Large-scale solar PV plants are almost always managed with monitoring software, but this does not hold true for smaller systems.

A report recently published by GTM Research and SoliChamba Consulting assesses that in most residential PV markets around the world, the attachment rate of monitoring software varies between 5 percent and 20 percent, with one noticeable exception: the U.S. boasts a uniquely high rate of 80 percent.

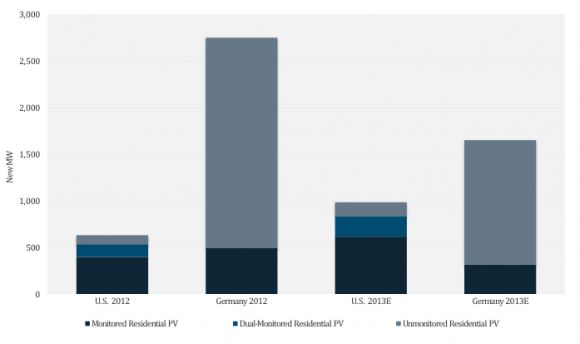

This means that in 2012 the U.S. residential monitoring market was approximately 400 megawatts, out of 500 megawatts of new installations. By comparison, Germany installed over five times more residential systems (2.7 gigawatts), but only 18 percent of those were monitored -- resulting in a 500-megawatt market size for monitoring technologies.

New Residential PV in the U.S. and Germany, 2012-2013

Source: GTM Research and SoliChamba Consulting

Why is the U.S. market so different from Germany and the rest of the world?

Predominantly because of the widespread adoption of third-party ownership (TPO) models such as solar leases and power purchase agreements (PPAs). In these scenarios, the PV system installed on the homeowner’s roof is owned by a fund investor and operated by a lease or PPA provider like SolarCity or Sunrun which is in charge of ensuring that the system performs as expected.

In Germany and most of the world, residential PV systems are owned by the homeowner, who receives a feed-in tariff statement from their local utility. Most owners simply check the system periodically to make sure that there is no fault, most commonly by checking the built-in inverter display, or sometimes with an external device. Only the savviest decide to purchase a monitoring software solution that remotely tracks energy production and detects faults.

GTM Research and SoliChamba Consulting also found that the predominance of TPO in the U.S. residential market creates a common scenario of dual monitoring, where the lease provider installs its own monitoring system while the inverter manufacturer (like Enphase Energy) also supplies its own monitoring solution free of charge. The percentage of dual-monitored systems is estimated at 35 percent, for a total over 138 megawatts. This phenomenon is virtually nonexistent in Germany.

In 2013, GTM Research projects that the U.S. residential market will reach 770 megawatts and Germany will contract to 1.6 gigawatts, while monitoring attachment rates are not expected to vary significantly. As a result, the U.S. monitoring market in this segment is projected to reach 600 megawatts (800 megawatts including dual-monitoring scenarios) and become the world’s largest market for residential monitoring software.

***

Cedric Brehaut is a consultant and market analyst with SoliChamba. For more competitive analysis on PV monitoring market size by country and segment, learn more about our new report, Global PV Monitoring: Technologies, Markets and Leading Players, 2013-2017.