It was just about a year ago that Tesla unveiled its Powerwall -- a sleek, capsule-like lithium-ion battery system, available in 7- and 10-kilowatt-hour configurations meant to provide backup power or optimize the value of rooftop solar PV. CEO Elon Musk said the product could “fundamentally change the way the world uses energy at the extreme scale."

The public reaction was huge, with Musk noting during an earnings call the week after launch that preorders had risen to some 38,000 -- although that’s without a money-down requirement, unlike preorders for Tesla’s Model S. The media had a field day with the concept, describing a future of homes that stored all the solar power they needed, as utilities were left stranded with the stragglers.

A year later, and Tesla isn’t talking as much about its Powerwall sales figures -- which makes sense, given that the real-world market for them can’t possibly catch up to the hype. Indeed, while Tesla has certainly grabbed the world’s attention for the potential of battery-backed solar, its market-share lead against competitors such as Sonnen, Sunverge, and others can be counted in the hundreds of units.

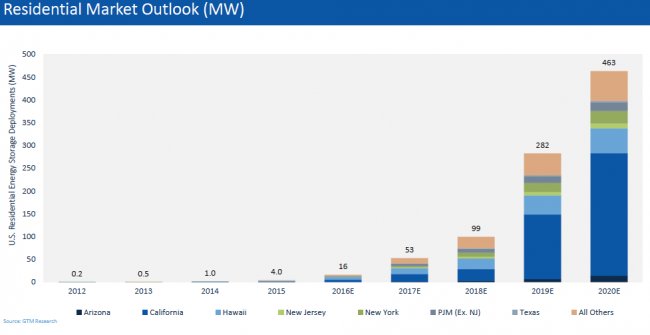

According to GTM Research, only 454 grid-connected residential battery systems were installed last year in key markets including Arizona, California, Hawaii, New Jersey, New York, Texas and the territory of mid-Atlantic grid operator PJM. That’s more than double the 181 installed in 2014, and represents nearly 4 megawatts of storage capacity, up from 1 megawatt the previous year.

Still, that’s about one-tenth the scale of the behind-the-meter commercial and industrial energy storage deployments in the same key markets, GTM Research notes. It’s also a lot less than the 25,000 or so residential solar-storage systems installed in Germany, where energy economics are much more supportive of the concept of storing solar for self-consumption or price arbitrage.

The opportunities in the United States are far more limited at present, and outside of utility-driven deployments, are largely driven by what Ravi Manghani, senior energy storage analyst at GTM Research, describes as “emotional factors.”

Those include the idea of using batteries as a more expensive alternative to backup generators; storing and shifting solar power in an energy regime that doesn't really make price arbitrage worthwhile; or achieving a sense of “energy independence,” while remaining almost entirely reliant on the grid at large for key household needs.

That’s an expensive proposition at present. While Tesla advertises its Powerwall at $3,000, that doesn't include inverter or installation costs. A GTM Research analysis of fourth-quarter 2015 pricing trends pegs the average all-in cost of residential energy storage at $1,300 to $2,000 per kilowatt-hour, a lot more than commercial-scale behind-the-meter storage, which came in at $900 to $1,500 per kilowatt-hour.

Simply put, there’s only one U.S. market that can support residential solar-storage at these costs, and that’s Hawaii -- a fact that’s led to the state leading the country in installations last year. In California, the other leading market, grid-connected residential batteries that can achieve certain daily cycling requirements are supported by the state’s Self-Generation Incentive Program, which covers up to half of the cost of installation.

But the broader opportunities outside these markets will rely on lining up cost-cutting or revenue-generating use cases, “not just for customer benefits, but to benefit the grid,” Manghani said. Certain key projects in these bellwether states and around the country are testing these grid management propositions, as we will discuss at the end of this.

Not every single one of these projects links batteries with solar, he noted -- Sunverge’s project with Kentucky municipal utility Glasgow EPB doesn’t, for example. But about 90 percent of the projects GTM Research is tracking do come with solar, and “as the market grows, the value streams for residential storage are largely going to be through time-of-use and load-shifting,” which should strengthen the case for pairing the two, Manghani said.

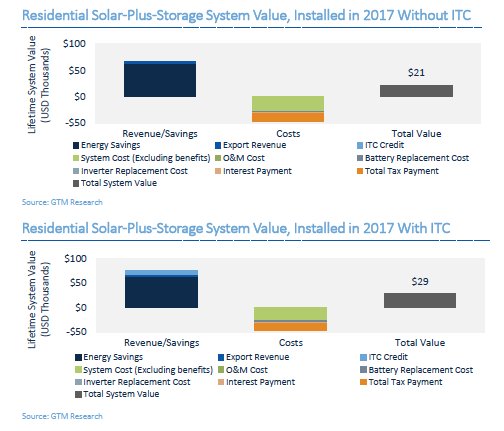

The reauthorization of the federal Investment Tax Credit for solar will also boost the solar-storage combination business case, he added. While the ITC doesn't apply to standalone storage, it does extend its 30 percent credit to the costs of batteries included in qualifying solar projects -- as long as they spend most of their time storing electrons generated via sunlight, not taken from the grid.

Indeed, mixing and matching the incentives for green energy, self-supply, backup power and grid support will be the key for allowing residential solar-storage to grow beyond its current limits, he said. Changes in net metering policies and time-of-use pricing programs will have a significant impact, Manghani said. So will evolving state energy policies, like New York’s Reforming the Energy Vision or California’s Distribution Resources Plan proceeding, that could provide grid values for shifting and firming solar generation on the grid edge.

California: The biggest market with the best numbers

Let’s start with California, not only the state with the most residential solar-storage, but the one with the most detailed installation figures, in the form of the state’s Self-Generation Incentive Program (SGIP) database.

According to data compiled by GTM Research, as of January 2016, 168 residential energy storage projects totaling 820 kilowatts had received an SGIP incentive, and an additional 264 projects, or 1.44 megawatts, had reserved funding. Of that, 1.3 megawatts of total capacity had been interconnected.

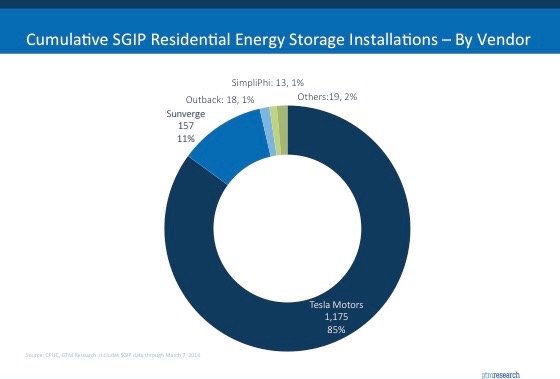

That figure includes some of the inaugural Tesla-SolarCity pilot projects deployed in the early part of the decade, as well as everything that’s come since. And according to the data, Tesla and SolarCity are still the leaders in the field by a long shot, as the following chart shows (figures are in kilowatts).

Tesla is the battery vendor tracked in this chart, but cross-referencing this data against installer data indicates that almost every Tesla Powerwall in the state has been installed by SolarCity. SolarCity, in turn, has networked all of its solar-battery systems for monitoring, and is using its Demand Logic software to actively control its larger commercial-scale deployments to reduce demand charges for its customers.

What its 1,175 kilowatts of residential storage systems are doing at present is less clear. SolarCity has been talking for a long time about the value that aggregated solar-storage systems could provide to utilities and grid operators. But it hasn’t yet publicly disclosed how it might be studying the application of these capabilities in the state.

Coming in second in the SGIP rankings is Sunverge. The San Francisco-based startup lacks the deep pockets of rivals like Tesla and the existing market channels of SolarCity, but it’s been working with utilities, homebuilders and other partners to put its systems in the field. Its biggest project in the state is a 34-home deployment that’s using solar, batteries and home energy management to achieve net-zero-energy status, as well as responding to peak pricing signals from utility Sacramento Municipal Utility District.

Other residential storage vendors on the SGIP list, including Outback Power, SimpliPhi Power, JLM Energy, East Penn and Trojan Battery Company, have fewer than 3 projects apiece, putting them much further back in the pack.

It’s possible that companies like these are installing off-grid systems that aren’t being captured by the utility interconnection applications that GTM Research uses to track installations, Manghani said. “This is a very important distinction, because there are probably thousands of lead-acid batteries getting deployed for pure backup that don't get counted.”

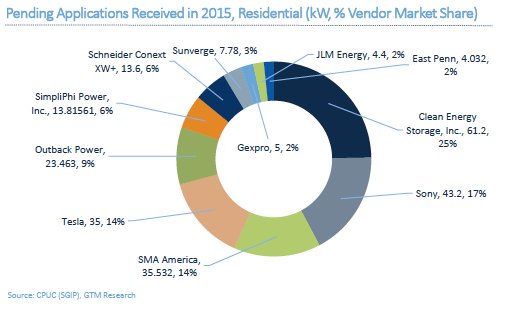

It’s also worth noting that smaller storage players could find partners in the form of the smaller-scale regional solar installers that make up the “long tail” of the residential PV market, he said. We’ve already seen a host of partnerships on this front, including Sungevity and Sonnen, Enphase and Eliiy, Tabuchi Electric and Geli, JuiceBox Energy and Arise Solar, and others. This chart of pending applications for SGIP funds for residential energy storage systems submitted in 2015 shows the scope of the contenders looking at California’s opportunity.

Hawaii: The market where household solar-battery systems pencil out

That’s certainly the case in Hawaii, where a combination of a healthy local solar installer base, high electricity prices and recent changes to net-metering policy that incentivize energy storage are creating a wide-open, if small, market for contenders of all descriptions.

Hawaii was already a hotbed for off-grid solar-storage systems before state regulators replaced its net-metering program last year. The state’s new Customer Self-Supply tariff curtails compensation for solar energy exported to the grid, creating new incentives to store solar power when it’s abundant and then using it to precool the house during the day, or supply energy during evening peak usage.

SolarCity and Tesla are certainly targeting this opportunity. In February, SolarCity launched a combination offering built to suit the new tariff, with solar PV, a Tesla battery, a smart thermostat from Nest and a smart electric water heater from Steffes Corp.

But with a homegrown industry that doesn’t rely on access to state incentives to function, “It’s still very much a fragmented market,” Manghani said. Some notable participants in the state include E-Gear using Eguana Technologies' battery-inverter systems, Blue Planet Energy using Sony batteries, and Haleakala Solar using Aquion’s batteries.

One big contender to watch in Hawaii is Sonnen, the German startup with thousands of systems in its home country, he said. Sonnen expanded into the U.S. in January, and in February announced that its systems have been qualified for installation in Hawaii, the first target market for its residential product.

The federal ITC extension has added significant value to Hawaii’s solar-storage proposition. GTM Research laid out a test case involving 5 kilowatts of solar PV and 10 kilowatt-hours of storage on Oahu under the state’s new self-supply tariff, which found significant improvements in net present value and internal rate of return for the project.

How utility pilots are driving deployments in other states

Outside California and Hawaii, the vast majority of residential solar-storage installations are being driven by utilities. No two are exactly alike, but they can generally be split into two different categories -- those that envision the utility as owner of the assets in question, and those that don’t.

A good example of the former comes from Arizona. Last year, the state’s biggest utility, Arizona Public Service, proposed to test batteries in 75 solar-equipped homes, along with a new set of rates and demand charges. The proposal, approved in January, was part of a broader request to increase the fixed charges that net-metered customers pay. APS has also gotten permission to deploy residential PV as a utility asset, a prospect that solar companies have complained is an attempt by the utility to take their business away from them.

A different utility model is being tried by Green Mountain Power in Vermont. Under a program launched in December, the utility is offering certain customers the option to receive a Tesla Powerwall for no upfront cost, in exchange for monthly payments and the permission for the utility to control the system to meet its grid needs. Vermont, unlike most states with a vertically integrated utility regime, has set up an alternative regulatory structure that allows GMP to try business models like these.

New York’s energy storage pilots under its REV proceeding represent a third alternative. Under a plan submitted in July, Consolidated Edison will initially own the storage systems it’s installing in partnership with SunPower and Sunverge, with a goal of gathering 1.8 megawatts of capacity to serve as a “clean virtual power plant” (PDF). But utility ownership in this case is just a way to get the systems out there, test their technical capabilities, and collect the data required to create the third-party market structures envisioned under REV.

California hasn’t gone as far as New York has in declaring its intentions to create an entirely new distribution network business model based on third-party participation. But it is experimenting with grid-edge aggregation programs, such as the Demand Response Auction Mechanism, or grid operator CAISO’s new distributed energy resource provider structure, which could open up revenues for solar-storage systems.

California’s ongoing proceedings to value distributed energy as an alternative to grid investments could also open up opportunities for residential solar-storage. So far, the utility pilot projects being envisioned for this proceeding would allow utilities a significant level of control over where systems like these are located and who controls them, much as New York’s REV is doing.

But utility San Diego Gas & Electric has proposed an alternative -- a special energy storage tariff to incentivize customers to set up their battery to respond to price signals that will encourage it to store and discharge energy according to system-wide and local grid needs.