UOP: Petro-chemical producer. Gas processor. Petroleum refiner.

Hardly synonyms for a clean technology leader.

Considering that UOP's parent company, Honeywell, ranks in the top five producers of "Superfund" toxic sites and has had to pay $400M+ in fines for dumping mercury and toxic waste into lakes while improperly reporting sulfur dioxide and other particulates into the air, I understand your skepticism.

Unlikely as it may seem, UOP is leading the charge in developing catalysts required to transform feedstocks into "drop in" fuels like renewable diesel, jet fuel, and gasoline that require no changes to fuel infrastructure or fleet engines.

When you think of biofuels, what comes to mind?

Probably first-generation ethanol or biodiesel. Maybe cellulosic ethanol.

What do all of these fuels have in common?

Their performance is inferior to petroleum, they are uneconomical in the U.S., and they are heavily subsidized.

Let's take corn ethanol, for example. This year, the U.S. will use almost one-third of its corn crop to displace about 6% of the country's gasoline consumption. The amount of fertilizer, water, and energy that goes into corn ethanol makes it questionable whether the energy and GHG balance of corn ethanol is positive or negative (see An Inconvenient Truth: Biofuels Have a Carbon Footprint). Ethanol is only approved in blends up to 10% without engine modification and carries only two-thirds the amount of energy as a gallon of gasoline. Additionally, the miscibility of ethanol prevents it from being transported via petroleum pipeline. The only people who believe ethanol will ever displace significant amounts of petroleum and facilitate U.S. energy independence are corn and ethanol lobbyists -- i.e., the recipients of at least $5 billion of taxpayer money in the form of controversial "corporate welfare" payouts every year (see The True Cost of Corn Ethanol).

Despite congressional preference for ethanol and biodiesel (see EPA Issues Renewable Fuel Standards), a number of companies are pursuing the creation of drop-in fuels that mimic the chemical characteristics of petroleum.

The two main approaches being used are bio-chemical and thermo-chemical. On the bio-chemical path, companies like Amyris, Joule, LS9, and Synthetic Genomics are tinkering with the genetic make-up of microbial organisms and metabolically engineering them to secrete fuels like diesel.

The main thermo-chemical routes involve Fischer-Tropsch gasification, pyrolysis, and upgrading (see Commercial Jet Biofuel: Sooner Than We Think?).

UOP is a leader in the latter two categories. The company's pyrolysis technology is based on a joint venture with Ensyn that is known as Envergent Technologies. Also known as "bio oil" and "thermal cracking," pyrolysis is a thermo-chemical conversion process that decomposes biomass in the absence of oxygen (and combustion). The process is conducted at lower temperatures (500-600°C) compared to gasification, resulting in lower energy costs. As the off-gases cool, the liquids coagulate, resulting in a mixture of oil with low viscosity and 15-20% water. Envergent uses what is called "fast" pyrolysis to turn agricultural, forestry, and post-consumer waste into the bio-oil.

Pyrolysis is an advantageous process due to the diversity of feedstocks that it can handle. Yet, the resulting bio-oil, like other lipid feedstocks such as algae oil, are only intermediary oils that require further upgrading into the downstream fuel of choice. Conveniently, UOP also is the leading upgrading company of bio-feedstocks.

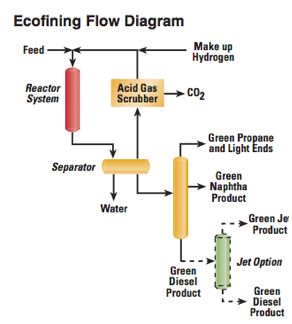

In conjunction with the Italian company Eni S.p.A, UOP has commercialized a "hydroprocessing" technology that converts oils and wastes into renewable diesel fuel and jet fuel. The process deoxygenates feedstocks by adding hydrogen to produce a highly-stable green diesel or jet fuel.

The Ecofining process leverages existing infrastructure to drive down capital and operating costs. Our conversations with companies that utilize UOP's upgrading technology reveal that the cost a company pays UOP to transform a lipid into renewable diesel is between $0.25-$0.40/gal (see Biofuels 2010: Spotting the Next Wave). When blended into an existing petroleum diesel pool, the high cetane and low density of green diesel can enhance the pool's performance characteristics, resulting in 50% improvements in lifecycle GHG emissions when compared to petroleum.

In 2010, Galp Energy of Portugal and Eni are expected to open commercial facilities that rely on this technology. UOP's upgrading technology was also used in the green jet-fuel flights undertaken in recent years by Air New Zealand, Continental Airlines, Japan Airlines, and KLM with feedstocks as diverse as algae, jatropha, and camelina. While other companies like Neste Oil and Dynamic Fuels (a joint venture between Tyson Foods and Syntroleum) have proprietary upgrading platforms, UOP's technology suite is notable for the sheer scope of partnerships it has amassed. The company has bio-feedstock upgrading deals with AltAir, Solazyme, Rentech, India Oil, China National Petroleum Corporation (CNPC), Masdar Institute, DARPA, and the Department of Energy.

UOP's dominance of the downstream market combined with the substantial investments that oil companies like BP, Exxon, Shell, and Chevron have made in advanced biofuels illustrate that synthetic biofuels containing identical chemical characteristics as petroleum are progressing from the fringe to the mainstream faster than many realize.