Latin America will be a multi-gigawatt PV market by the end of this year, a first for the region.

By 2018, GTM Research anticipates that just Mexico and Brazil combined will be home to 2 gigawatts and 3.4 gigawatts of solar PV, respectively -- due in large part to the capacity additions awarded in recent auctions.

In the latest edition of the Latin America PV Playbook, GTM Research highlights the key drivers influencing the market’s growth in its transition to a multi-gigawatt market.

Whether you are already in the region or eyeing expansion there, here are three facts that you should know about the market.

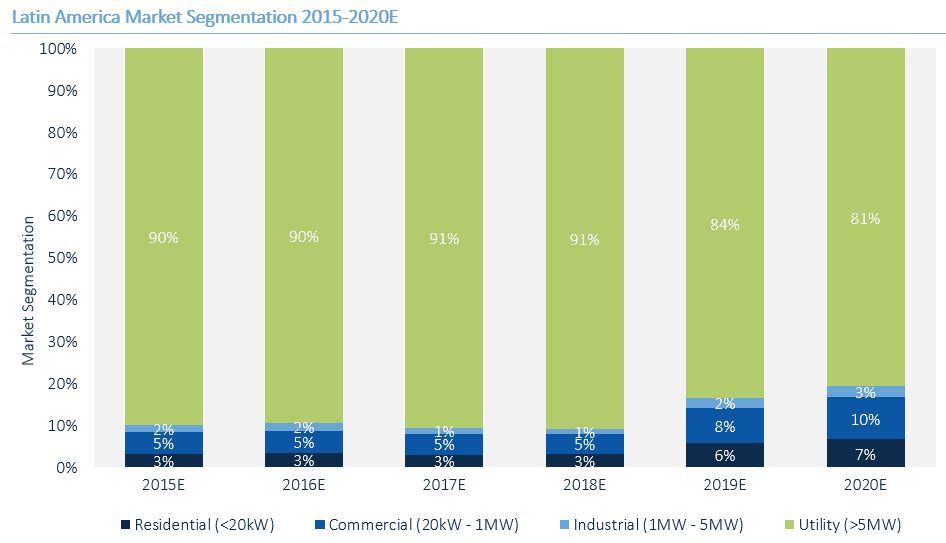

Utility-scale PV accounts for 90 percent of Latin America PV

The region is led by Chile, Mexico and Brazil, all of which are predominately utility-scale markets -- with solar beating out other sources of renewables in auction.

Today, 90 percent of solar PV in Latin America comes from large arrays; however, GTM Research anticipates distributed generation markets to grow and grab a larger share of the market by 2020. In many of these markets, this shift will come from the lack of transmission required to carry power from high-insolation regions to the source of consumption, making on-site generation a more attractive option.

Source: Latin America PV Playbook

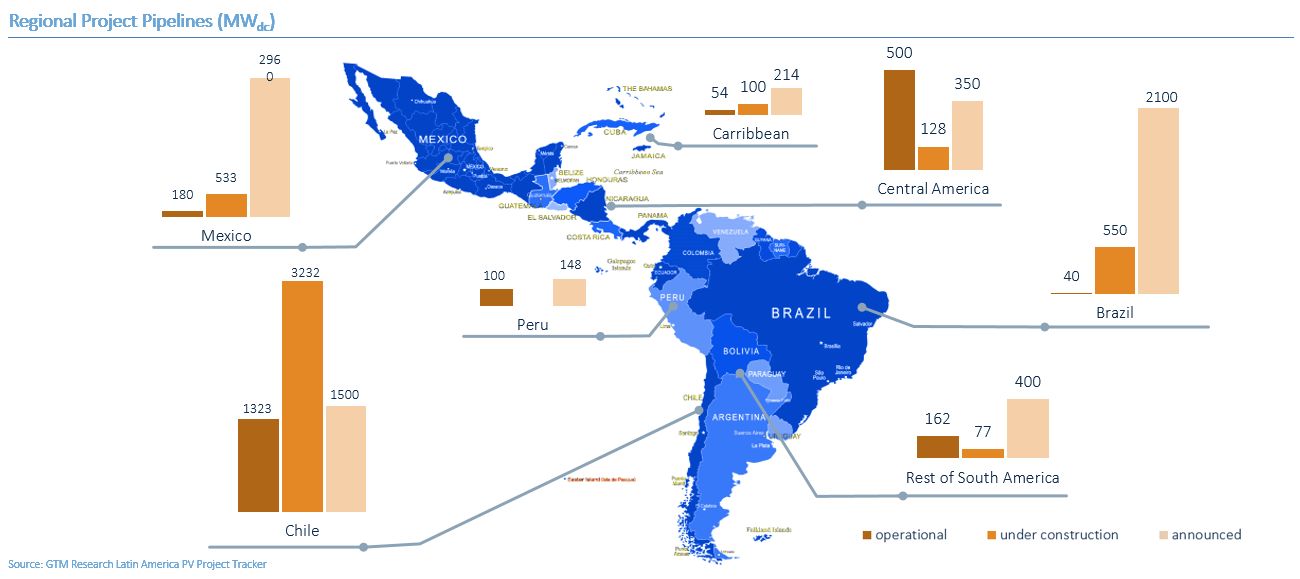

Mexico and Brazil each have more than 500 MW of PV under construction

GTM Research has identified more than 1,100 projects across 30 Latin American countries, ranging from small-scale projects in the Caribbean to several hundred-megawatt-solar-farms in the Atacama Desert of northern Chile. Chile makes up the majority of projects under construction from merchant projects; however, Brazil and Mexico each have a half a gigawatt worth of projects in the works.

Enel Green Power is Latin America’s leading developer, but challengers are emerging

The report tracks the leading developers in 30 countries. Italian developer Enel Green Power is the market’s leading player and looks to hold its top spot, with 700 megawatts of PV currently under construction with much more capacity contracted and operational. Other developers making waves in the region include Fisterra Energy in Mexico and Canadian Solar in Brazil. GTM Research notes that we can expect the developer landscapes in Mexico and Brazil to change as auctioned projects begin to secure financing and make progress toward their commercial operation dates.

***

The Latin America PV Playbook is the definitive source of data and analysis covering the Latin American solar market. Download the free executive summary here.