Since the U.S. Department of Commerce’s preliminary ruling on SolarWorld’s anti-dumping petition, the PV industry has been plagued by two burning questions: what will be the cost impact to manufacturers, and how will this cost affect pricing in the U.S. market? In this analysis, we walk through the expected cost and pricing impact of the Anti-Dumping/Countervailing Duty (AD/CVD) tariff on Trina Solar.

While management’s remarks from the Q1 earnings call suggest that Trina currently holds duty-exempt inventory utilizing third-party sourcing from outside China, this tariff-free product was not available for all orders in the first quarter. Despite the probability of anti-dumping tariffs being levied on Chinese manufacturers, Trina maintained shipments into the U.S. during the first quarter of 2012 in order to maintain service to its existing U.S. customers. Choosing to act as the importer of record, Trina was then forced to bear the burden of preliminary duties announced in May. In its Q1 2012 earnings presentation, Trina reported a $0.07 per watt in-house cost increase attributed to the AD/CVD tariffs.

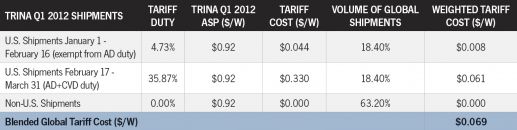

The first question is: can we arrive at the $0.07/W number with some back-of-the-envelope math? The answer is yes. Assuming a Q1 2012 average selling price (ASP) of $0.92 per watt, the full 36 percent AD/CVD tariff equates to a duty of $0.33 per watt. However, things get tricky from here on out, given the different ruling dates for the AD and CVD tariffs and the critical circumstances determinations that pushed tariffs for both of these rulings back to 90 days before the ruling date. For our analysis, we assume that half of Trina’s Q1 shipments to the U.S. were subject to the full AD/CVD tariff of ~36 percent, while the remaining U.S.-bound modules were shipped prior to the 90-day retroactive duty period for the AD duties (January 1 to February 16) and therefore incurred only the CVD tariff of 4.73 percent, which amounts to a charge of $0.04 per watt. When accounting for the fact that only 36.8 percent of Trina’s shipments went into the U.S. market in Q1, we arrive at a blended AD/CVD charge of around $0.069 per watt.

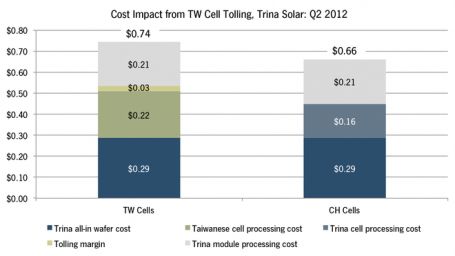

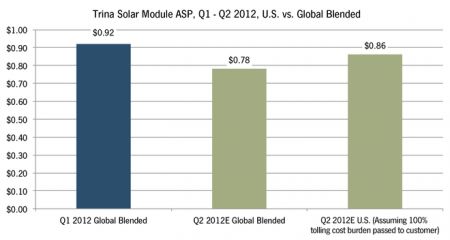

The more important question, however, is what the cost and price impacts will be going forward. First off, Trina expects its global blended ASP to decline by around 15 percent in Q2 2012, which would imply a figure of around $0.78 per watt. For U.S. shipments, we expect that 100 percent of Trina’s U.S.-bound cells will be obtained via tolling from Taiwan and will not be subject to the tariff. We estimate the wafer-to-cell conversion cost in Taiwan to be $0.22 per watt (compared to $0.16 per watt in China), and based on a 5 percent tolling margin, we estimate an additional $0.03 per watt cost increase for third-party sourcing. This equates to the overall tolling cost difference of around $0.08 per watt and a cost impact of 11 percent. In the worst-case scenario for customers, let us assume that the entire $0.08 per watt amount is passed onto the customer. This implies a U.S. ASP of $0.86 per watt, which is still 6 percent below the Q1 ASP.

Source: GTM Research

Based on this analysis, the AD/CVD tariff will not materially affect pricing in the U.S. market. Though tolling cells through Taiwan does impose a slight cost increase on manufacturers, it does not prohibit them from pricing modules well below their domestic competitors. Coupled with further conversion cost reductions (Trina, Hanwha, Yingli, and Jinko are all calling for poly-to-module costs of $0.50 per watt by year end) and the continuing decline in ASPs, we expect pricing to continue falling over the course of the year, both globally and in the U.S. Fears that the tariff ruling would lead to a significant increase in U.S. pricing and end up dampening U.S. demand are, in our opinion, unfounded.

For more information on company-specific pricing and cost structure, subscribe to GTM Research's Global PV Competitive Intelligence Tracker. Featuring 225 companies and more than 260 facilities, this service offers granular data insight into the global PV supply and demand markets on a monthly basis. Is your organization looking to enhance its visibility into the mechanisms of the evolving global PV market? Learn more about how the Tracker can be your guide.