The year is 2007. Generous subsidy programs in Germany and Spain are driving demand for PV through the roof, and crystalline silicon module vendors are struggling to keep pace. Polysilicon is hard to find, and the little that is available is selling for well over $300/kg. Crystalline silicon modules, at $4 per watt, aren't cheap. Of the three available thin-film options, CdTe and CIGS require significant investment in R&D, are tricky to manufacture at scale, and consequently have potentially lengthy times-to-market. But you can't wait -- there is money to be earned, and earned now.

It was in this environment that the business case for amorphous silicon PV was made. Unlike its crystalline cousin, feedstock (silane) utilization was insignificant, meaning that raw material availability wasn't much of a problem. And unlike its thin-film brethren, a-Si was a relatively mature technology; companies like Sharp and Mitsubishi had already been making this stuff for years. With ready-made manufacturing lines available from vendors such as Applied Materials and Oerlikon, all you had to do was buy the equipment and turn the key (or so you were told), meaning that time-to-market was low, which would allow you to cash in on the current boom. And while manufacturing costs were still considerably higher than the sub-$1-per-watt levels that proponents were claiming (aided no doubt by equipment costs of $2.50 to $3 per watt), well, it didn't really matter. At that time, price was not an issue; if you could make it, you could sell it. The result: a flurry of announcements from previously little-known manufacturers of their entry into the space, many of them Chinese (NexPower, Best, Sunner and Trony being just a few names on the list), and billions in business for equipment vendors.

Fast forward to mid-2009, and things are a little different now. Polysilicon is now cheap and abundant. Manufacturers are running at utilizations of below 50 percent on average. Crystalline silicon module prices have been halved to almost $2 per watt, putting thin-film producers under severe pricing pressure. Bankability, previously not much of an issue, is now front-of-mind for buyers and banks, effectively shutting out new technologies and companies. Whatever opportunity exists in the thin-film arena is pretty much the sole domain of First Solar, which continues to reduce manufacturing costs and expand capacity. By comparison, amorphous silicon has higher costs (a problem exacerbated by low production levels), lower efficiencies (therefore commanding a lower price), and a significant question mark hovering over the long-term ability of companies to honor their warranties. No surprise, then, that 2009 was rife with order cancellations and a near-absence of equipment sales for Applied and Oerlikon. Positive news flow has been hard to come by, and the sorry state of triple-junction producer United Solar (despite the fact that its laminate product is hardly representative of most a-Si companies) has only served to further persuade detractors to dismiss the technology as uncompetitive.

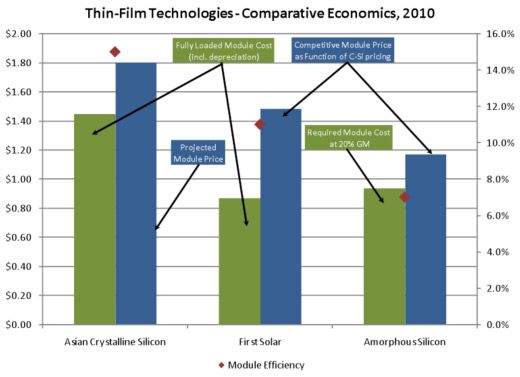

There is a great deal of truth in such dire assessments: few a-Si manufacturers are currently in a position to compete with the incumbent heavyweights. Assuming prices for Asian multicrystalline modules are $1.80 per watt by mid-2010, a competitive efficiency-adjusted price for First Solar is $1.50 per watt (which gives them a healthy margin of 41 percent at current module costs), and that for single junction a-Si is $1.20 per watt. At a gross margin profile of 20 percent, this requires fully loaded costs to be 95 cents per watt. It is safe to say that most a-Si producers are still a ways off from this cost structure (it is true that Chinese single-junction modules are currently selling for $1.10 to $1.20 per watt, but this is likely marginal/cash cost pricing). There is thus much catching up to be done. Adding to this, intra-species competition is also brutal: there was 2.3 GW of a-Si capacity by the end of 2009 itself, with a further 1.2 GW coming online in 2010. When structural oversupply rears its head once again following the German feed-in tariff reductions in July, a large majority of the more than 80 companies in the space will have a hard time solving the dual problems of selling product at a profit and utilizing sufficient capacity.

At the same time, however, obituaries that write off the prospects of the technology altogether are premature. While most a-Si companies remained quiet throughout 2009, there were signs that some manufacturers made progress in key areas, as this December 2009 article by Greentech Media uncovered. With tandem-junction being sold commercially by firms such as Sunfilm, Pramac, and Inventux, thirteen manufacturers are now shipping product with efficiencies exceeding seven percent. Companies such as Signet Solar have won multi-megawatt supply deals, and a number of a-Si projects were completed in 2009, most prominently, Sharp's 6.25 MW project in Mendota. Moreover, key target markets such as India and China (where a-Si has an advantage due to its lower temperature coefficient) are poised for strong growth in 2010 and 2011, and a-Si manufacturers have a strong regional presence there. And on the whole, amorphous companies may be better equipped to deal with the tumult of 2009 and 2010 than their competitors, thanks to their large corporate parents. More so than any other technology, many a-Si producers are subsidiaries of huge diversified conglomerates with deep pockets, providing them a certain degree of insulation from problems that are both external (macroeconomic concerns) and internal (product ramp-up and liquidity) in nature. Examples here include Sharp, Bosch, QS Solar, ENN Solar and Tianwei SolarFilms. Regarding bankability, the concern that a-Si companies may not be around to honor their warranties can be addressed using a simple solution: insurance for the warranty, provided by the combination of regional insurance providers and globally established reinsurers. While this may add a few cents in module costs, the economic security obtained makes a huge difference when it comes to finding project financing, which would in turn undercut incumbents' advantage in this department. Amongst a-Si companies, Signet Solar and NexPower are early adopters, and more are expected to follow.

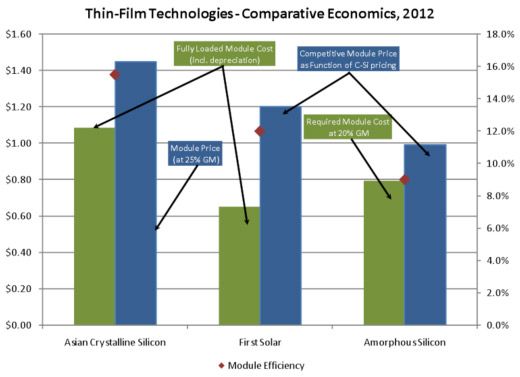

Perhaps most important is the fact that the cost window, while squeezed shut for 2009, may still be open two to three years out. An analysis of likely module economics in 2012 shows that at an Asian multicrystalline module price of $1.45 per watt and a First Solar price of $1.17 per watt, 9-percent-efficiency amorphous silicon would have to sell for about 95 cents to a dollar a watt, implying a fully loaded 2012 cost of about 80 cents a watt. While both cost and efficiency targets are challenging, they are far from impossible; indeed, a prominent manufacturer revealed that they are currently manufacturing single junction product at 8 percent efficiency and expect to be at a dollar a watt by the end of this year. At the very minimum, Sharp and Trony appear to be in a similar boat. This last point signifies an interesting inversion of value proposition: where a-Si's promise once lay in its present (i.e., its ease to manufacture and low time-to-market), its viability is now dependent on efficiencies and costs two to three years from now.

All considered, the possibility that at least a few a-Si manufacturers will emerge as strong challengers to established firms by 2012 cannot be ruled out. With so much attention currently being focused on the competition between First Solar and Asian crystalline manufacturers and the emergence of CIGS from the woodwork (Nanosolar, Miasolé, Solyndra), it is easy for companies to ignore the threat posed by the quiet and seemingly undifferentiated mass of amorphous silicon firms now waiting in the wings. They would be wise, however, to do otherwise.