Investor-owned utilities and transmission companies invested a record $34.9 billion in transmission and distribution infrastructure in 2012, according to the Edison Electric Institute.

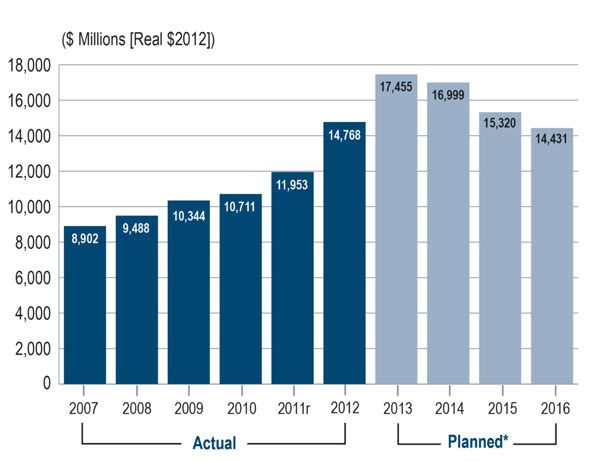

The spending on transmission, $14.8 billion, was nearly a 24 percent increase over 2011 investments. It is the largest year-over-year percentage increase since 2000. The spending is driven by many factors, including large transmission projects and interconnection of renewable sources such as utility-scale solar projects and wind farms. EEI found in another report that about three-quarters of transmission spending through 2023 will be to integrate renewables.

Transmission is hardly the sexiest topic in grid modernization, but it is key to the changing energy landscape. In some regions, particularly the Midwest, transmission projects are helping to minimize the burden on the grid as older coal-fired power plants retire.

In some areas, upgraded transmission and energy efficiency were able to completely offset the closing of coal plants. Some East Coast utilities attribute the increase to post-Sandy hardening of the grid, according to EEI. Just this week, the USDA announced $1.8 billion for rural grid modernization, with the bulk going to transmission and distribution.

Other factors are also making it easier for transmission projects to move forward. In 2011, the Federal Energy Regulatory Commission passed Order No. 1000, which reformed the cost allocation and planning requirements for transmission projects. It was largely seen as a boon to move projects forward that would support renewables, but has also helped to integrate more gas-fired power plants into the grid.

Earlier this year, EEI had revised some of its transmission investments downward after some large projects were canceled. The organization expected investment to peak in 2012 at around $14 billion. That forecast has now ben revised upward with a peak of about $17.5 billion in 2013 and only a slightly smaller figure of $17 billion in 2014.