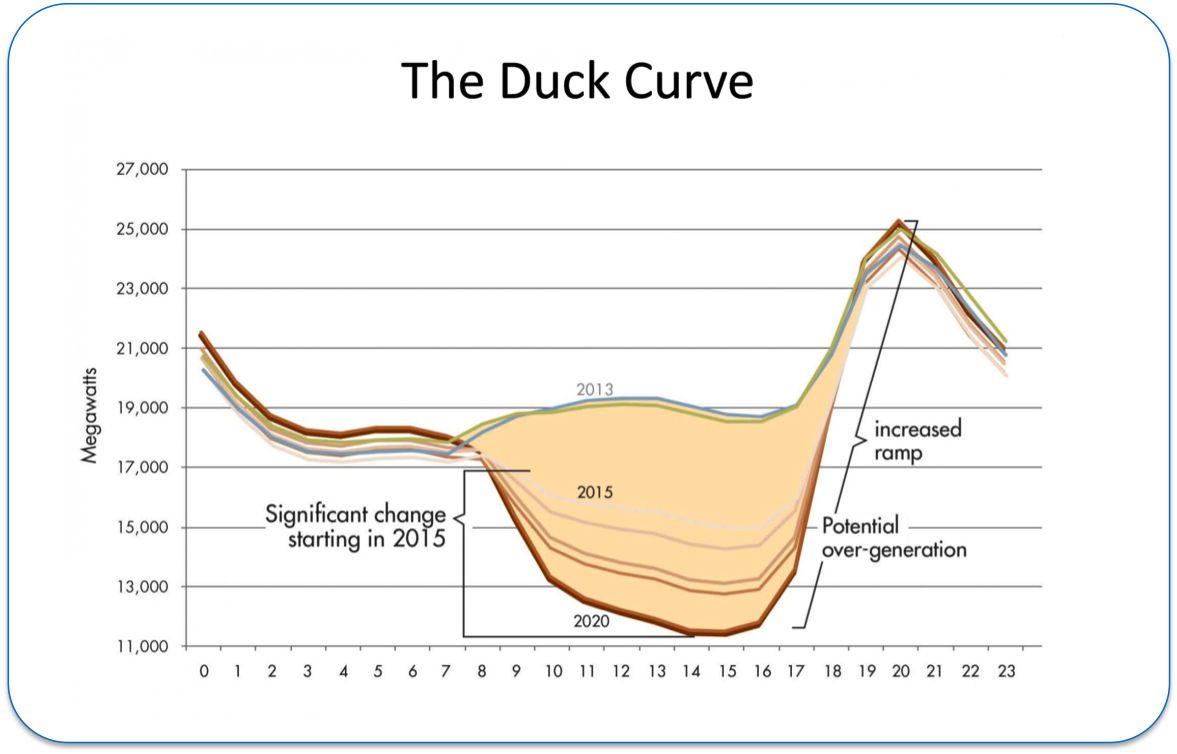

Distributed generation is changing the load shape of the grid. Increasingly, the traditional afternoon peak is being replaced by an afternoon valley, when solar generation is at its highest. The valley period is in turn followed by a steep and problematic peak in the late afternoon, as power from solar generation decreases, people return home from work and school, and residential loads increase.

This new load shape is often referred to as the “duck curve” for reasons which should be clear from the chart below.

Because power plants can’t respond quickly enough to manage this new evening ramp-up, expensive and dirty power sources are kept idling during the day to step in when demand suddenly increases. During the day -- in the duck’s “belly” -- solar over-generates, pushing the cost of energy into negative territory (which means it actually pays to use power).

While energy policy nerds like me have long worried about the hypothetical impact of these changes, we are now seeing the real effects. For California, which has by far the most solar generation in the country and a newly increased renewable energy target of 50 percent, this new reality is here today.

Solutions to this problem will come from a variety of technologies and load management approaches, including storage, demand response, and energy efficiency, to create permanent load shape change. There’s a whole new set of rules, and we are just starting to learn how to play the game.

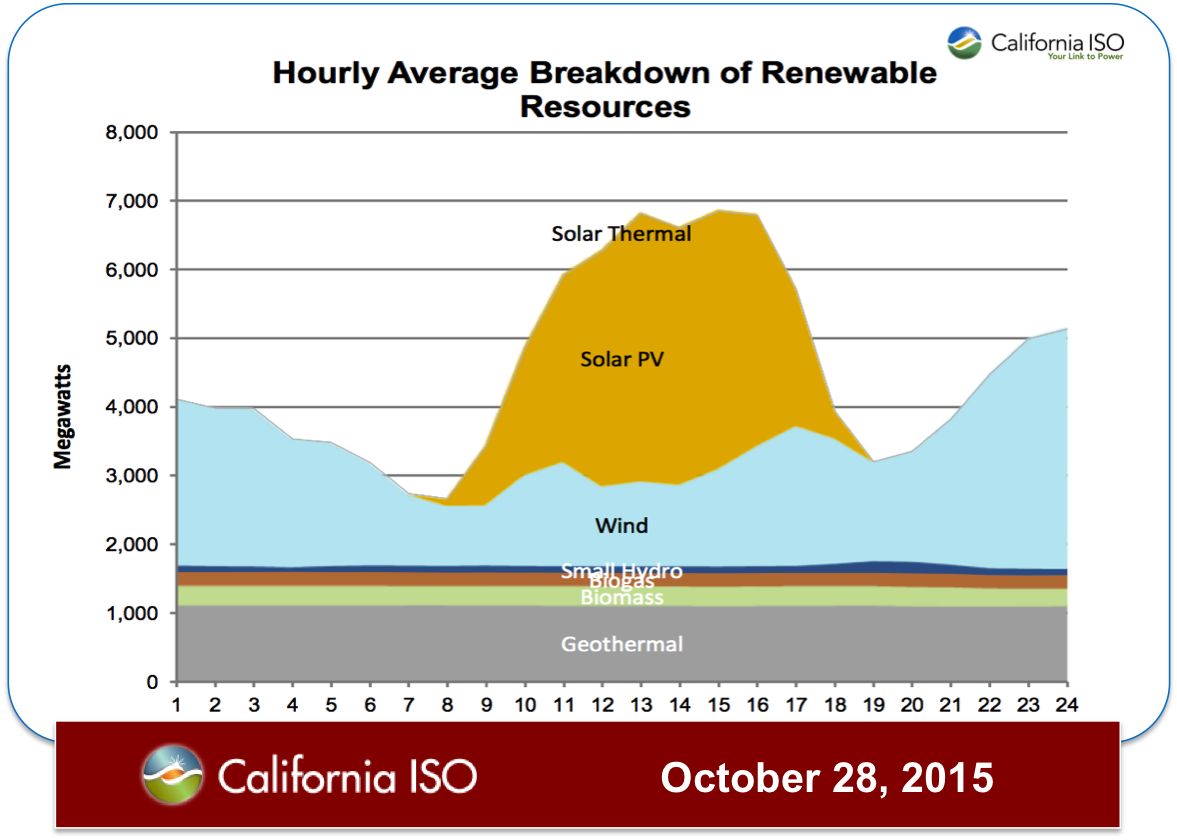

The following charts from CAISO show the mid-afternoon peak generation of renewable resources in California.

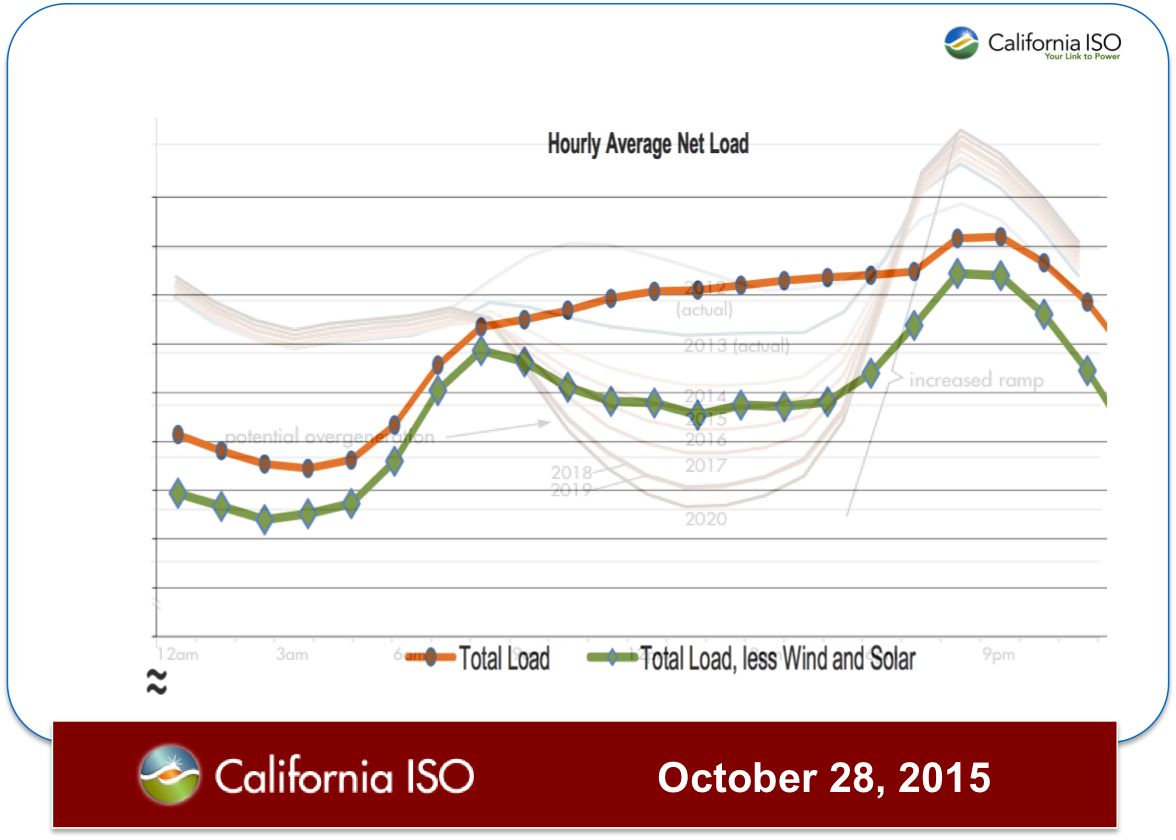

As predicted, this bubble of solar generation is changing the load shape in California. The following chart shows the total load on the CAISO grid and the new shape created by production from renewable resources. As you can see, the “duck curve” is no longer theory, but a daily reality.

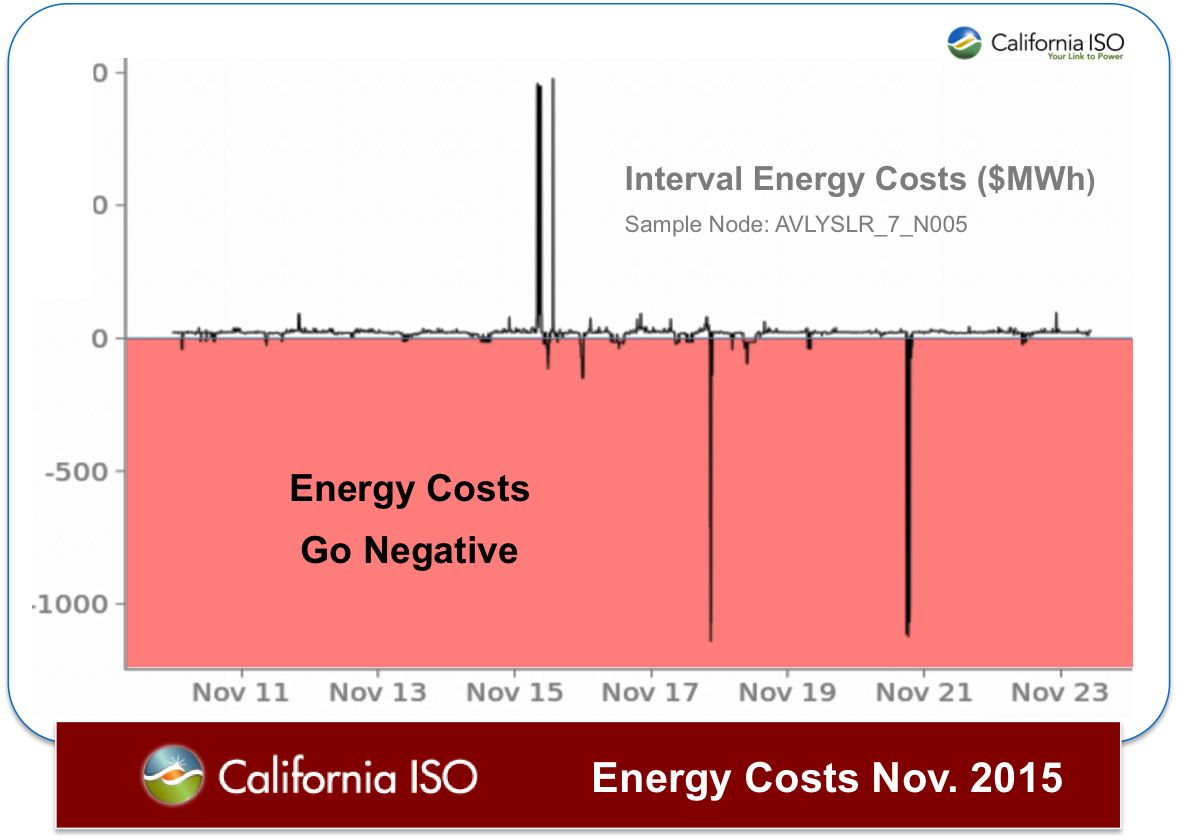

This new load profile is having a dramatic impact on energy prices. The graphic below shows average energy prices over a week in November. Nearly every day, as a result of the new load profile, megawatt-hour costs are dipping into negative territory.

This new load profile is having a dramatic impact on energy prices. The graphic below shows average energy prices over a week in November. Nearly every day, as a result of the new load profile, megawatt-hour costs are dipping into negative territory.

So what does this mean for energy efficiency?

Given this changing load shape, the role of energy efficiency can no longer be a focus on lowering overall kilowatt-hours and British thermal units consumed. Instead, we’ll all have to change the way we think about and deploy energy efficiency. Rather than a measure taken to reduce demand to meet a particular efficiency target, satisfy a performance standard, or fulfill the needs of a utility program, energy efficiency will now have to be treated as actual energy capacity.

It will need to become a form of “supply” that can be deployed in real time to help climb the steep neck of the duck curve.

If efficiency is to be deployed as a resource, we’ll need to know when and where it is occurring with enough confidence to satisfy those making procurement choices and working to keep the lights on.

Doing so requires system-wide data about buildings, energy use, and a new level of transparency about how energy savings are calculated. In California, we finally have those necessary building blocks in place to make this leap possible. In residential efficiency in particular, we have standardized project data using the national HP-XML standard through the CalTRACK process (meaning contractors can pick their software, but all tools can output the same interoperable data set). Thanks to PG&E’s newly released version of its “Share My Data” Green Button solution, it has become simple to access both hourly electric interval data and daily gas consumption through a simple API.

While there’s a lot of work to be done to shift from programs and standards to deployable resources, there’s also a lot of momentum. Efforts like the EDF Investor Confidence Project are helping to design protocols and standards for quantifying the savings of energy-efficiency investments, as is the Open EE Meter, an open-source platform to make savings transparent and available to all market participants. These open protocols, designed to facilitate a competitive market, will also be invaluable to grid operators and planners who can start to count efficiency gains as they make procurement choices.

In this new grid paradigm, energy efficiency’s true potential will shift from baseload savings toward a market-oriented approach, where the value of saving energy at the right times -- and in the right parts of the grid -- will climb dramatically. The opportunity to capture the full value of load shape will have a major impact on the design of efficiency projects and the types of technologies that drive the best returns for building owners and investors.

As an example, in a “duck curve” world, air-conditioning efficiency will no longer be primarily about reducing energy use during the hottest afternoon hours. Instead, grid operators and building managers will need to collaborate on new approaches that use the building like a thermal battery to store cooling energy and coast through the neck of the duck, reducing loads during the most valuable periods.

The eventual mix of load-shaping technologies and business models that provide valuable grid services and save measurable carbon are yet to be fully determined -- and they are evolving too quickly for regulatory processes to keep up. This kind of complexity can only self-organize through competitive markets.

The good news is that energy efficiency is, in general, less expensive than many alternative services available to meet grid demand. Efficiency as demand capacity that delivers permanent load shape change can capture savings that are worth substantially more than current programs. Valuing investments that use efficiency to permanently change load shape will increase its value.

The duck has landed, and it represents a new opportunity for energy efficiency to evolve from simple energy savings to delivering demand capacity as a true grid resource that can help the duck start to fly.

***

Matt Golden is a principal with Efficiency.org, an organization that works with government and industry to close the gap between public policy, private investment and the delivery of energy efficiency to market.