As more U.S. residential solar customers choose to purchase, rather than lease solar panels, direct ownership is on its way to overtaking third-party ownership and reclaiming its position as the leading solar financing model for the first time since 2011.

According to GTM Research’s latest report, U.S. Residential Solar Financing 2016-2021, 55 percent of all U.S. residential solar capacity installed next year will be purchased by customers paying either in cash or with a loan.

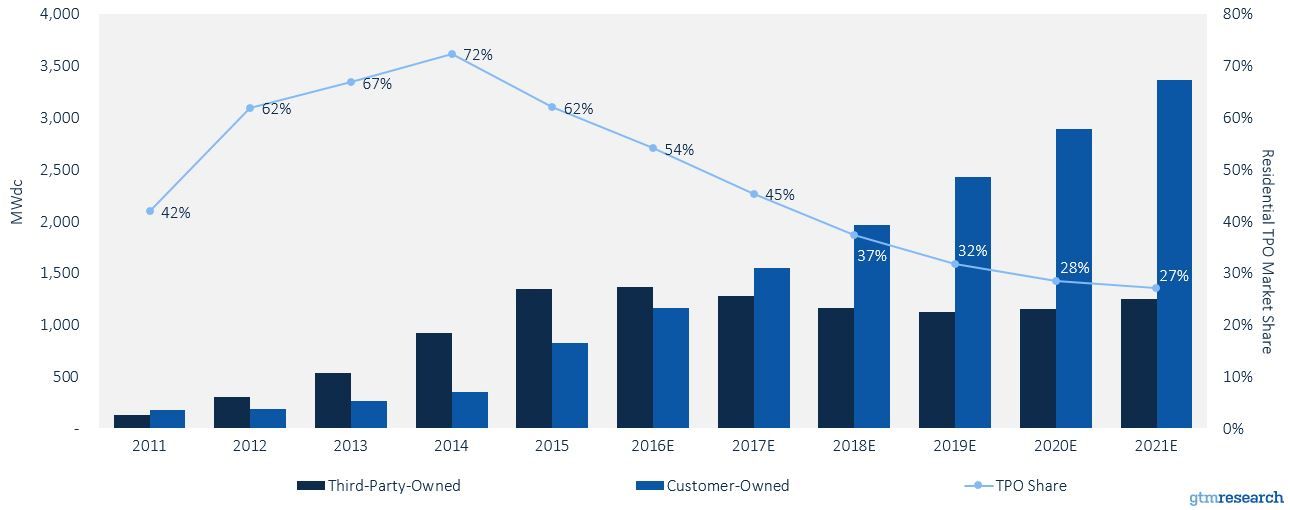

Third-party ownership is on the decline, namely solar leases and PPAs. At its peak, third-party ownership represented 72 percent of all systems installed in 2014. In megawatt terms, third-party ownership will remain relatively flat, while direct ownership will continue to grow.

FIGURE: Residential TPO Penetration and Installations by Ownership Type, 2011-2021E

Source: GTM Research U.S. Residential Solar Financing 2016-2021

There are several key factors contributing to this shift, according to the report. One key trend is a slowdown in the large national installers like SolarCity and Vivint Solar, who, despite having loan products, still deploy more solar in the form of leases.

Local installers, on the other hand, are growing more quickly than the national players and sell more systems for cash, especilaly as the cost of solar continues to decline. Lastly, the report points to emerging state markets like Utah and Florida where PPAs are not allowed under current laws, and installers have no choice but to sell systems to customers.

“The solar loan market is much more fragmented than the leasing market ever was,” said report author Nicole Litvak. “Installers and homeowners have access to more companies financing loans as well as multiple options for loan tenors, interest rates, and dealer fees.” According to the report, Mosaic was the leading solar loan provider in the first half of 2016.

GTM Research forecasts that 73 percent of all solar systems sold in 2021 will be owned directly by customers.