Future energy scenarios are dependent on assumptions about the prices and scalability of energy sources, often relying on historic learning curves to predict the future costs of various fuels or generation technologies.

But the academic literature has become overly focused on comparing learning curves for different energy technologies, often in an attempt to divine intrinsic economic qualities about different technologies.

In particular, it’s common to highlight the difference between the trends for solar PV panels, which are often described as following Moore’s law, contrasted with nuclear power, where costs appear only to increase over time. But the metric that matters most -- the cost of generating electricity -- appears to follow no guaranteed trend for these technologies, as new data shows.

Solar power has achieved substantial cost declines over the past decade, with module prices plummeting over 70 percent. But the policy cost has been substantial, with deployment programs like feed-in tariffs in Spain and Germany and U.S. net metering encountering serious opposition. Deployment of new solar in Germany has fallen every year for the last three years.

Nuclear power, meanwhile, is assumed to be too expensive to build and even has "negative learning." On the other hand, nuclear power plants provide large-scale, steady baseload electricity once they’re built. When looking at actual costs of generating electricity, nuclear power is still one of the cheapest -- and countries that rely heavily on nuclear power have below-average retail electricity prices.

In our new paper published in Energy Policy, we present a more detailed set of historical costs for nuclear power around the world that show a lack of intrinsic cost escalation. There are a variety of cost trends for nuclear, including recent experiences of cost stability and decline.

Historically, nuclear power plants have been constructed, not manufactured -- built like airports or highways. It seems nonsensical to expect learning-by-doing in a country like the U.S., where dozens of different utilities contract with dozens of different construction firms to build an ever-changing fleet of reactor designs under ever-changing regulation.

Yet this is precisely what many studies assume when they compare the learning curves of nuclear power projects with, for instance, modular solar technologies. Making the problem seem worse, many studies rely on costs from a single country, the United States, and compare to global solar panel prices.

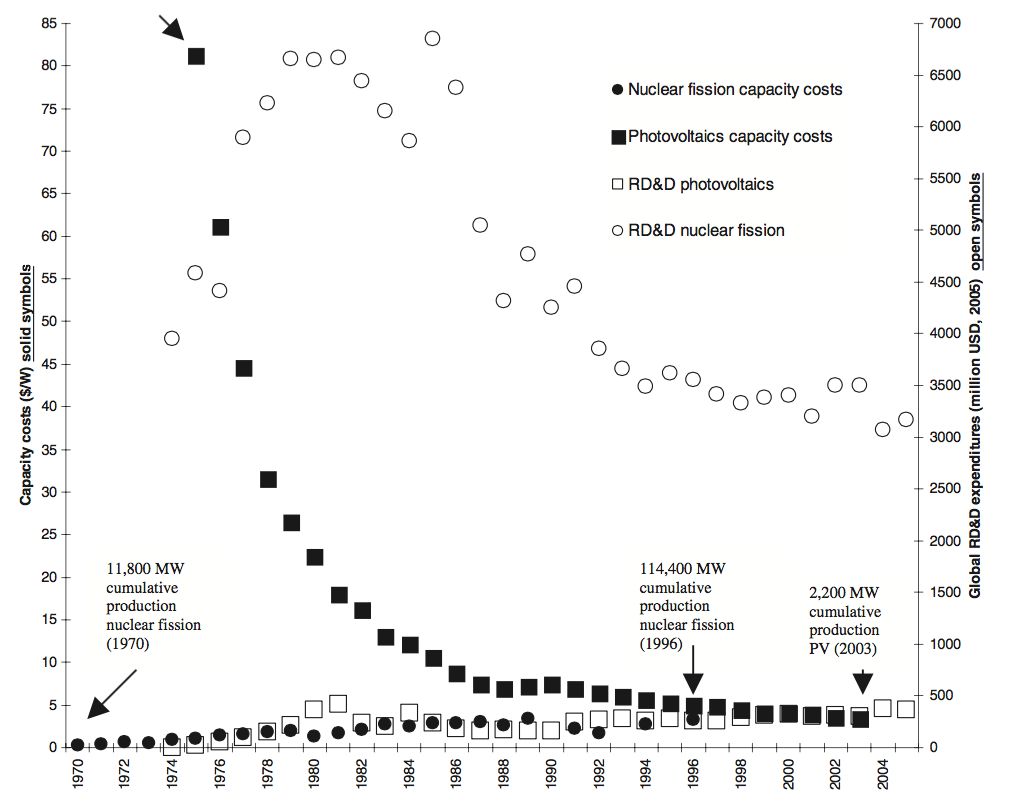

For example, a 2006 paper by Jessica Trancik compares the capacity price of solar panels globally to those of nuclear power plants in the United States. There are several problems with Trancik’s analysis.

One problem is that the solar costs examined are not installed costs, but simply the price for the module, whereas the nuclear costs are the full installed costs. Another problem is that a watt of nuclear power provides about three times as much energy over a year as a watt of solar power. A chart comparing the levelized cost of energy for these two technologies would be more enlightening.

Lastly, the causes of solar’s cost decline are assumed to be learning, but could also be factors such as commodity prices, market dumping by Chinese manufacturers, or increased market competition.

Our new data sheds light on nuclear learning, showing that even this complex technology can improve learning in certain circumstances.

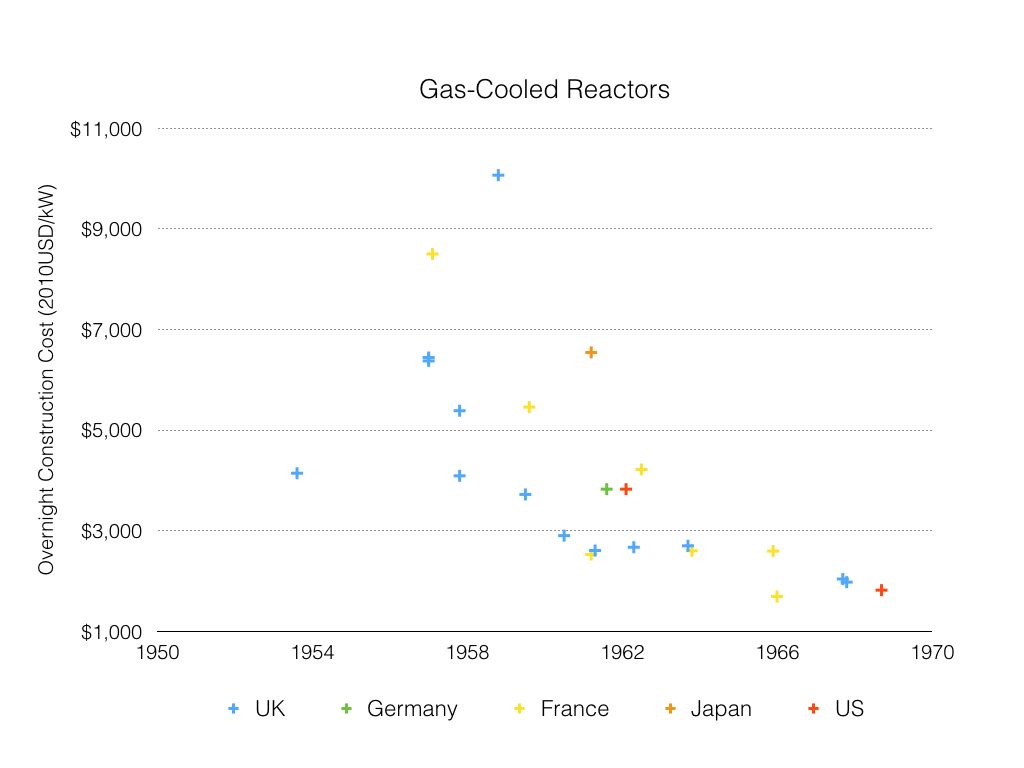

The problem with showing a global nuclear learning curve is that there are hundreds of different reactor types of different sizes, and any trends among specific reactor models are lost. When isolating a single reactor type -- say gas-cooled reactors -- we can see a robust learning trend across several countries. Gas-cooled reactors are simpler designs that are inherently safer, which means they require fewer redundant safety systems.

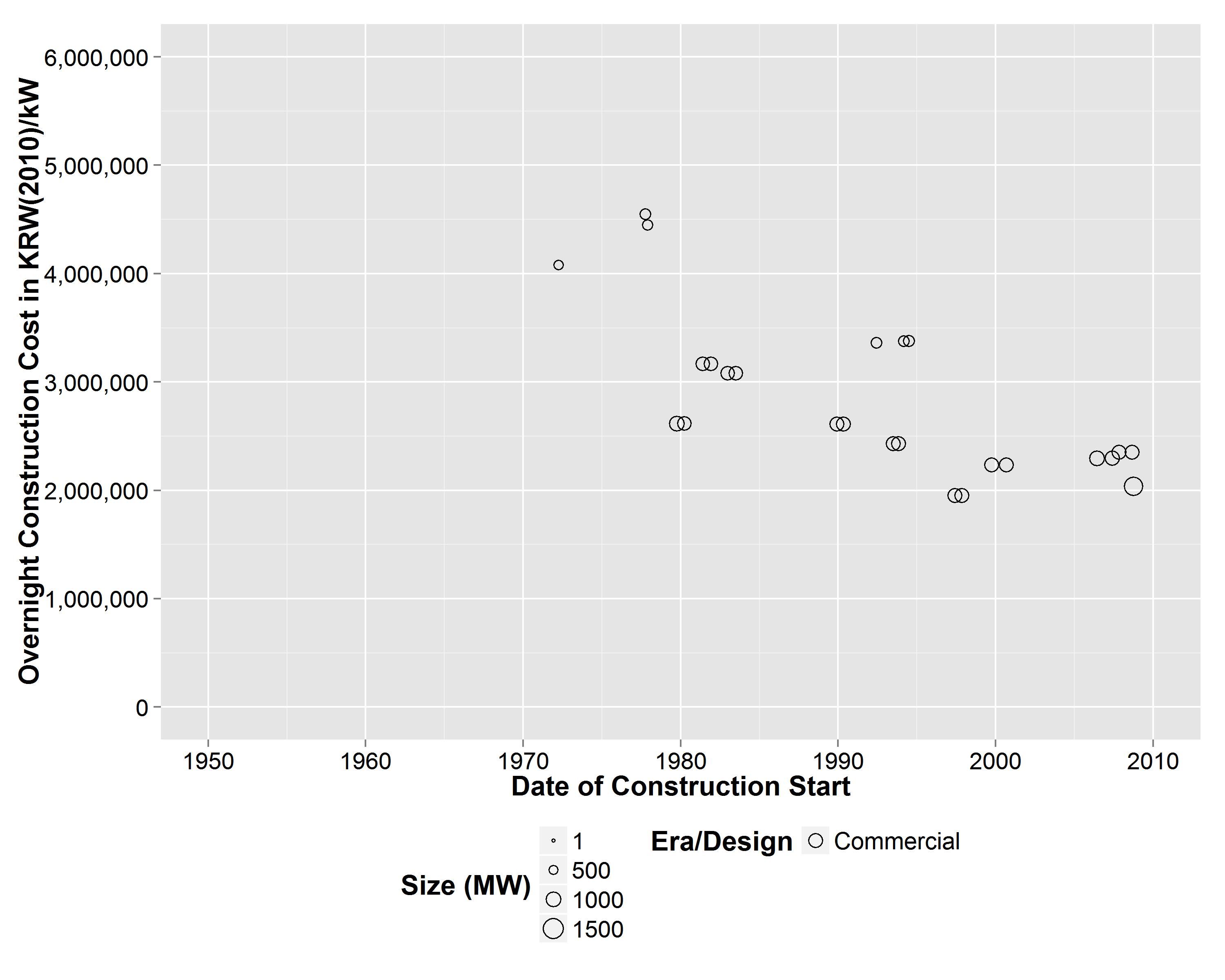

Single countries can show consistent cost declines as well. Just look at the experience in South Korea, shown in the chart below. There are many potential explanations for the positive learning in South Korea’s nuclear industry. Most notably, South Korea usually built reactors in pairs, often with four to eight reactors at a single site. South Korea also has a single utility that owns and operates all the nuclear power plants. It also happens to design and construct all the plants.

But even if we can get truly comparable costs for different energy technologies, it isn’t a true apples-to-apples comparison. Different technologies provide different qualities of energy.

Even if the levelized cost of solar is comparable with the levelized cost of nuclear or coal, utilities might place a higher value on reliable baseload power, and an even higher value for peaking power plants such as natural-gas turbines.

Papers like Trancik’s argue that large baseload technologies can’t experience the fast learning rates that smaller modular technologies can. While this may be true for component costs, renewables may just as well experience cost escalation in installed costs as their market share expands.

Utilities will start to require higher-quality energy from distributed renewables. Both nuclear power and coal power increased in costs in the 1970s in the United States as they had to meet increased demands for safety and environmental standards. As the share of renewable generation continues growing, renewables may face more stringent demands on load-balancing, transmission siting limitations, curtailment to protect migratory wildlife or overload of grid, or phase momentum balancing.

What all this tells us is that power-sector system costs are the most important consideration. Solar and wind have gotten much cheaper in recent years, but their value to the grid declines as they scale up.

Nuclear power provides cheap, reliable electricity, but has proven difficult to finance and construct, especially in deregulated markets. How can we adopt a systemic approach and make sure all our promising zero-carbon power technologies fit together effectively?

Most experts agree that renewables and nuclear both have roles to play in a clean energy future. The question is how to drive progress in different technology categories, and how far the cost declines can continue. While learning rates across energy technologies vary widely, an apples-to-apples comparison adds little insight.

The most pressing question is how we can drive down the costs for reliable, low-carbon power. How do we share best practices across diverse technologies and global industries? And most importantly, how do we ensure that rapidly industrializing countries can develop their domestic energy industries at the end of the learning curve, rather than the beginning?