This is the first piece in a three-part series exploring thin film's place in today's solar market from the author of GTM Research's latest report, Thin Film 2012–2016: Technologies, Markets and Strategies for Survival.

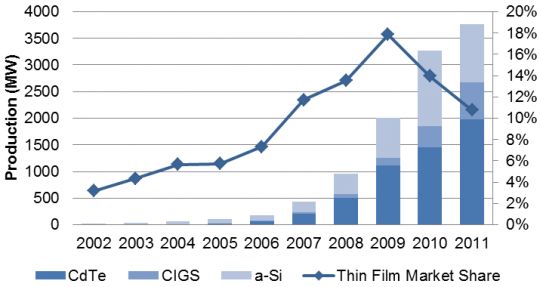

No other PV technology has seen as many false fits and starts or held as much promise as thin-film PV. During the height of the polysilicon bottleneck between 2004 and 2009, thin-film PV’s prospects seemed unparalleled. Shipments of thin film grew from a paltry 68 megawatts in 2004 to 2 gigawatts in 2009 -- a compound annual growth rate (CAGR) of 97 percent. By the end of 2009, thin film commanded 18 percent of the total market with no signs of slowing, unless one properly read the polysilicon tea leaves.

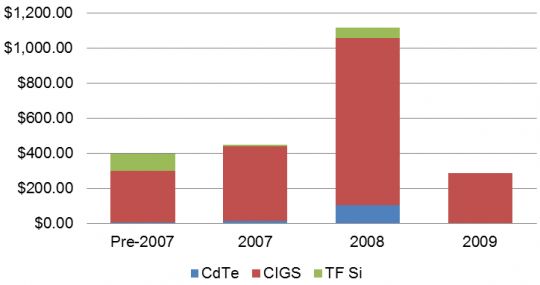

Spurred by spot polysilicon prices that blew beyond $400 per kilogram, thin-film solar startups quickly amassed coffers combining to total nearly $3 billion of publicly announced private investment by the end of 2009, peaking at $1.1 billion in 2008. Recipients were almost exclusively Silicon Valley CIGS startups, with names like Solyndra, Nanosolar, and MiaSolé depositing the biggest checks. By late 2009, a new presidential administration had freed public debt financing for solar projects and manufacturers through the Department of Energy (DOE) Loan Guarantee Program. The first loan went to cylindrical CIGS manufacturer Solyndra for a total of $535 million. By the end of the program in 2011, the DOE had loaned nearly $1.3 billion for solar manufacturers, of which $1.1 billion was allocated to thin-film solar manufacturers.

FIGURE: Venture Capital Investment into Thin Film PV Through 2009

Source: Thin Film 2012–2016: Technologies, Markets and Strategies for Survival (GTM Research)

While thin film continued to grow to 3.7 gigawatts in 2011, cheap crystalline silicon dominated the industry conversation from 2010 onward. Market share of thin-film PV dropped to 11 percent. Chinese commodity PV was the new drug of choice, and for the first time, the words “bankable” and “Chinese” were uttered in the same breath. Leading Chinese manufacturers blew past the gigawatt scale and entered into the industrial age of solar production. While the initial growth patterns coupled with new feed-in tariffs swept all parts of the solar value chain to new heights in 2010, by the beginning of 2011, the party had quickly turned into a hangover.

FIGURE: Historical Thin-Film PV Production, 2002-2011

Source: Thin Film 2012–2016: Technologies, Markets and Strategies for Survival (GTM Research)

Flash forward to our current industry environment, where suppliers are meeting the market with wavering optimism to deep-seated paranoia. “Emerging markets” are the new hot term, with conversations feeling out the demand markets in non-traditional markets like South America, South Africa, and Southeast Asia -- not out of curiosity but out of desperation. As European demand flattens and more importantly, the oversupply of cheap c-Si continues to test the market, thin film manufacturers have been left in the dark.

In the last nine months, bad news has dominated the thin-film PV segment. Solyndra made the biggest splash when it declared bankruptcy and defaulted on its $535 million Department of Energy Loan Guarantee. But political theater aside, several other thin film firms have rolled back manufacturing plans, including many thin-film silicon companies delaying capacity expansion and others like Abound Solar ceasing production and retooling for a recovering demand market. Even industry leader First Solar has had to slowly roll back its capacity, first eliminating its CIGS research division, delaying its Arizona facility, scrapping plans in Vietnam and finally closing its Germany facility and indefinitely idling Malaysia capacity. With production guidance from First Solar ranging between 1.5 gigawatts, 1.7 gigawatts in 2012 total production would drop by over 10 percent year-over-year.

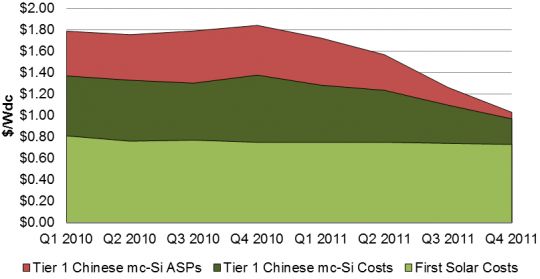

We’ve heard it a million times already: skydiving crystalline silicon module prices, especially from Chinese module manufacturers, have crushed margins and forced once-promising technologies and companies into crisis mode. Module pricing has dipped below the once-storied target of $1 per watt (dc) and the main question for thin-film PV manufacturers is “How far will -- or rather, can -- crystalline silicon prices fall?” With polysilicon prices (as forecasted by GTM Research) tightening to $20 per kilogram, coupled with improved polysilicon yields and cell efficiencies, does thin film stand a chance? With only roughly 10 thin film manufacturers above 100 megawatts of year-end capacity as of late 2011, is the window closing on thin film manufacturers' ability to cobble the fragments of their promise into a compelling value proposition?

FIGURE: Module ASPs versus c-Si and TF PV costs

Source: Thin Film 2012–2016: Technologies, Markets and Strategies for Survival (GTM Research)

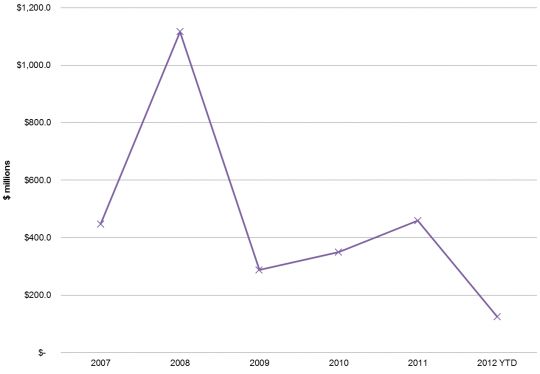

The answer is, perhaps surprisingly, yes -- at least for some industry players. While the crushing module pricing environments have dashed the hopes of many small thin film manufacturers, large corporations see distressed assets and investors desperately searching for an exit. In the past year, venture capital has recovered slightly from 2009 lows, and early 2012 investments are still strong. While year-to-date totals hover around $125 million, investments have reflected reduced market potential, with rumors that Nanosolar and MiaSolé both took large hits from once-lofty valuations in their latest rounds.

FIGURE: VC funding into thin-film PV through 2012 YTD

Source: Thin Film 2012–2016: Technologies, Markets and Strategies for Survival (GTM Research)

While outright buyouts have been rare in thin film, GE’s acquisition of Primestar last April and Tokyo Electron’s February purchase of Oerlikon Solar are the tip of the iceberg. Already, major Asian investors have begun to dabble in thin-film PV investments, testing the waters for a bigger play. Recent thin film investments by Asian industrial conglomerates include Hyundai Heavy Industries’ JV with Saint-Gobain’s Avancis division in Korea, including an initial 100-megawatt facility; AVACO and TSMC’s play in Stion and their subsequent Korean and Taiwan manufacturing plans using Stion’s technology; SK’s $50 million dip into HelioVolt; TFG Radiant’s 39 percent ownership in Ascent Solar and planned Asian manufacturing that could be worth up to $275 million for Ascent; and Mitsubishi Heavy Industries’ MOU with Taiwan Oerlikon Micromorph® customer Auria Solar. Other quieter CIGS research and development efforts are being carried out by LG, AUO and Samsung, with Samsung on the active hunt for a big move in the space (we hold strong that MiaSolé would be an attractive fit).

Are these investors simply playing into the pied piper of thin film pipe dreams, or is there a secret sauce that will carry thin film across the finish line? In part two of this series, we will investigate the underlying cost structure of thin film manufacturing and question whether efficiency gains will be enough to bring thin-film PV to competitiveness.