GTM Research just released its preliminary 2015 global PV inverter rankings, in which we found that the inverter market landscape has become increasingly consolidated among leading vendors. While global demand rose 33 percent in 2015, the top 10 PV inverter vendors increased their share of the market to 75 percent of all inverter shipments, the highest total since 2010.

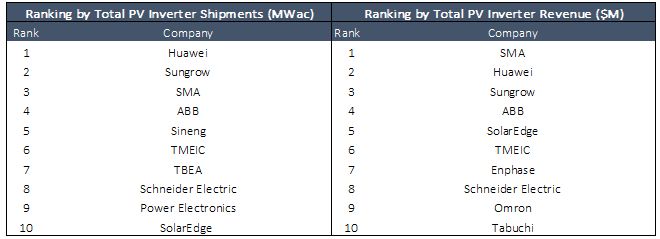

SMA found itself back in the black after multiple years of volume declines and posted losses. While the company is still the clear global leader in PV inverter revenue, it has found itself displaced from the top of the inverter shipment charts as global demand has shifted toward China. According to our findings, Huawei was the leading inverter vendor by shipments in 2015, and four of the top six vendors were Chinese suppliers.

FIGURE: Top 10 Global PV Inverter Vendors by Shipments and Revenue, 2015

Source: GTM Research

(Editor's note: This article's original publication contained an error in the estimation of Schneider Electric's 2015 global PV inverter revenue. The revised estimate moves Schneider Electric from No. eleven to No. eight in that ranking.)

Peering into the black box of China

These figures merit closer consideration, particularly the fact that the top six players in China shipped 25 gigawatts (AC) of inverters to China in 2015 -- an astounding figure for a market that, according to the China National Energy Administration, interconnected 15 gigawatts (DC) of solar during the year.

China, of course, has quickly become the foundation of global demand for solar equipment. One out of every three PV modules connected to the grid last year was installed in China, and while China’s share of the market may shrink this year, it will still absorb a whopping 27 percent of global demand. But rock-bottom pricing has kept most foreign vendors on the sidelines. As a result, the market has consolidated around its leading domestic inverter suppliers as it has matured. According to reported figures, Huawei’s and Sungrow’s domestic shipments in 2015 alone accounted for over 70 percent of shipments to the Chinese market and exceeded the capacity of all projects interconnected during the year.

There could be several explanations for the mismatch. First, we have to consider a potential lag from shipment to installation, where shipments could be delivered to sites that are still undergoing construction in early 2016. The second consideration is the ratio of project installations to project interconnections. While inverters are typically one of the last pieces of equipment shipped, project energization depends on the medium-voltage system, system commissioning grid upgrades, and the interconnection process. Coupled together, there can be a large lag between when inverters leave the factory and when those inverters begin pumping power to the grid. One additional thing to consider is that Chinese developers typically use a 1:1 DC-AC ratio, which means that Chinese systems have greater inverter capacity requirements than do systems in other markets.

Something darker or yet another wild west moment?

There is also the ominous possibility that vendors have exaggerated their figures. A few Chinese vendors have already pointed fingers, claiming that other vendors have inflated their reported figures. GTM Research does ask for verifiable proof of shipment totals and conducts interviews with developers and EPCs on the ground in order to justify product shipment figures that are out of line with the market expectations. However, without visibility into the progress of every project in the ground, verifying shipment totals is difficult at best.

This isn’t the first time we’ve seen greater-than-expected shipments in the inverter market. In 2010, relief of a bottlenecked supply chain for PV power electronics came in the form of a 3.7 gigawatts (AC) global oversupply at the end of the year. Additionally, murky dealings in Italy resulted in as much as 3 gigawatts of projects installed but not yet connected to the grid at year's end 2010. This led to a further disconnect between inverter shipments and project interconnections in that year.

Perhaps most relevantly, during China’s early boom years of 2011 and 2012, we heard similar murmurings of module-shipment claims that were far inflated from the reality of what was being installed. These murmurings primarily came from competitors who simply “couldn’t believe nor trust” what the Chinese competition were claiming.

Making sense of it all

So what does this mean for China? Regardless of shipment totals, it’s clear that China continues to suffer from a massive interconnection bottleneck. Though 15 gigawatts were connected in 2015, over 18 gigawatts of PV was fully installed according to the National Bureau of Statistics of China. China’s slowing electricity load growth, coupled with curtailment of renewables in many regions, may further exacerbate delays for PV connections going forward. This means that 2016 interconnections in China could be massive (north of 20 gigawatts) -- or it could mean that inverter manufacturers will have gigawatts' worth of product in warehouses and in the field that may never see power from the sun.

In either case, there are two clear takeaways for the global inverter landscape. One, don’t start a land war in Asia an inverter business in China as a non-Chinese company. And two, with a strong but hotly competitive base in China, it’s clear that Chinese inverter manufacturers will more aggressively target global markets. Shipments by Chinese inverter manufacturers outside of China exceeded 3 gigawatts in 2015, sold in the U.S. and other markets at a heavy discount to prevailing pricing. That’s not to say that the gig is up for non-Chinese players; after all, both GE and SolarEdge were able to rise 10 spots in our global inverter rankings due to their innovative products. But the stakes are rising, prices are falling, and incumbent inverter vendors must now be prepared to compete with a new class of high-volume, low-cost and technologically capable foreign suppliers.

***

MJ Shiao is the director of solar research at GTM Research. Scott Moskowitz is a solar analyst covering PV systems and technology.

Contact [email protected] for more information on GTM Research's ongoing inverter research.