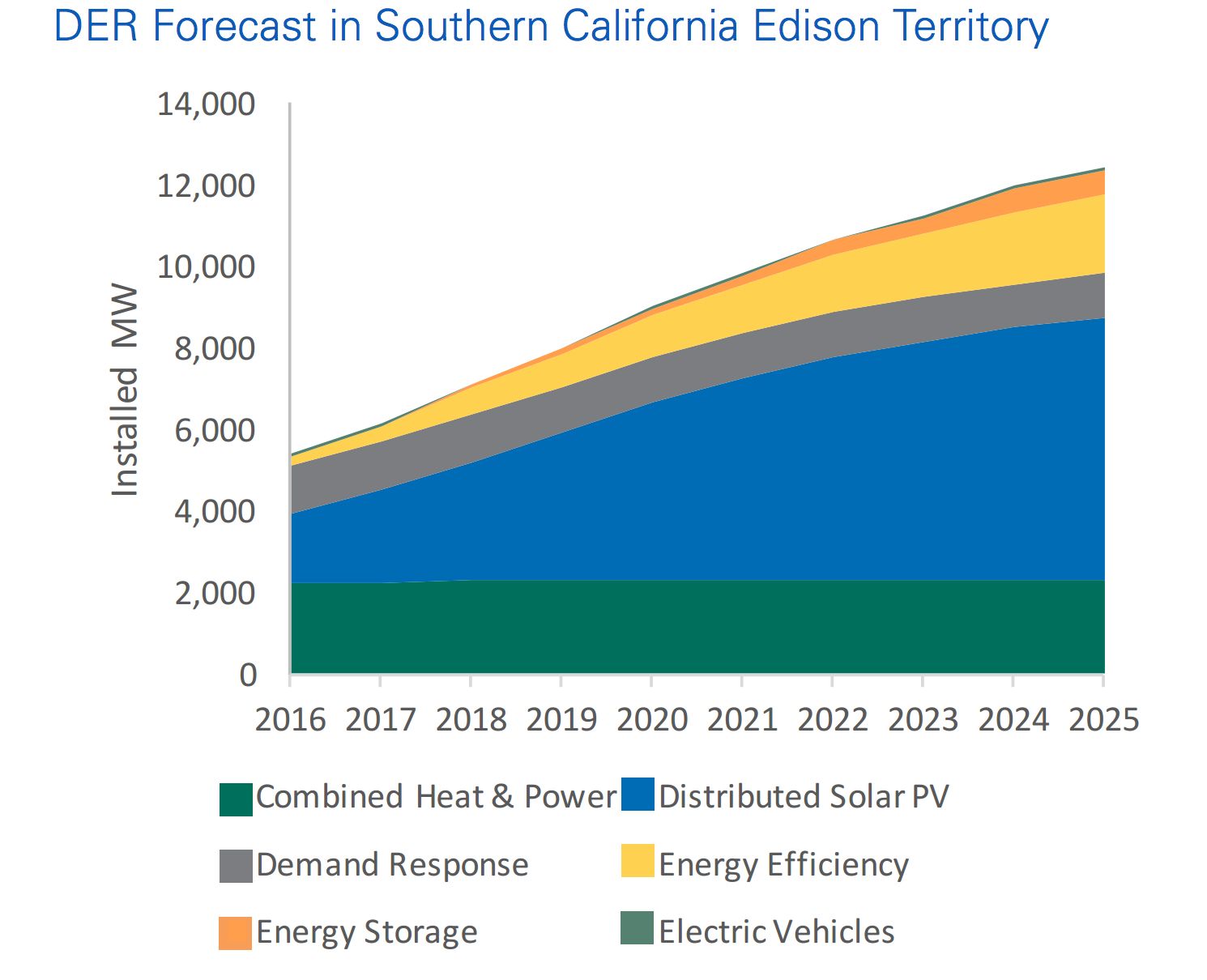

SCE sees the writing on the wall. Today’s electricity customers are increasingly adopting DERs to achieve cost savings, enhanced reliability and a lower carbon footprint. California is home to 50 percent of private solar systems in the U.S. -- more than half a million businesses and homes. Today, there are more than 200,000 plug-in electric vehicles in the state and a goal to reach 1.5 million by 2025. California has also seen strong adoption of energy storage, energy efficiency and demand response products. SCE estimates DER penetration could more than double in its service area over the next decade.

FIGURE 1: SCE's Changing Electricity Mix

SCE's plan also asserts the role of the utility as the distribution system operator (DSO).

“DSOs will interact with hundreds of thousands -- even millions -- of distributed resources, and coordinate between control rooms and field crews in real time to manage new markets and grid operations simultaneously,” the paper says. “Utilities already perform many of these functions and have the scale and capability to integrate DERs into the planning, development and operations of a modernized distribution grid.”

In 2015, SCE operators performed more than 22,000 switching procedures to reconfigure or isolate portions of distribution circuits to deal with outages, upgrade the system, or integrate new technologies. As DERs play a more prominent role on the grid, these operations will only become more challenging.

Getting out of "passive mode"

The SCE paper calls for the deployment of more communications and automation equipment along the network to resolve operational issues. Developing those operational capabilities will require the “expansion of fiber optic and field area networks for real-time data collection; automated sensors and devices to capture data and to control grid devices in response to real-time disturbances; and management systems to operate the distributed grid and markets.”

On September 1, SCE filed a $23.3 billion rate case that includes $2.1 billion in grid modernization spending between 2018 and 2020, to facilitate the adoption of DERs and enable them to provide grid services.

“We absolutely see that we would be the distribution system operator, and that we should offer up...market opportunities,” said SCE President Ron Nichols, in an interview.

“It would be a situation where, rather than us being in a passive mode -- where customers put solar on when they want to, where they want to, and how they want to -- we will have...more information on where the locations are more beneficial and, therefore, where customers could get a higher payment,” he said.

New York and California have already taken steps toward realizing this more collaborative DER future. New York is crafting market-based solutions through its Reforming the Energy Vision proceeding. In addition to carrying out distribution resources plans, California’s three investor-owned utilities are in the process of crafting Integrated Distributed Energy Resource plans, which will include proposals for market-based demonstration projects. Today, however, SCE notes that retail DER customers do not have simple ways to participate in wholesale power markets, nor to receive compensation for services to the local power grid.

In June, the Federal Energy Regulatory Commission approved the California Independent System Operator’s (CAISO) request to allow rooftop solar, behind-the-meter batteries, plug-in electric vehicles and fast-acting demand response systems play in state’s grid markets as a revenue-generating resource.

“We need to move to a market-based structure for valuing all DERs to ensure that they are fully compensated for the value that they bring to the grid,” said Jon Wellinghoff, SolarCity's chief policy officer, in an interview. “Unfortunately, with the exception of the steps FERC has taken to enable these resources to participate in wholesale electric markets, we are still far away from realizing their full valuation potential that would include the value they bring to the distribution grid.”

SCE is working on a pilot project with SolarCity and the SunSpec Alliance that could be a model for the future. Under the $4 million program, SolarCity will aggregate the portfolio of 50 homes to provide distribution grid support, as well as ancillary services into California’s wholesale market. With the funds in its rate request, SCE wants to deploy more pilots to test out the concept.

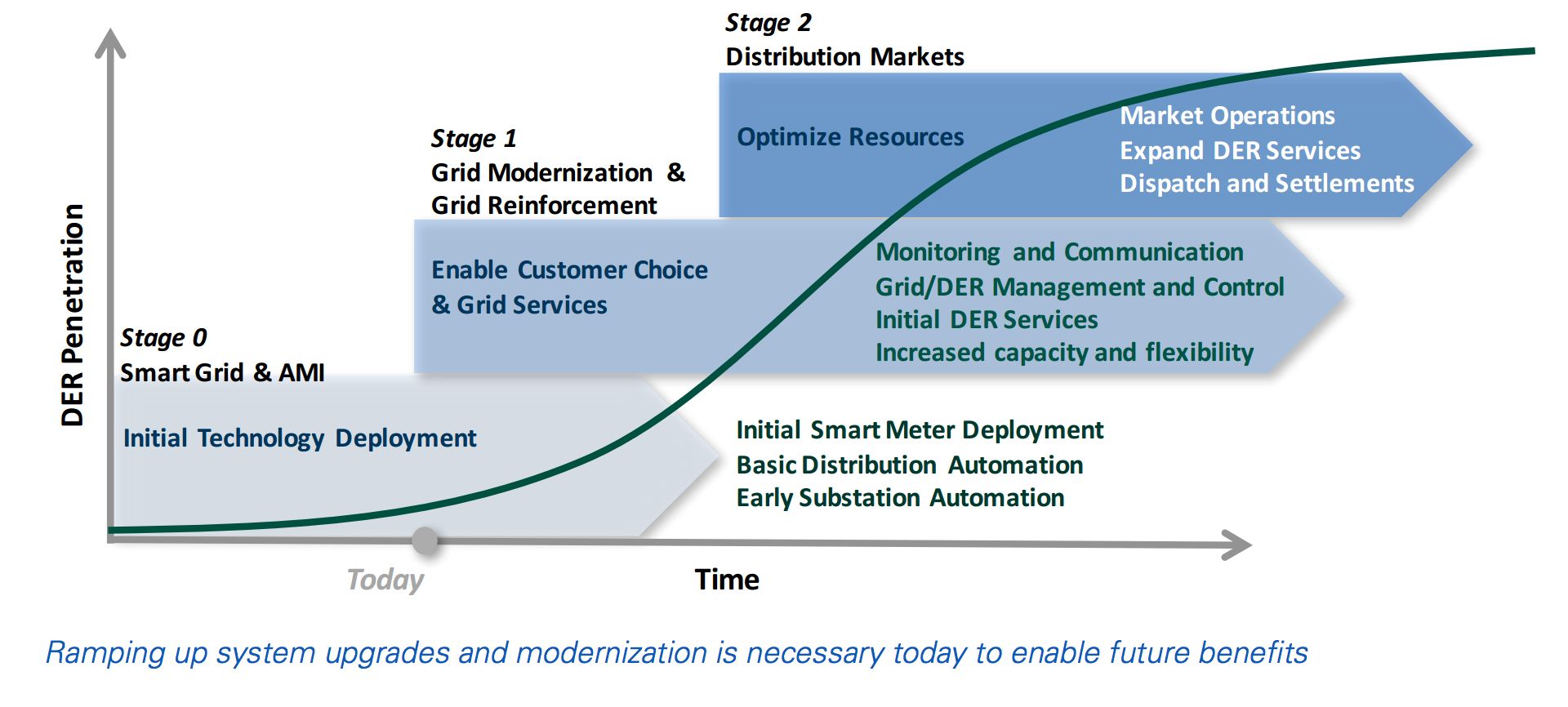

FIGURE 2: How SCE Sees the Electricity Market Evolving Over Time

“The commission has had a number of prescribed demonstration and pilot projects, and none of them included starting to determine how you actually establish a market and testing that,” said Nichols. ‘We proposed in our general rate case that we just filed that there be demonstrations that do just that -- that we take segments of our system, specific circuits, open those up to distributed energy resources and identify the types of grid services that we're looking for.”

“We're not going to prescribe what technology they should be, but we’d say, 'Here's what we need in the way of voltage control; here are the opportunities for bidding into the wholesale market, here are the opportunities for integrating wholesale renewable resources,'” he said. “Then we would go out and have solicitations and test not only the performance of the technologies, but also what the types of transactions are that we need to offer up so that these DER providers can play in the market.”

To participate in wholesale energy markets or provide distribution services, providers of DERs will have to prove they’re available, dependable and durable with an understandable and proven asset life. For its part, the DSO will work with regulators, bulk system operators, DER providers, and customers to create competitive markets that fairly compensate DERs, provide visibility and access to the grid, and enable the bundling of services to optimize DER benefits.

In defense of net metering

How much control utilities have in this market-based DER future is a potential point of contention. Arizona Public Service, for instance, is testing solar and smart inverters in a new configuration where the utility has full control of the resources. Utilities could choose to expand on that model. SCE, meanwhile, believes third-party aggregators are best suited to manage bundles of DERs in a market application, but would work closely with the utility to deploy services where needed.

Lynn Jurich, CEO of Sunrun, believes that competitive third-party providers are far better equipped to manage customer relationships as DER markets evolve.

“One of the challenges I think utilities will have is that new business models are going to be about bringing consumer choice and simplicity to consumers,” she said in an interview at SPI. “People are not going to willingly give control of devices or their home to a party that is not a trusted party that can’t deliver a simple and easy-to-understand service.”

Jurich added that as markets change, it’s important to ensure utilities maintain an incentive structure that allows companies to continue to innovate.

There are significant physical and control challenges to pooling DER assets. However, moving to a rate design that better reflects the costs and benefits of DERs is arguably the trickiest aspect of this transition.

Utilities, solar companies and other technology providers are rallying around market-based solutions for the deployment of DERs, but the concept relies on creating fair and transparent rates that capture the time- and location-based contributions DERs provide. For many utilities, this means moving away from net metering -- something most solar companies are hesitant to do.

At its simplest, a replacement payment mechanism for net metering would clearly identify the wholesale, distribution and societal value of energy injected into a specific part of the grid, according to the SCE paper. The DSO would regularly update these mechanisms to reflect the economic fundamentals of the system and the experience of competitive markets, so that DER compensation reflects local system needs and market values.

New York is narrowing in on a rate solution through its LMP+D calculation proceeding. In May, solar and utility stakeholders came to a landmark agreement that proposes an orderly step-down in DER credits, while phasing in a location-based compensation method.

While some policy discussions have evolved, ditching net metering will be difficult. The concept of a transition timeline is baked into the New York agreement, but signatories did not agree on what that transition timeline would look like for residential solar. And parties that did not sign the New York agreement flat-out rejected the concept of a net metering phase-out.

“We argue that behind-the-meter systems and mass residential systems should remain on NEM for the foreseeable future, because there’s no evidence that that’s a problem, and lots of evidence that it’s a valuable tool for compensating customers,” Sean Garren, Northeast regional manager for Vote Solar, told GTM in June.

On an SPI panel, Jurich also defended net metering, and said solar subsidies should be dropped only “when the polluters get taxed.”

Connecting the dots

While it holds the potential to solve policy disagreements and see distributed solar grow exponentially, the creation of widespread, competitive DER markets is still years away -- even in the most progressive states.

The DER market concept needs time to evolve on the regulatory side. Many states are just starting the discussion on how to value customer-owned resources. Reports like the National Association of Regulatory Utility Commissioners’ draft manual on DER compensation and the Smart Electric Power Alliance (SEPA) and Nexant’s new methodology for determining the locational value of DERs are helping to shape the discussion.

As the SCE paper argues, utilities also need to make major infrastructure investments in order to make DER markets possible. And that’s coming from a utility that’s already well ahead of the game. According to Julia Hamm, president and CEO of SEPA, most utilities don’t have the technical capability to closely evaluate their distribution system and the locational value of DERs, much less the ability to update those values on a regular basis. At the same time, Hamm noted that third parties need to upgrade their products and services, too.

“With all of these conversations happening around DER aggregation, it’s giving technology companies a reason to innovate in a way they didn’t have before,” she said. “We need these technology solutions to make it all work together effectively.”

Solar companies are starting to package their products with energy storage and form partnerships with the electric-vehicle industry. But there isn’t a simple, comprehensive DER-package-plus-energy-management system available to residential consumers today.

“We’re starting to see individual dots get connected, but we need to get to a point where all of the dots are connected,” said Hamm. Connecting all of the dots will take time, she added.

“We don’t believe it should be full retail-rate net metering today and tomorrow we switch to the end goal,” Hamm said. “We think there needs to be a transparent transition so everyone -- the utilities and the DER industry -- can evolve their business models accordingly.”

Meanwhile, as a ton of work goes into designing market-based solutions for DER compensation, many states may choose to avoid this route.

“We know there is going to be this evolution, but it’s likely not an evolution to the same thing everywhere,” said Hamm. “There may be markets like California and New York...where the idea of aggregated DERs and selling into the market works well, but in other parts of the country that may not be what the evolution looks like.”