Many are calling this the end of the nuclear age in America.

When utility partners Santee Cooper and South Carolina Electric & Gas (SCE&G) abandoned plans last month to complete two reactors already under construction, it was widely viewed as a crippling setback for the future of modern nuclear in the U.S.

The V.C. Summer Nuclear Station was meant to represent the next generation of advanced and more affordable nuclear power plants. But it was plagued by delays and cost overruns that developers ultimately couldn’t justify.

“It’s a disaster for the possibility of new nuclear projects being built here,” said John Parsons, an energy economist at the Massachusetts Institute of Technology.

The fate of South Carolina’s reactors signals how bleak the future is for nuclear in the U.S. with the advent of cheap natural gas and competitive renewable energy. At the same time, the U.S. nuclear fleet is aging, and facilities are being decommissioned. Recent closures include California’s San Onofre plant, Wisconsin’s Kewaunee plant, Vermont’s Yankee plant and Florida’s Crystal River plant. New York’s Indian Point facility and Diablo Canyon -- California’s last remaining nuclear power plant -- are slated to close in the coming years.

But the nuclear saga isn’t over just yet.

Georgia is still moving ahead with plans to build the Vogtle nuclear project -- at least for now. Meanwhile, South Carolina stakeholders are just starting to address the damage from the V.C. Summer abandonment. State lawmakers have launched a special session and are seeking to block the utility from making additional rate hikes to cover the incomplete reactors.

Meanwhile, South Carolina Gov. Henry McMaster said Wednesday that companies are interested in buying all or part of state-run utility Santee Cooper, which could reboot the $9 billion Fairfield County nuclear plant expansion, The Post and Courier reports.

All of this is taking place amid heated legal and policy debates over the fate of existing nuclear power plants, and as the Trump administration forms its broader strategy on baseload power and national security -- which could have implications for nuclear.

Energy Secretary Rick Perry recently made the case that there’s value in maintaining nuclear energy expertise on home soil for military purposes. Because the U.S. has withdrawn from the nuclear power sector in recent decades, "the development of our weapons side [has also been] affected,” Perry said. In light of new threats from North Korea, the argument for enhancing U.S. nuclear capability across the board is likely to gain some traction.

"At some point you have to ask, 'At what cost?'"

Market watchers had trained their eyes on the South Carolina and Georgia projects as harbingers of hope for the industry and a potential nuclear renaissance. Both were to be among the first nuclear power built in the U.S. since the 1990s. But each has been dogged by cost overruns, construction delays, and the bankruptcy of Toshiba’s Westinghouse Electric Company, which designed the plants' AP1000 reactors.

Adding to the uncertainty: a glut of cheap natural gas and a flood of increasingly cost-effective renewable technologies.

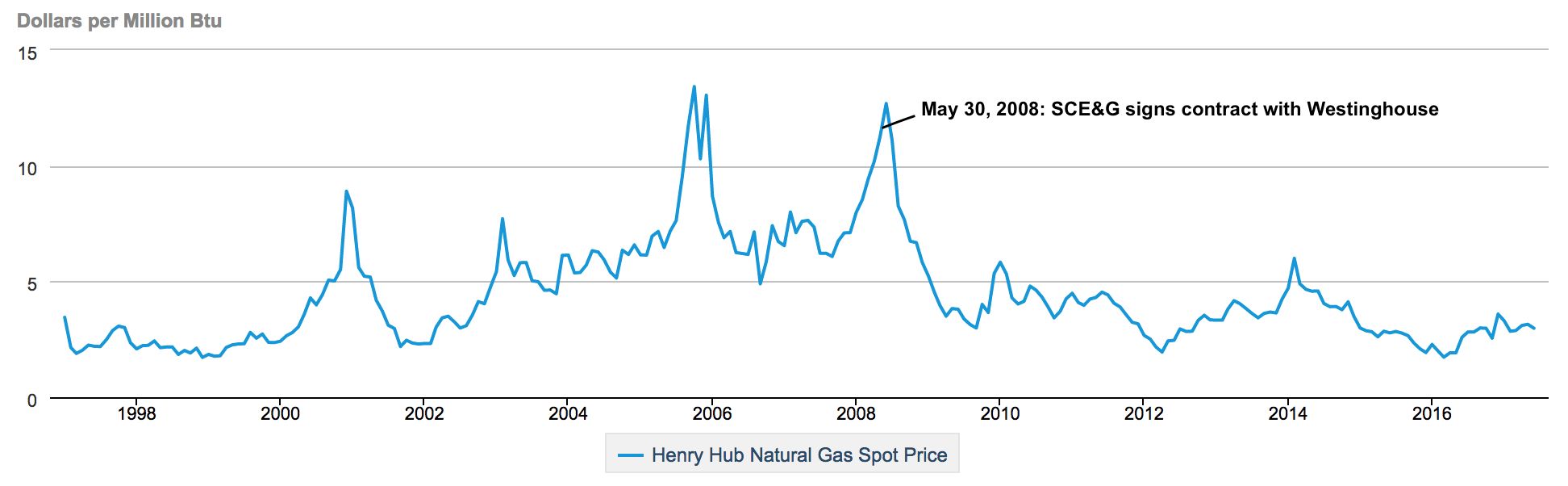

Henry Hub Natural Gas Spot Price

Experts say the future hinges on one integral factor: cost.

“These projects were originally intended to demonstrate the ability of new nuclear projects to be built at a reasonable cost,” said Parsons, who is helping lead an ongoing MIT study on the future of nuclear. “They’re proving the exact opposite.”

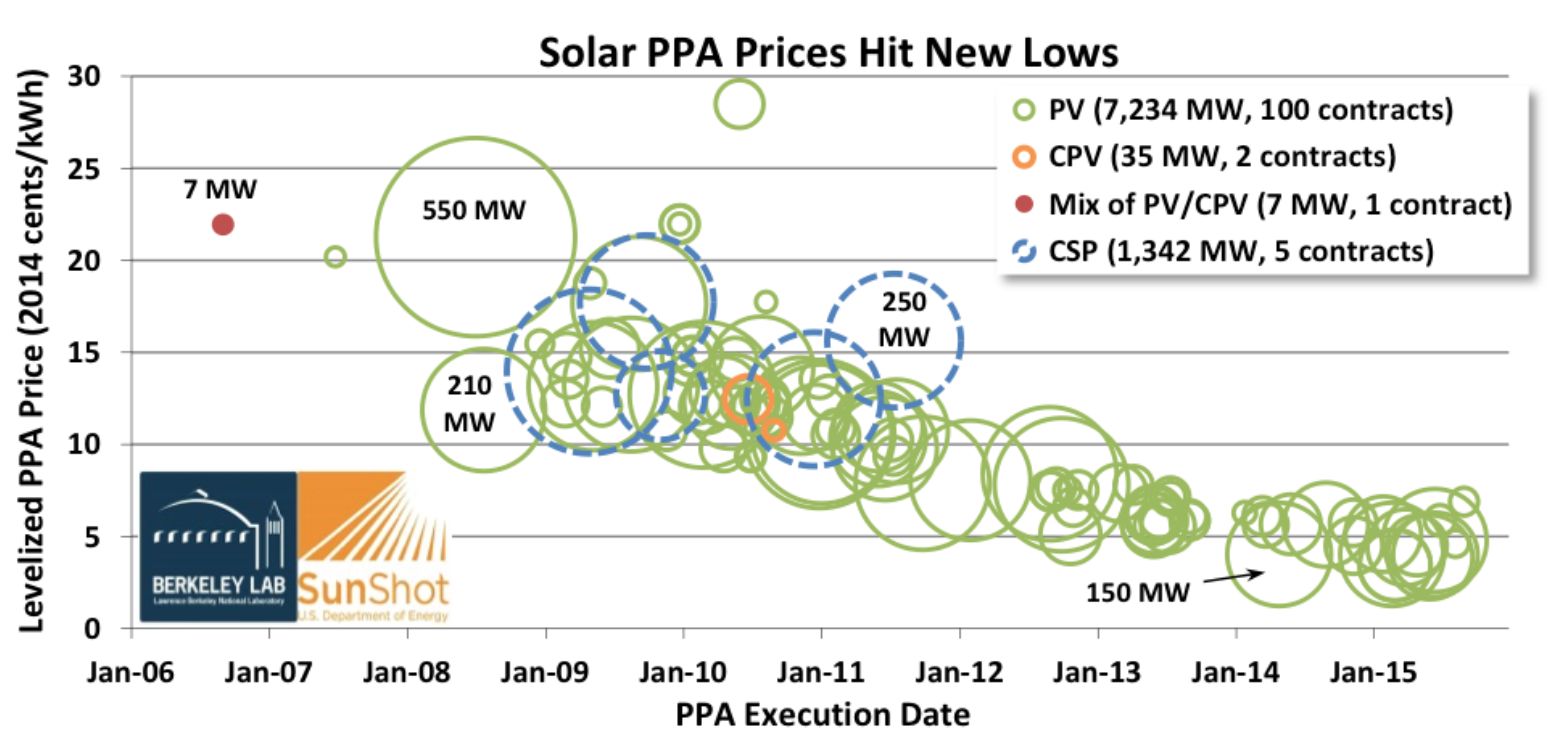

When Georgia and South Carolina signed contracts for their new nuclear projects, natural gas prices were high and volatile, and renewable energy prices weren’t nearly as attractive, said Scott Thomasson, Southeast director for Vote Solar. Today, the cost picture looks very different, he said, and both states have to re-examine their energy options.

“We’re making the point that solar has become more affordable, more accessible and less risky…than these large generation projects,” Thomasson said. “So as these states take a fresh look at the path forward, we’re helping them make sure that solar and renewables are front and center in the conversation.”

“We’re not taking a position against the nuclear projects,” he added. “But at some point you have to ask, 'At what cost?'”

After construction and regulatory snags, the South Carolina project ballooned to a cost of $9 billion and was less than 40 percent complete. Santee Cooper and SCE&G, the two utility partners on the project, originally projected the cost at $11.5 billion. Recent estimates put the price tag closer to $14 billion, but even that number has been called into question.

Adding to customer frustration, a state law passed in 2007 allowed SCE&G to recoup the costs of the new reactors while they were under construction, and even if the work is never completed.

In neighboring Georgia, Southern Company said on an August 2 investor call that finishing the Vogtle plant may set the utility and its partners back as much as $25 billion.

Georgia regulator: "I'm thinking about the future of U.S. safety"

Georgia Public Service Commissioners have attempted to distance their state’s Vogtle project from V.C. Summer’s failed reactors. In Georgia, financing is spread among more companies and the project has a customer base over three times the size of South Carolina’s.

Commissioner Tim Echols said Georgia is also benefiting from a federal loan guarantee, which their neighboring state does not have. “Every time that South Carolina went to Wall Street to get money, they were paying a risk premium,” he said. “We get cheaper money because the DOE's running shotgun with us.”

“It really is apples and oranges between South Carolina and Georgia,” said Echols.

Georgia Power's Vogtle units 3 and 4 under construction

Echols is one of the most ardent supporters of the Vogtle plant -- despite the ongoing challenges. The Republican commissioner is known as a strong renewable energy advocate and a champion of electric vehicles. He believes clean energy is a win-win for Georgia -- “with better air quality, more jobs and lower transmission costs,” he told the Athens Banner-Herald last year. He also believes natural gas should be used to meet his state’s energy needs.

He said he supports nuclear because he sees the limitations of these other resources -- particularly from a national security perspective. Natural gas is delivered just in time for use, which means it would only take a few strategically placed explosions for a U.S. enemy to disrupt the national supply and the broader economy as a result.

“As a regulator, I’m thinking about the worst-case scenarios and the future of our safety, not only of my state, but of our country. [...] I think we need to minimize the risk of grid outages, and the impact that it has, but no one's talking about that. Everybody's just talking about the financial piece of it, and frankly, the only people whose business that is are the people of Georgia, because they're the ones who are being asked to pay for it.”

“I think from a national security standpoint [the Vogtle] plant and many others need to be finished,” he added. “As long as [Toshiba] can stay solvent, I think there's enough strong will within our commission and strong will within Southern Company to push through this and finish the project.”

Toshiba, parent of the bankrupt nuclear technology firm Westinghouse, is due to make its first payment for the Vogtle plant in October as part of a $3.68 billion financial guarantee. But Toshiba is facing its own financial troubles. Echols said Japanese government representatives have assured him they won’t let the company go under. At the same time, the Trump administration needs to pressure Japan not to let Toshiba go bankrupt, he said.

“Donald Trump and the Secretary of State need to do a full-court press, in my opinion, in making sure that the Japanese government props that company up,” said Echols.

“And we have some leverage, because Japan is very dependent upon our warships right now, sitting out there protecting them from a North Korean missile or two,” he added.

Hubris, boondoggles and backpedaling

Southern Company subsidiary Georgia Power is scheduled to complete its latest cost assessment of the Vogtle plant by the end of August, which will be followed by a PSC hearing. The utility’s cost request is already expected to increase by another $1 billion.

Echols said he justifies the cost because, in addition to security concerns, he anticipates that natural gas prices will increase as environmentalists put pressure on policymakers to block hydraulic fracturing, and as the U.S. is beginning to export more of the fuel. That dynamic will make baseload nuclear resources look more attractive. Furthermore, Georgia ratepayers have already invested $4.5 billion in the facility.

“The last thing I want to do to my ratepayers is to say, ‘Look, I spent $4.5 billion of your money, and you have nothing to show for it,’” he said. “That's a formula for getting unelected, as far as I'm concerned.”

John Coequyt, director of Sierra Club’s federal and international climate campaign, said he’s shocked stakeholders remain committed to Vogtle in light of the V.C. Summer experience.

“It was hubris that led these states to believe they could build cost-effective nuclear power reactors,” he said. “Everyone should have known with everything that we’ve seen in the last decades that this wasn’t going to work out and that [the projects] were very likely to become super-expensive boondoggles, which is what’s happening.”

“I find it amazing that a sitting public service commissioner in Georgia would be anything but backpedaling as fast as they could go,” Coequyt said.

Can innovation turn the tide?

Nuclear still provides nearly 20 percent of U.S. power, following only natural gas and coal. But if industry trends continue, that could change, said Daniel Kammen, director at University of California, Berkeley’s Renewable and Appropriate Energy Laboratory.

Many of the globe’s 447 nuclear plants must go offline by 2040, and only 61 new plants are currently slated for construction -- if they can get off the ground. “It’s just a drop in the bucket of maintaining operating capacity,” Kammen said.

Both Kammen and Parsons of MIT say there have to be fundamental shifts in technology or affordability for the market to forgive what happened in the Southeast, which could still happen -- if the industry can get its act together.

Kammen points to technologies like molten-salt and pebble-bed reactors as possible opportunities for the industry. Director of Energy at the nonprofit Breakthrough Institute, Jessica Lovering, said assembly-built modular reactors, like from Oregon-based NuScale Power, could present viable and cost-effective innovation. During his administration's recent Energy Week event, President Donald Trump also ordered a review of U.S. energy policy to help revive the nuclear industry.

But questions remain about whether change will advance fast enough. “People are pessimistic about the future,” said Lovering. “But it could change with the success of the Vogtle project and NuScale.”

Innovations abroad may also turn the tide. The Korea Electric Power Corporation is building a project in the United Arab Emirates that has mostly proceeded according to schedule. China is on its way to overtaking the U.S. in nuclear power capacity as that country’s quest for clean energy has the government investing billions in research and development on new technologies and plants.

"A dagger in the heart"

Though experts are skeptical nuclear can bounce back, they remain hopeful. “The stakes are enormous,” said Parsons. “The more choices we have for clean, economical power, the better it will be for global development and for climate change.”

Echols said he doesn’t understand how the “environmental left” can be so anti-nuclear. “Nuclear is zero-carbon, therefore it can help us,” he said. But he doesn’t anticipate he’ll be able to win over the likes of the Sierra Club, so he plans to remain focused on the tasks at hand.

“People know that I care deeply about renewable energy and that I've promoted it, and that I'm a strong advocate for electric vehicles,” said Echols. “Nuclear power is also an important part of our energy portfolio, and we need to finish [the Vogtle plant]. We don't need to waste $4.5 billion.”

“If Georgia fails, certainly, I think it will be a dagger in the heart of new nuclear power in the U.S.,” he said.