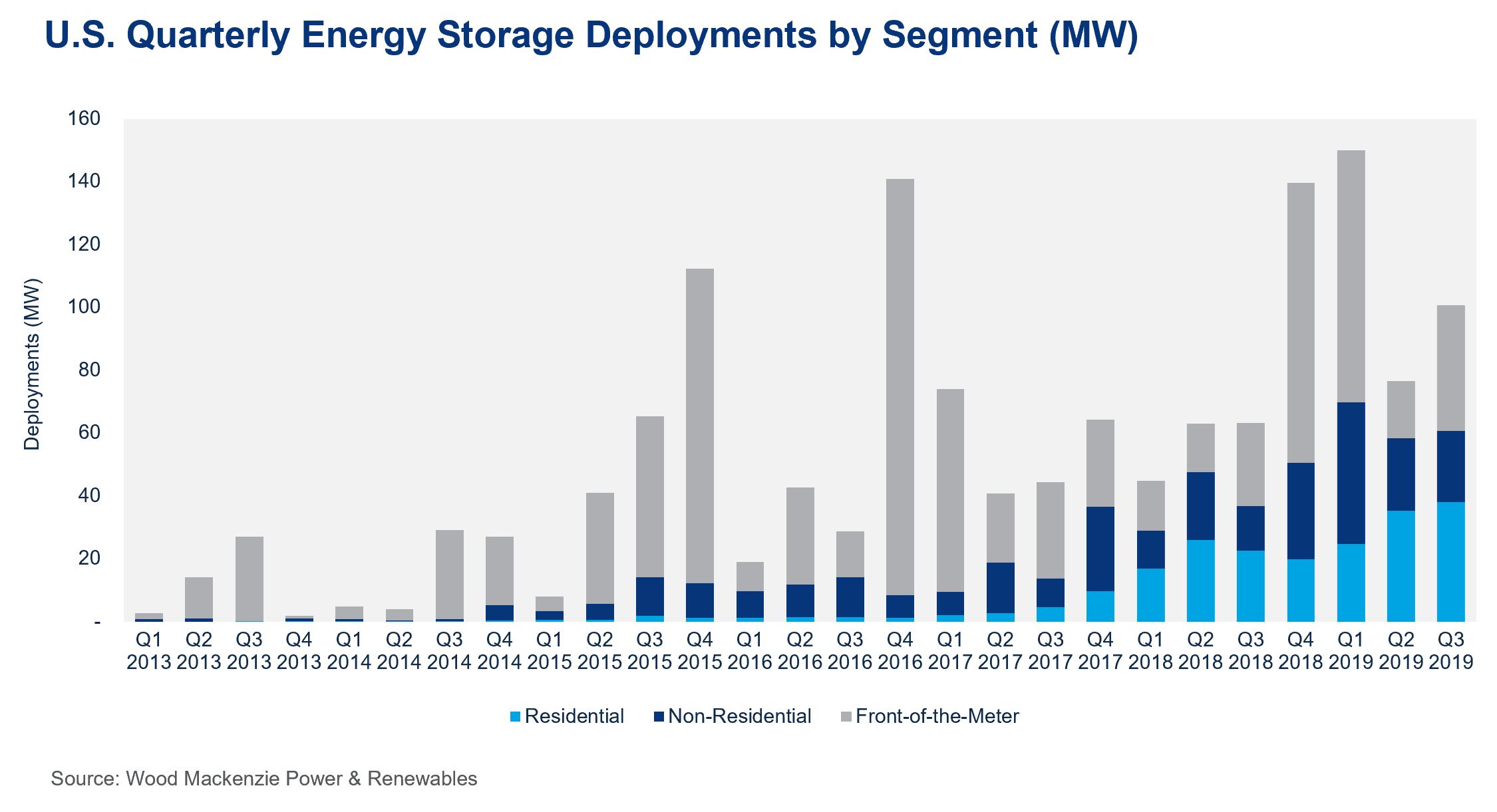

The U.S. energy storage market bounced back in the third quarter of 2019, both in front of and behind the meter. But the most notable events of the quarter — the massive fire-prevention power outages in California — will have much larger impacts in the year to come.

These are some of the top-line conclusions from the latest Energy Storage Monitor report, released Tuesday at the start of this week’s Energy Storage Summit in Denver. According to the latest data from Wood Mackenzie and the Energy Storage Association, Q3 saw a healthy increase in utility-scale storage projects, as well as another record-breaking showing for residential battery and solar-battery systems.

Front-of-meter storage deployments boomed in Q3 compared to a lackluster second quarter, with Massachusetts deploying 58 megawatt-hours of systems, Vermont and Arkansas tying for second with 24 megawatt-hours apiece, and Texas coming in third with 10 megawatts. This was up 121 percent compared to the second quarter, in keeping with the lumpy nature of a market driven by single large-scale projects.

More broadly speaking, 2019 is shaping up to see roughly 10 percent growth in front-of-meter deployments compared to last year, according to WoodMac.

As for the behind-the-meter battery market, a decrease in commercial, industrial and other non-residential deployments limited growth in the third quarter. But Q3 also included a record-breaking 40-megawatt increase in residential battery systems, with California deploying 46.4 megawatt-hours, Hawaii 10.6 megawatt-hours and Arizona 2.7 megawatt-hours.

California's blackouts

This growth in residential batteries was already happening before the fire-prevention blackouts of bankrupt Northern California utility Pacific Gas & Electric, which left millions of people without power for hours or days at a time in October and November. Those blackouts are too recent to account for much of the third quarter’s uptick.

But according to Brett Simon, Wood Mackenzie senior storage analyst, PG&E’s public safety power shutoff events are expected to start driving residential battery sales in early 2020, given the industry’s sales cycles. The ongoing threat of power outages, combined with other key shifts in California's regulatory policy, will contribute to record residential storage deployment next year, he said.

“We expect one in five residential solar systems installed in California in 2020 will be paired with storage,” Simon said. That’s about the rate of residential battery adoption being reported by leading solar installers such as Sunrun over recent quarters, but extended to the California market at large — a prediction being matched by other residential solar-storage contenders such as SunPower and Enphase.

California has increased its solar-storage efforts as a response to the state’s wildfire and power grid safety crisis. Simon noted that California regulators are directing $100 million in solar-battery incentives from the state’s Self-Generation Incentive Program for low-income or medically vulnerable residents in high-fire-threat areas.

Several San Francisco Bay Area community-choice aggregators are seeking 30 megawatts of behind-the-meter batteries paired with solar to be deployed in advance of next year’s fire season.

Even without wildfires and blackouts, California's policies are driving increased solar-storage adoption, Simon noted. The state’s Solar Roofs mandate demands PV on all new-build homes starting next year. At the same time, changes in the state’s net metering and time-of-use rates have increased the value of solar power stored in batteries and discharged later in the day, a dynamic that’s also driving battery adoption in Hawaii and Arizona.

While state-level policies continue to drive growth in key storage markets, it’s less clear how shifts in federal law and policy might impact the energy storage industry’s prospects in 2020. A bill introduced in Congress to provide tax credits to standalone energy storage has languished in committee, along with other renewable energy bills, as lawmakers have been consumed by the impeachment of President Donald Trump and other crises.

***

The most recent U.S. Energy Storage Monitor executive summary is available here. The executive summary is free and provides a bird's eye view of the U.S. energy storage market and the trends shaping it. In contrast, the full report features state-by-state breakdowns and analysis on storage deployments, growth forecasts, policies helping or hindering growth, financing trends and market strategies.