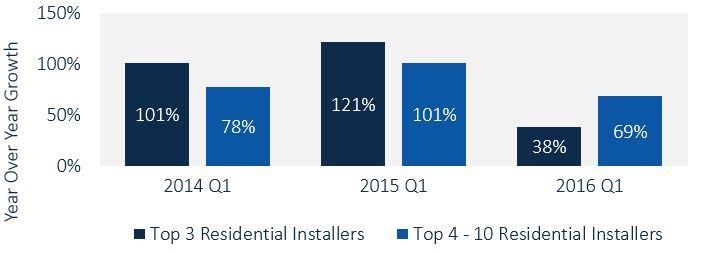

According to GTM Research’s Q2 2016 U.S. PV Leaderboard, regional installers are now growing faster than top national installers such as SolarCity, Vivint Solar and Sunrun. This highlights a trend that has flipped in the past year -- and which could lead to a less consolidated national market.

FIGURE: Growth of Top Residential Installers

Source: GTM Research Q2 2016 U.S. PV Leaderboard

As the top-tier companies have seen a relative slowdown in growth, including leader SolarCity, which recently revised its installation guidance downward, they are also beginning to lose collective market share. The top three national installers today make up 47.5 percent of the residential market, a number that has gradually come down in the last few quarters. At their peak in the third quarter of 2014, these same three installers controlled 53.4 percent of the market, and the top three ranked installers at the time (then SolarCity, Vivint Solar and Repower by Solar Universe) made up 53.9 percent. The combined market share of the current top 10 national installers has grown from 43.5 percent and 54.5 percent in the first quarters of 2014 and 2015, respectively, to 57.8 percent in the most recent quarter. So while the top three players are losing market share, the rest in the top 10 are gaining.

This growth outside of the top few national installers comes at a time when many individual state markets are seeing greater consolidation at the top in recent quarters. The following graph shows the combined market share that the top five installers in each state have held for each quarter over the past few years.

FIGURE: Combined Market Share of Top 5 Installers in Each State

Source: GTM Research Q2 2016 U.S. PV Leaderboard

States such as New Jersey and Massachusetts have seen a steady increase in the combined market share of the top five installers. In New Jersey, over 82 percent of the state market is dominated by just five installers, up from less than 50 percent being controlled by the same five installers a few years ago. In Massachusetts, this percentage has grown from about 37 percent at the beginning of 2013 to 68 percent today.

Other than SolarCity, many of the leading installers in individual states focus their installation efforts regionally rather than nationally, and it is these regional installers that are gaining in national market share.

PetersenDean, for instance, installs systems primarily in California and currently holds the No. 7 spot on the Leaderboard, up from No. 13 just a year ago. Just behind PetersenDean are Direct Energy Solar and Baker Electric, which have also risen in the Leaderboard ranks in recent quarters. Installations by these companies are concentrated in New England and California, respectively. Baker Electric in particular has shown enormous growth, with several quarters of double-digit growth and 1.5x year-over-year growth. This comes in contrast to the top two installers, SolarCity and Vivint Solar, which have experienced slow or negative growth in the last few quarters and much more modest year-over-year growth.

Last quarter, there were almost 450 residential installers that installed more than 75 kilowatts of capacity in the U.S. This long tail is becoming increasingly important as state and regional leaders emerge that break the mold of what it means to be a top solar installer.

***

GTM Research's U.S. PV Leaderboard tracks quarterly market shares for installers, module manufacturers, and inverter suppliers across the U.S. residential and commercial market segments. Contact [email protected] for more information.