Bankability is not a sales feature for module makers; it is a matter of survival.

In 2008, according to TUV Rheinland VP and Field Manager Richard Bozicevich, there were six labs doing module testing. In 2012, there were 46.

TUV Rheinland, which has done third-party validation to regulatory requirements for 140 years and does module testing for 70 percent of all solar manufacturers, is one of the four nationally recognized test laboratories (NRTLs) in North America, along with Underwriters Laboratory (UL), Intertek, and Canadian Standards Association (CSA).

In 2008 and 2009, “people were scrambling to just meet the core UL safety standards for the market, UL 1703,” Bozicevich said, “but a piece of glass could pass the UL test. There is no performance test in it.”

The first step toward bankability testing in the U.S. came when modules were expected to meet IEC standards, 61215 for crystalline silicon and 61646 for thin film, because they have performance elements in them.”

IEC tests verify that that modules maintain their performance under stress.

“Bankability was a nebulous term that meant different things to different manufacturers,” Bozicevich said. “The earliest tests were derivatives of the IEC testing. They took some of the induced stresses and multiplied them.”

That evolved. “They decided if it was a good test to do damp heat for 200 cycles, it would be a better indication of how the module would perform over time to do it for 400 cycles. That’s logical,” Bozicevich said. “But that doesn’t necessarily reproduce what the module would be subjected to in the field.”

TUV Rheinland’s “science guys have concluded that the tests done now [equate to] about the first eight years of performance,” Bozicevich said. “But modules have a 20-year to 30-year life expectancy. That is the part people are working on now.”

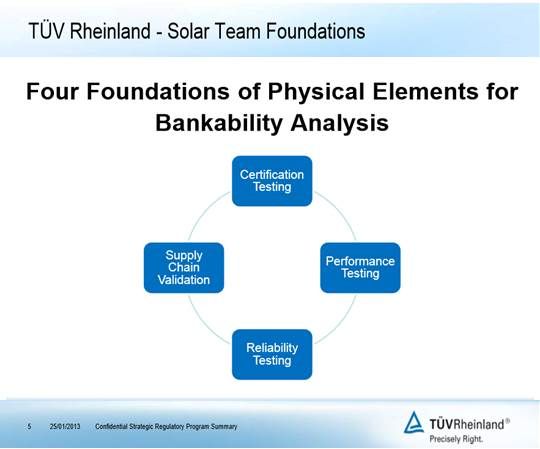

TUV Rheinland’s bankability program has four elements, Bozicevich said.

The first is basic certification testing to the UL and IEC standards.

The second is a type of performance testing that identifies how a solar technology will perform in a given location. “If you are going to get the last couple of pennies out of a module’s cost, you should look at that,” Bozicevich said. “It’s more than environmental testing. It looks at how the module performs in differing irradiances. Some are better in more direct irradiance, like Arizona, some in more diffuse irradiance, like Germany or India.”

Reliability testing is the third element. “Reliability is different than performance,” Bozicevich said. “We look at how the performance benchmark we set for the module is going to erode over time. That is a sort of long-term ROI in the field. And you are also vetting the full term of the safety elements. If adhesives in a module break down and the front glass starts to slide a bit after eight or ten years, when it is wet in the morning, there is the danger of electric shock. After fifteen years, a certain percentage of those modules will have to be kicked off-line because they are no longer safe and the power begins to erode.”

The fourth element is validation of the supply chain. “A module manufacturer,” Bozicevich said, "is never going to say they make any module different than any other module, but when you test them, [it is clear that] they do.”

Supply chain validation will likely become more important because, Bozicevich said, “as time goes on and everybody is forced to have tighter margins, you have to believe manufacturers will be looking for ways to trim margins by easing production costs on things that impact the build, things that get a product out the door a little more cost-effectively. But they likely won’t last 25 years.”

To avoid such products, Bozicevich said, “EPCs have us go into factories, take modules off the line, test them for power rating, run them through some performance and degradation tests and establish whether they meet the nameplate rating and initial certifications.”

The factory visit also includes “a line check and a paper trail documentation audit,” Bozicevich said. “Sometimes there are claims in the modules’ shipping paperwork that the manufacturer can’t validate with purchase orders.”

When discrepancies are found, Bozicevich said, the buyer may choose to cancel the purchase, to negotiate a reduced price, or to get replacement modules from the manufacturer.

Degradation, he explained, “could be valued at a two-penny discount or a five-penny discount, depending on the planned use. It is a question of ROI. If a buyer is only looking at a three-year amortization on the investment tax credit, they aren’t going to really care about long-term degradation.”

This is part of the darker side of the solar business, Bozicevich said. “We have met some really credible EPCs that are trying to divine the long-term performance of these products, and we have seen others who are just in and out and don’t care.”

***

This is the most recent in a GTM series on solar module testing which includes:

Testing and Ranking Solar Module Quality

What Do Solar Module Test Procedures Prove?