2002 - 2008: The Promise

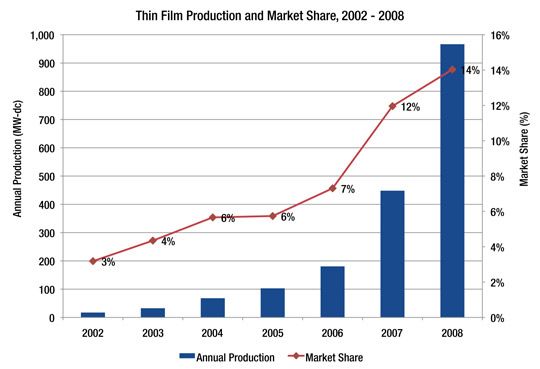

From only 17 MW in 2002 to 966 MW in 2008, thin film's rise over the last decade has been remarkable indeed. Fueled by the greatest success story in the PV industry -- cadmium telluride producer First Solar -- the technology has captured the imagination of industry participants and interested observers alike. First Solar represents the disruptive potential of thin-film PV in full: high throughput (1,011 megawatts in 2009), competitive efficiency (11%), and an industry-leading cost (currently 83 cents per watt), enabling significant profit (the only pure-play solar company to be listed on the S&P index). From market entry in 2002, the company has gone on to become the largest PV module producer in the world. The basis for this remarkable turnaround was a fundamental insight on part of investor/entrepreneur Harold McMaster in the early 1980s: that "the essential cost element of large area solar arrays was glass, and [he] could treat the actual solar cell as simply a different kind of coating on glass." In other words, thin-film PV represented a technology that could be manufactured using glass' high-throughput coating process instead of the slow, cumbersome batch process of traditional crystalline silicon wafer-based PV -- an approach that had one-hundredth the feedstock requirement.

The search for alternative technologies led to a tidal wave of investment and entrepreneurial activity in thin film, with 46 companies entering the market between 2004 and 2008, as well as $1.8 billion in venture capital investment in the space. As market share rose from a mere 3% in 2001 to 12% in 2007, companies spoke confidently of hundreds of megawatts of production at below a dollar per watt being within arm's reach. It was only a matter of time before thin film would replace crystalline silicon as the dominant PV technology, finally enabling the long sought-after dream of grid parity.

2009 - 2010: Trials, Tribulations

Or so the hype went. As of 2010, only one other company besides First Solar -- triple-junction amorphous silicon firm United Solar -- has produced in excess of 100 MW annually. The cost structure of most amorphous silicon, considering its low efficiency, is barely competitive with crystalline silicon, and CIGS producers have encountered technical issues in manufacturing that have forced them to delay commercial production since 2007. To make matters more difficult, capital constraints made banks and developers shy away from thin film in favor of more mature and abundant crystalline silicon modules for projects in 2009. First Solar aside, one would have to admit that the results have yet to live up to the talk. As Asian crystalline silicon PV producers continue to ramp down costs and increase capacity beyond the gigawatt level, the question must be asked: will results ever meet expectations, and if so, when? In other words, will thin film fulfill its potential and make meaningful inroads into the solar energy landscape, creating new markets in the process? Or will it be relegated to a bit-player role in the growth of the global PV market?

2010 and Beyond: Inching Towards Inflection

As detailed in GTM Research's just-published report Thin Film 2010: Market Outlook through 2015, assessing thin film's impact on the global PV market in the years ahead requires an understanding of the factors that influence demand for this technology, and of how these factors interact when determining technology selection in PV markets. After a comprehensive analysis of more than 160 manufacturers, extensive data collection, and analysis that spanned three months, it is possible to trace the evolution of key aspects of the industry over the next three years. The following set of insights emerges as a result.

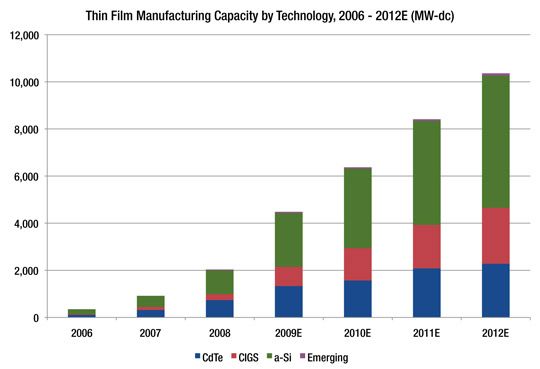

1. Thin film capacity will exceed 10 GW by the end of 2012. Thin film manufacturing capacity grew from just 349 MW at the end of 2006 to over 4.4 GW by the end of 2009, more than doubling every year, which reflected the attractiveness of investment in thin film due to the impact of the polysilicon shortage during that time. From 2010 onwards, the rate of expansion is expected to slow significantly; this reflects more sober plans in the aftermath of global oversupply, low consequent capacity utilization, and the lack of financing. Still, there will be over 10 GW of thin film capacity by the end of 2012, and there is room for upside adjustment if demand grows faster than expected. Amorphous silicon is expected to constitute a dominant majority at 5.65 GW, while CdTe and CIGS will have roughly even capacity share at 2.47 GW and 2.11 GW respectively.

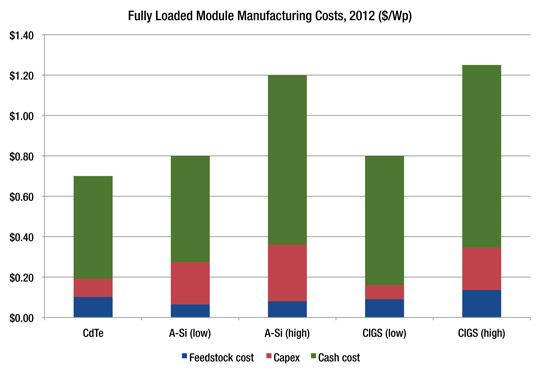

2. Best-practice producers across all technologies will achieve costs of 80 cents per watt by the beginning of 2012, but there will be significant variation across producers. The figure below displays forecasted module costs for the beginning of 2012. CdTe costs are expected to drop to about 70 cents by this time. While possible tellurium price spikes present some risk to these numbers, the threat is limited by a thinner film and higher feedstock utilization from efficiency gains. In the case of amorphous silicon, it is expected that single-junction technology will hit its practical efficiency ceiling (8% to 8.5%) for many producers by 2012, and will start getting phased out thereafter. Tandem-junction, which just began to spread its wings in 2009, will take its place and become more representative of the a-Si market, at 10% efficiency. Costs for these technologies are expected to range from $0.80 to $1.20 per watt. CIGS should show an exponential improvement in costs from 2010 to 2012, due to the commercialization of high-throughput manufacturing through roll-to-roll processes by a few producers. For these firms, costs could be as low as 80 cents a watt. On the other end, smaller fabs that persist with glass substrates could be up to 50% more expensive, at $1.25 per watt.

3. First Solar will continue its dominance, remaining the largest thin film manufacturer in the world over the next three years. First Solar is expected to maintain its lead as by far the largest thin film manufacturer in the world, with over 2 GW of capacity spread across its plants in Germany, France, Ohio, and Malaysia. It will be followed by Sharp (tandem-junction a-Si), Showa Shell Sekiyu, a.k.a Solar Frontier (CIS), Solyndra (cylindrical CIGS), and QS Solar (double junction a-Si). Put together, the 20 largest firms in 2012 (by capacity) made up almost 90% of total thin-film production in 2008, implying that most of the top current producers should continue to be amongst the biggest in the industry in the near term. They also make up almost two-thirds of total thin film capacity in 2010 and 2012.

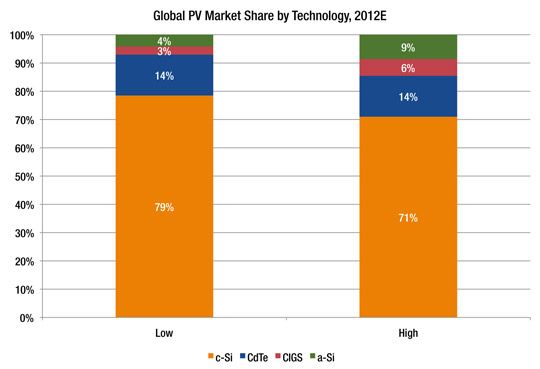

4. CIGS and amorphous silicon (particularly turnkey line production) will likely not see meaningful market share before 2013, after which cost reductions and efficiency improvements will finally start to drive a competitive product offering at an adequate margin. This is also the time horizon required for bankability concerns to be alleviated for thin film companies with quality modules. The chart below displays thin film market share for two scenarios, a "low-penetration" scenario where overall market share stagnates at 21% by 2012, and a "high-penetration" share that assumes a share of 30% by this time. In both cases, there is limited opportunity for a-Si and CIGS producers after assuming 90 percent utilization for First Solar.

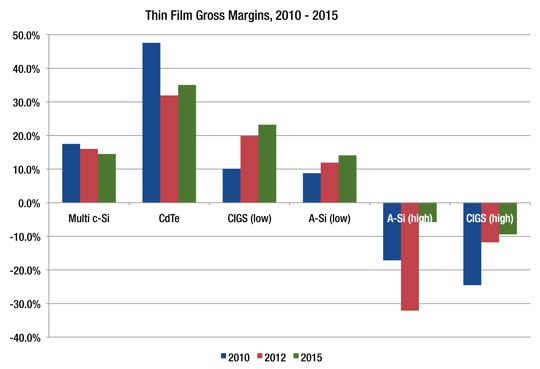

5. High-margin thin film production will be a game played by the select few. A return to "normal" silicon prices over the next five years and the dramatic improvements that Chinese manufacturers have made in conversion cost and silicon utilization will mean that the window of opportunity for thin film is small and is constantly contracting. In particular, amorphous silicon will be a low-margin product for most manufacturers. There is a serious need for producers to differentiate themselves from one another in this space, and those that have had a head start will have a significant advantage in developing differentiated products. Single-junction a-Si will become obsolete by 2012, as its cost/efficiency combination will no longer result in a profitable product.

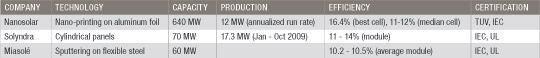

6. All signs point to one of the venture-backed CIGS companies (Solyndra, Nanosolar, Miasolé) emerging as successful representatives of this technology. The future of CIGS as a low-cost technology lies in producing it on flexible substrates at large scale. At the same time, flexible substrates also have lower efficiencies, meaning that continual R&D investment will be required to improve efficiencies and drive competitiveness. For the most part, CIGS on glass will be a niche market. The past year saw three VC-backed flexible substrate firms (Nanosolar, Solyndra, Miasolé) enter into commercial production and achieve key technological milestones. It is likely that most of these companies will fail, but the few successful firm(s) will ramp up production and drive cost reduction in an exponential fashion. At this point, who these will be exactly is far from clear.

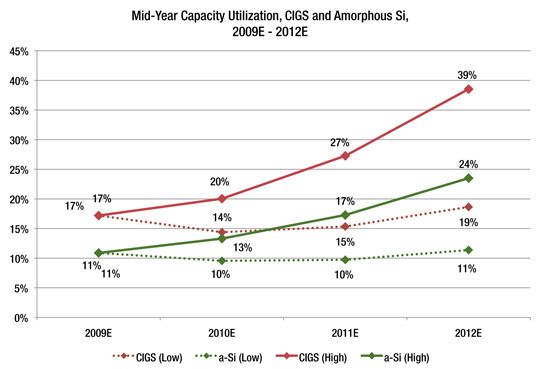

7. The coming years should see a great deal more consolidation than has been witnessed so far in the thin film industry. Many companies that lack the cushion provided by a large corporate parent will lose the race between profitability and solvency. Mid-sized amorphous silicon companies will be especially susceptible to this trend, as there is a natural fit for companies that use equipment from the same vendor (as in the example of Sontor and Sunfilm). In the case of CdTe and CIGS, this will take the form of the selling and licensing of IP assets (as has been witnessed in the case of CIGS startup Daystar). Evidence for this thesis comes from the figure below, which displays mid-year capacity utilizations for CIGS and amorphous silicon.

While GTM Research still sees the thin-film industry as having significant promise, both in terms of altering the global PV as well as the overall energy landscape, the time horizon for this looks to be further off than it seemed in 2007 and 2008. Only past 2013 will thin film adoption, the case of First Solar aside, begin to really take off, and developments over the next three years will play a crucial role in determining the exact pace of this transition.

Lest the delays and difficulties cause the faithful to be discouraged and the skeptics to be dismissive, a little history may shed a lot of light. It was not until 2002, almost 20 years after its inception, that First Solar shipped commercial product. Founder Harold McMaster had confidently predicted that "in five years SCI [First Solar's previous incarnation] will be able to produce a watt of solar energy for 60 cents"; this was in 1998, meaning that he will have been off by more than a decade. In both cases, therefore, success would arrive a lot later than expected. But arrive, to put it mildly, it did.

For more information on Thin Film 2010: Market Outlook through 2015, and to download the executive summary, go here.