Evergreen Solar (Nasdaq:ESLR), a silicon wafer manufacturer, just announced its financial results for the third quarter.

Good News

- Record shipments of 42.6 megawatts compared with 39.8 megawatts in the second quarter 2010, up 7.2 percent.

- Total manufacturing cost at their Devens facility decreased 3.1 percent to $1.88 per watt from $1.94 per watt in the second quarter of 2010. (This could be considered less than good news given the costs of Chinese c-Si-based modules.)

- The firm's new Wuhan, China facility produced 3.4 megawatts of Evergreen-branded solar panels.

- Michael El-Hillow, the new CEO said, "We expect shipments in the fourth quarter to be in the range of about 48 megawatts."

- Revenues for the third quarter of 2010 were $86.5 million, up 2.4 percent compared to second quarter revenues of $84.5 million.

Bad News

- Average selling price for the third quarter of 2010 was $2.02 per watt, down from $2.04 per watt in the second quarter of 2010.

- Gross margin for the third quarter of 2010 was 7.5 percent, compared to 8.6 percent in the second quarter of 2010.

- Operating loss for the third quarter was $22.7 million, compared to $15.5 million for the second quarter of 2010. Operating loss in the third quarter of 2010 increased due mainly to a $6.4 million charge relating to the write-off of a receivable associated with a Korean customer and a decrease in royalty revenue.

This news needs to be viewed through the lens of Evergreen's once high-flying history, which we summarized here. Here are some highlights -- and lowlights -- from that saga:

***

Ten years ago, Evergreen Solar had a successful IPO. Venture investors like Nth Power did very well in that liquidity event.

The solar industry in 2000 was tiny compared to the current market, totaling somewhere in the 175 megawatt range, a figure that pales in comparison to the approximately 15 gigawatts that will ship in 2010. At the time, Evergreen's string ribbon technology seemed to offer an innovative, lower-cost alternative to conventional crystalline silicon growth with the potential to lower the amount of silicon per watt.

But a decade of scaling-up and innovation across the solar value chain would appear to have left the once-lauded Evergreen behind.

In 2009, Evergreen started closing down domestic module production and auctioning off equipment.

That same year, faced with a now non-competitive cost-structure, the firm began moving module manufacturing to a Chinese contract manufacturer.

Sales for the year 2009 were $271.8 million. According to their annual report, total panel cost was about $2.05 per watt in the fourth quarter 2009, down from $3.19 in the first quarter of the year. And that's still too much.

In early 2010, Sovello, the Q-Cells-Evergreen-REC joint venture, on the verge of bankruptcy, was sold to German private equity firm Ventizz Capital.

Earlier this year, Evergreen "received a deficiency letter from the NASDAQ Stock Market stating that, based on the closing bid price of the Registrant’s common stock for the last 30 consecutive business days, the Registrant no longer meets the minimum $1.00 per share requirement for continued listing on the NASDAQ Global Market under Marketplace Rule 5450(a)(1)" (this info was gleaned from the SEC 8K filing). Evergreen has a grace period of 180 calendar days, or until December 28, 2010, in which to regain compliance with the minimum bid price rule.

Also from the SEC filing:

As a possible means of regaining compliance, Evergreen's board of directors has asked that stockholders approve a 1-for-6 reverse stock split at the annual meeting of stockholders. If the reverse split is approved by the stockholders and then adopted by the board of directors, the bid price of the Registrant’s common stock should increase sufficiently to achieve compliance with the minimum bid requirements.

So, the reverse stock split will get the share price over a dollar, but will in no way address the fundamental deficiencies in Evergreen's cost structure.

Over the past year, Evergreen's shares have traded between $0.60 and a 52-week high of $1.87.

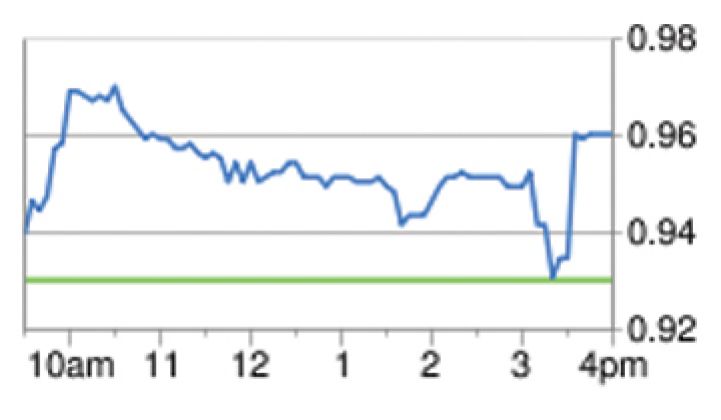

Judging from the SEC insider trading form, Evergreen's directors and staff have been selling their shares a lot more than purchasing stock in their company. The stock is currently at $0.96, up 3 percent, as of Nov 1, 2010.

The Evergreen saga is illustrative of the falling costs in this market, the questionable value and differentiation of an innovative process that doesn't come along with innovative pricing -- and a grave warning to any solar module company with stubbornly high cost structures.