Over the last decade, most of the leading solar markets around the world have faced some kind of dramatic slowdown or freeze after starting out strong.

Germany, Greece, Italy, Spain, Ukraine, and the Czech Republic have all had to suddenly adjust or eliminate incentive programs in recent years due to a frenzy of activity. In some cases, as in Spain and the Czech Republic, the solar industry virtually disappeared overnight after feed-in tariffs were retroactively rolled back.

American states such as Massachusetts, Pennsylvania and New Jersey have also gone through their own boom-bust cycles as incentive programs were changed, or tradable credit markets collapsed.

And then there's California, which has had a much different experience.

While many solar incentive schemes have crashed and burned, California is quietly closing out its own state program two years ahead of schedule -- and hardly anyone has taken notice.

"The program ended with a whimper. The California Solar Initiative did exactly what it was supposed to do," said Bill Stewart, the president of SolarCraft, a solar installer based in Northern California.

The California Solar Initiative (CSI) was created by the state's legislature in 2006 with strong support from then-Governor Arnold Schwarzenegger, who had a vision of putting solar systems on 1 million roofs around the state. The goal of the CSI incentive program, implemented in 2007, was to support nearly 2,000 megawatts of residential and commercial projects by 2016.

Today, the state's investor-owned utilities have exhausted nearly all available incentives through the program, surpassing the initial target by hundreds of megawatts. But unlike in other regions, installers in California are not closing their businesses or complaining about the end of the solar market as incentives disappear. Instead, they're installing projects in record numbers.

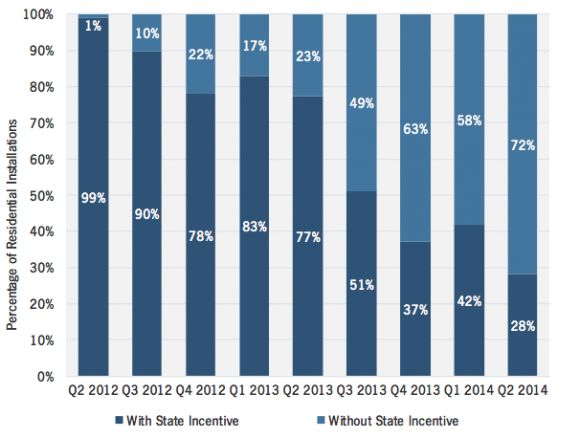

According to data from GTM Research, 72 percent of all residential solar projects in the state were completed without any state incentives in the second quarter of 2014. California installers will deploy more than 1 gigawatt of residential and commercial projects this year, the majority completed without the help of the CSI incentives.

By 2018, California could be installing more than 2.5 gigawatts of residential and commercial systems with zero state incentives.

FIGURE 1: California Residential Solar Installations Without State Incentives

Source: GTM Research

"Solar is still a really good deal for customers," said Stewart, who has long since ceased applying for CSI incentives. Stewart did note that the federal Investment Tax Credit and net metering rules are still essential for making projects work in California, however.

How did California create a program with such a smooth phaseout?

The most important element, according to installers and program administrators, were volumetric reductions in incentives. Every time a certain number of megawatts was deployed, payments stepped down accordingly. That allowed the market to dictate incentive levels, instead of relying on lawmakers or an artificially imposed annual timeframe.

Even when utilities started running through their allotted CSI rebates -- which fell to just a few hundred dollars per residential system last year -- installers never slowed down. That's because solar companies were able to drop their costs and rely less on state subsidies as the market matured.

By contrast, Germany, the world's biggest solar market in terms of cumulative capacity, was slow to make legislative fixes to its feed-in tariff as the market exploded between 2010 and 2013. It is now dealing with billions of euros in yearly costs for contracts signed at the height of the boom.

"It really does speak to the importance of volumetric reductions. It was very predictable," said Katrina Morton, a senior project manager at the Center for Sustainable Energy (CSE), the organization that administered SDG&E's incentives through the CSI.

The shift to a performance-based incentive model also ensured that higher quality projects got built.

“It really does speak to the importance of volumetric reductions. It was very predictable.”

Before the CSI, California's utilities simply issued rebates based on nameplate capacity, with no performance requirements. In 2007, regulators created a performance-based incentive for commercial projects and an "expected performance" rebate for small commercial and residential projects based on geography, tilt, equipment type, shading and solar resource availability. The state was trying to avoid past problems that had occurred when some installers put up shoddy systems as quickly as possible to capture the rebate.

"I was around in the '80s when they had the state tax credit with no guidelines. It got very scammy toward the end," said SolarCraft's Stewart. "We learned our lesson from that, and I thought this program was really well designed."

There was vigorous debate within the industry over whether to establish a pure performance-based model or some kind of rebate structure. Ultimately, a compromise was reached: commercial systems of 100 kilowatts or more would get a performance-based incentive, and systems under that size would get the expected performance-based rebate.

"As the industry got accustomed to it, things started clicking for both residential and commercial in California," said GTM Research solar analyst Cory Honeyman.

Both of those sectors now account for 2,825 gigawatts of capacity in the state, surpassing the initial CSI target of 1,940 megawatts by 2016. And California's solar industry now supports more workers than all of the state's investor-owned utilities combined.

However, for some, the legacy of the CSI is not as clear-cut.

Glenn Harris, CEO of the California solar consultancy SunCentric, believes that factors outside the program contributed to the growth of the state's solar industry far more than the CSI design.

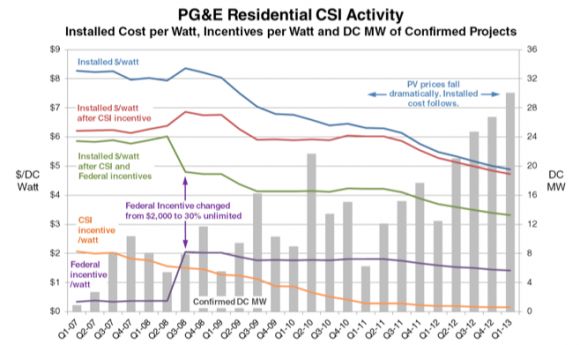

"The CSI program got some lucky breaks," said Harris, who pointed to the eight-year extension of the uncapped federal Investment Tax Credit, the crash in global solar panel prices, and the growth of third-party financing as factors that were more important to the success of the program.

FIGURE 2: External Factors Contributing to Solar's Success in California

Source: SunCentric Consulting

No one disagrees that California got a lot of outside help. But so did every other state with an incentive program at that time, said CSE's Katrina Morton. California had a structure in place to take advantage of those external market forces.

"I think it was the perfect storm," said Morton. "It wasn’t all on the shoulders of the CSI, but [it] certainly had something to do with it."

Harris, who was an early critic of the program's administrative costs and slow uptake during the first year, agreed that the incentives provided a measure of certainty for installers in 2009, during the worst of the economic downturn. "You could definitely say it helped the industry through some of those pains," he said.

“The CSI program got some lucky breaks.”

But it wasn't clear in the beginning how successful the CSI would ultimately become. By October 2008, more than a year and a half into the program, the industry had only installed 90 megawatts of capacity. Harris and numerous installers complained about high administrative costs and long lead times for incentives. They also worried that incentive levels would step down too quickly if companies rushed to submit applications, even if the project never went forward.

"It was, in many ways, an overly burdened government program that made installers into administrators," said Harris. Having a different program administrator for each of California's three investor-owned utilities also added complexity.

Benjamin Airth, a senior project manager at CSE responsible for administering SDG&E's residential incentives, said that the concerns from installers were heard. After a series of town hall meetings with the solar community, program administrators eventually created a paperless application process, streamlined incentive approval, and beefed up customer education and lead generation programs.

"Many of the efficiencies that were implemented were a direct result of installer feedback," said Airth.

The changes worked. After a couple of years of modest growth, the California market eventually began to ramp up. According to a recent report from the Lawrence Berkeley National Laboratory, the CSI realized an incentive pass-through rate of 99 percent. That means almost all incentives were given directly to consumers -- a sign of an effective system.

The results "suggest a reasonably competitive market and, at least from the perspective of incentive pass-through, a well-functioning subsidy program," wrote the authors.

That effectiveness was proven by the lack of news about the program as it wore on. After some initial public concerns, focus on the CSI outside of California largely faded. That, say onlookers, was a very good thing.

"No news is pretty fantastic news for a solar program," said GTM Research's Honeyman. "If it works well, you shouldn't be hearing about it."

Attention has now turned to other issues related to distributed generation in California: net metering policy, storage procurement targets, distribution grid planning, and a bidding process for smaller utility-scale solar plants. Having fulfilled its mission, the CSI is quietly coming to an end -- something that can't be said for many incentive programs around the world.

Although California wasn't installing close to the volume of solar that Germany did between 2010 and 2013, the state created a sustainable market without burdensome legacy costs. It now rivals some of the leading countries in the world in terms of cumulative solar deployment.

Attributing California's solar surge entirely to the CSI would be wrong. But SolarCraft's Bill Stewart believes the program was as influential as any other external factor guiding the U.S. solar market: "Without the CSI, the industry wouldn’t be nearly what it is today."