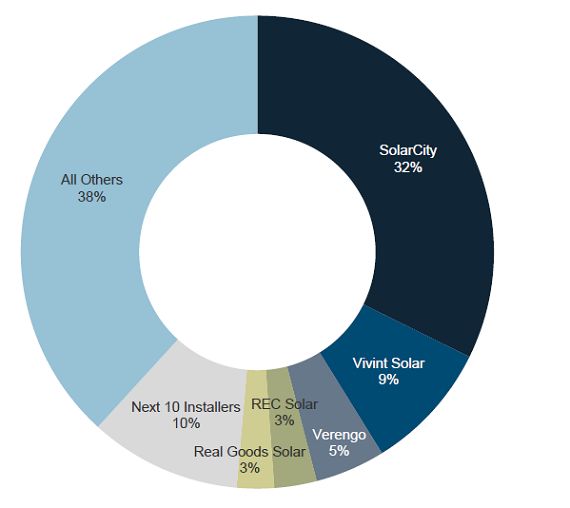

REC Solar’s 65 percent year-on-year growth from Q3 2012 to Q3 2013 beat the overall U.S. residential solar industry’s estimated 49 percent year-on-year growth by a wide margin.

With the industry debating the most cost-effective ways to find potential solar customers, a consultation with REC Solar, a sixteen-year veteran of installation, seemed like a good idea.

“We have tried to keep the small-company passion for solar and attention to detail as we gain large-company credibility,” said REC Solar VP/General Manager Ethan Miller.

Its focus on customer service won REC Solar 4 stars overall from thirteen reviews, giving the company for the highest Yelp rating among solar installers in its California service area. That performance increased referrals for REC Solar by 50 percent in 2013.

“Focus on customer service is a very important key to success, as referrals are the best [and] cheapest source of customers,” explained solar analyst Nicole Litvak, author of GTM Research’s U.S. Residential Solar PV Customer Acquisition: Strategies, Costs and Vendors.

Customer acquisition cost cuts will significantly lower the price of solar, according to Litvak. "Residential solar customer acquisition currently costs installers $0.49 per watt,” her study found. “Over the next four years, this cost will fall to $0.35 per watt, saving the industry a total of $619 million between 2014 and 2017.”

FIGURE: Leading U.S. Residential Installers, Q3 2013

Source: GTM Research's U.S. PV Leaderboard, Q4 2013

Picking the right emerging solar markets is another lynchpin of the REC Solar growth strategy, Miller said. “We don’t want [to bother with] flash-in-the-pan markets, so we’re not always the first into a market. When we go in, we are there for the long run.” In 2013, REC Solar focused on the quadrupling California Inland Empire market, as well as New York and Hawaii.

While 40 percent of solar install orders are canceled industry-wide, only 5 percent of REC Solar’s customers cancel. “When we qualify customers, we are honest and educate them about solar,” Miller explained. “That way, we are more likely to meet their expectations.”

"It's all about education," said Michael Mullen, Roof Diagnostics Solar Sales VP, at GTM’s 2013 Solar Summit. “That's the key to growing this industry -- educating people."

Marketing companies from outside of residential solar are coming, Clean Power Finance CEO Nat Kreamer recently observed, and that will drive growth up and customer acquisition costs down.

An example would be Vivint Solar, which has installed home security systems nationally for twenty years, has big media ties, and has become the second-largest national installer over the last eighteen months. “We acquire customers. That’s what we do," Vivint VP Thomas Plagemann recently said. "We took that customer acquisition engine and applied it to solar.”

The biggest and most cost-effective part of REC Solar’s growth may have come from its strong retail partners program.

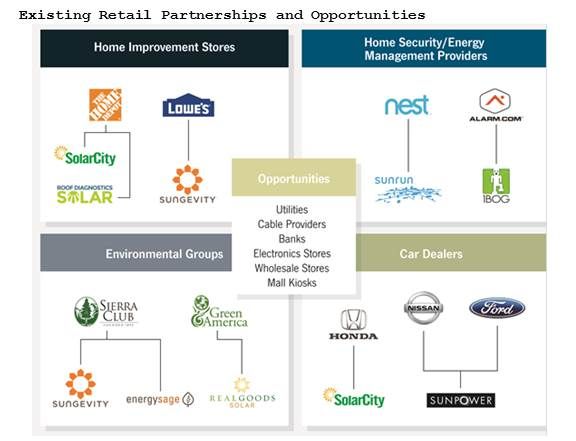

“Retail partnerships are one of the most important emerging trends in the residential solar market,” wrote Litvak in her report on customer acquisition. The biggest successes come from placing sales representatives in home improvement stores. SolarCity and Roof Diagnostics are at Home Depot, and Sungevity is at Lowe’s.

Source: GTM Research’s U.S. Residential Solar PV Customer Acquisition: Strategies, Costs and Vendors.

The cost per lead is higher than it is for referrals, but such partnerships generate more leads and a higher conversion rate, Litvak wrote. Retail partnerships are, however, “much more difficult to establish, as they generally involve larger corporations and therefore a more complicated negotiation process," she explained.

“We look for companies that have similar values,” Miller said of his company’s successful retail partnerships. REC Solar has one “major national big-box retail partner,” he said, which, because of “brand sensitivity,” he declined to name.

Another partnership strategy is with local merchants, Miller said. “If a community has a bath and kitchen retailer with six outlets, we can set up kiosks in their store or parking lot. The sales consultants manning the kiosks can be more effective because they are local. They know the community. They may be members of the Chamber of Commerce, or a customer may trust them because they met at a PTA meeting.”

REC Solar has twenty locations across the country and a sales and field marketing team of several hundred people. Its cost of customer acquisition is very close to the published national average of $0.49 per watt, according to Miller.

“Investing in new tools, in new methods of lead generation like canvassing, and in phone and online marketing can drive growth, but that comes with other sacrifices," he explained. "We want to have the lowest cost, but we want to balance that with our values.”

Finally, some of REC Solar's growth came from providing third-party ownership opportunities for low- and no-down-payment financing, Miller said. That will continue to be where the bulk of the installs are going forward, he added, and REC Solar will get them through its partnerships with Sunrun and Clean Power Finance.