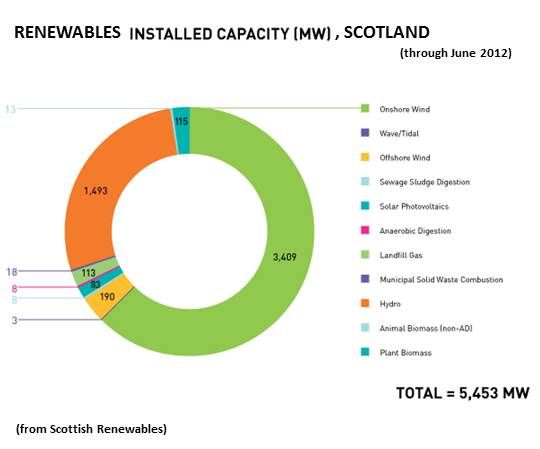

The U.K. is committed to getting 15 percent of its total energy and 20 percent of its power from renewables by 2020. Scotland is committed to getting half of its power from renewables by 2015 and all of its power from renewables by 2020.

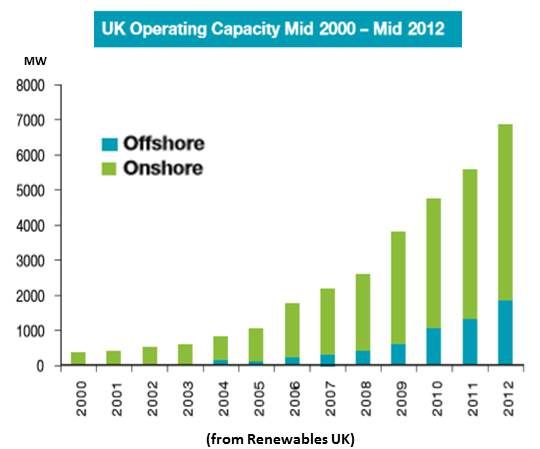

To meet these targets, the U.K. has already built 2.67 gigawatts of Europe’s 4.3 total installed gigawatts of offshore wind. It is estimated the U.K. has the potential to deploy 18 gigawatts of offshore wind by 2020 and 40 gigawatts by 2030.

Scotland has 190 megawatts of installed offshore capacity. Seven projects, representing 10 gigawatts of capacity, are planned. At least four of those gigawatts are expected to be in service by March 2017.

By way of comparison, the U.S. has built no offshore wind and the U.S. Department of Energy’s target is to get “steel in the water” along the Atlantic coast by 2017.

The U.K. has committed itself to bringing offshore wind’s 140 pounds per megawatt-hour price to 100 pounds per megawatt by 2020. That translates to about $0.15 per kilowatt-hour and is price-competitive.

The numbers are big but the names of the multinational energy giants competing in the sector suggests there is a business case informing them. ABB, Alstom, StatoilHydro (NYSE:STO), EDF, Siemens (NYSE:SI), E.ON, Dong and Vattenfall, to name a few, are not corporations which tend to chase fads.

In his welcoming speech at the U.K. Offshore Wind and Supply Chain Conference in Aberdeen, Scotland, Scottish Renewables CEO Niall Stuart noted that recent U.K. energy legislation has clarified many questions, but an important one remains: “What is the U.K. government’s commitment beyond 2020?” The implication was that the offshore wind industry is looking to the U.K. government for policy certainty so investments to build the supply chain and workforce can be made with confidence.

Building offshore wind, Stuart said, “is a key part of the moral and social imperative of addressing climate change.” He quoted Lord Stern, author of the landmark 2006 Stern Report on climate change, saying climate change is “happening faster than I thought, going farther than I thought, having a greater economic impact than I thought, and we need to do more than I thought.”

In the twelve months preceding June 2012, offshore wind investment in the U.K. totaled 1.5 billion pounds. That investment added an estimated 150 million pounds to 600 million pounds to the U.K. economy. In Scotland, Stuart said, offshore wind has already injected 165 million pounds into the economy and created an estimated hundreds of jobs, though the country has barely tapped its projected ocean energy potential of 209 gigawatts, the bulk of which is offshore wind. One of the biggest obstacles is cost. Offshore wind at present is 130 to 140 pounds per megawatt-hour.

Scottish Enterprise CEO Dr. Lena Wilson noted that Scotland has already seen industrial development and job creation from Areva, Gamesa, Samsung and Mitsubishi (NYSE:MTU). “The scale of opportunity is immense,” she said. “Initial costs in the North Sea oil and gas industry were prohibitive but dropped fast,” she reminded. “I ferociously believe we can do that again.”

Scotland First Minister Alex Salmond recalled that Shell (NYSE:RDS.A) had said getting at the North Sea oil and gas resources would require going to “a new and uninvented region of oil technology.” But, he said, seven years later Shell was getting two million barrels of oil from the North Sea, thanks to economic incentives and human ingenuity.

A panel of experts later in the morning talked about some of the offshore wind technologies that will have to change. Cranes may be eliminated. The supply chain must be built and streamlined. Wind resources in deeper waters farther offshore must be tapped. Floating wind turbines are coming.

Shifting offshore wind’s cost curve will definitely be a challenge, Salmond acknowledged, but the U.K., and especially Scotland, has two key advantages. The oil and gas industry already has learned how to work in the harsh environment and deep waters far offshore and it has already built much of the port and transport infrastructure needed to build North Sea wind.

When oil exploration in the North Sea began, Salmond said, there was the hope that the cost curve would move, and it did. “It is remarkable what you can do,” he said, “when your intentions and your mind are focused.”