Toshiba, armed with its acquisition of Swiss smart metering giant Landis+Gyr, is turning its eyes to the challenge of cracking the U.S. smart grid market, including the smart home energy market. But look to cities and other large-scale entities for its first moves in linking smart grid and building energy efficiency.

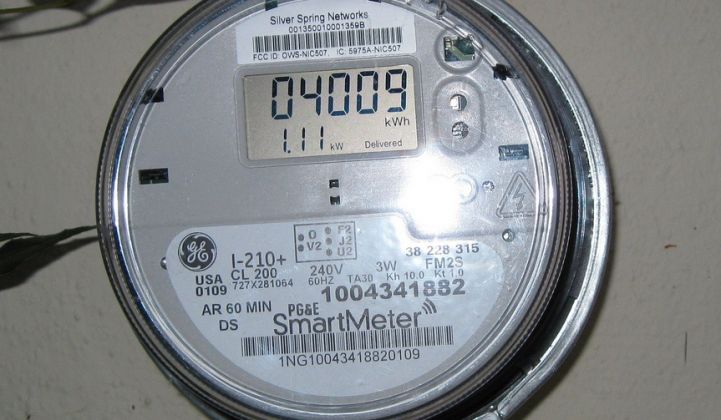

The Japanese industrial giant on Monday announced some goals for global and U.S. smart grid growth, including plans to move into the U.S. smart grid market via Landis+Gyr, which now holds top place amongst North American smart meter deployments.

Toshiba expects its 'small community business' initiative, which links residential and commercial buildings with energy efficiency and smart grid services, to generate $11.67 billion by 2015, with some $1.82 billion of that to come from the United States, Reuters reported. Just how much of that business might come as add-ons to existing L+G deployments (versus new business), Toshiba didn’t say.

Toshiba also announced it intends to enter the U.S. smart home energy market by year’s end and generate 10 billion yen ($130 million) in revenue in that field by 2016, the report stated. That announcement was no doubt timed to coincide with the start of the CES show in Las Vegas this week, where consumer electronics and communications companies will be featuring energy efficiency gadgets and marketing schemes alongside their high-end, energy-intensive streaming video and home networking platforms.

But while residential energy management is still mostly an afterthought in that market, saving energy at the commercial, industrial and government level is a going business today. It’s also one where Toshiba has already begun using expertise from Landis+Gyr, which it bought for $2.3 billion in a reportedly contested acquisition in May 2010, to crack U.S. markets.

This December announcement from Toshiba, for example, highlights the role its L+G group will plan in bringing a “smart community” deployment to the city of Stratford, Conn. The project described includes standard energy efficiency improvements, such as smarter and more efficient lighting systems, as well as the potential to add energy-efficient pumps, solar power systems and fuel cells to the mix over time.

Toshiba’s plans are just some of the major smart grid and smart building initiatives and partnerships emerging from Japan’s tech giants. Hitachi and Panasonic formed a partnership to explore neighborhood and home-area networking in 2010, for example, looking at ways to integrate solar systems, smart appliances, energy storage devices and communications.

Likewise, late last year, Mitsubishi started up a series of smart grid/smart building projects in Japan, aimed at testing a combination of technologies’ ability to balance power use and generation capacity to help the country manage the energy crisis it has faced ever since the Fukushima nuclear power plant disaster. The same pressures led Toshiba and Mitsui to announce plans for a 50-megawatt, utility-scale solar power project in Japan in August.

While much of the pilot work has been going on in Japan, the United States has also been seeing its fair share. A New Mexico-based integrated solar energy/storage/smart building project includes Los Alamos National Laboratory and Japanese companies, including Mitsubishi, Sharp, NTT Docomo, Kyocera and Panasonic. On the Hawaiian island of Maui, Hitachi is working on a series of smart grid pilot projects, including plug-in vehicle charging controls and distribution substation automation projects. Another project, the Digital Grid Consortium, is looking at solid-state grid equipment that could change the way today’s power grids work in the future.

Much of the work going on here is behind-the-scenes, underscoring the fact that smart grid and smart building industries are still far away from being able to support a wide range of recognizable brands in full-bore consumer markets. There’s little point in marketing systems to integrate solar panels, smart appliances, plug-in vehicles and in-home fuel cells and batteries until those individual products are already on the market en masse, after all.