If this year’s DistribuTECH conference could be said to have had one overarching theme, it would be that the integrated, interoperable smart grid ecosystem, long promised but yet to be delivered, may be on the verge of becoming a reality.

That’s one takeaway from last week’s smart grid confab in San Antonio, where the industry got a look at some real-world examples of how utilities, grid vendors and IT giants are pushing the boundaries of the traditionally defined smart grid.

We’ve covered some key work on this front, including Duke Energy’s efforts to integrate multiple vendor devices on the edge of the distribution grid, and last week’s “grid devices as applications platform” announcements from two companies vying for the title of smart grid networking kingpin, Silver Spring Networks and Cisco Systems.

But a stroll across the cavernous showroom floor of San Antonio’s convention center revealed a host of new products, platforms and services with similar aims. Consider this an incomplete, yet illustrative, tally of the latest technology seeking to tie these last-mile smart grid interconnections into place.

Connecting the smart meter network to EV chargers, solar inverters

Smart meter vendor Itron had some interesting products on display at its DistribuTECH booth, including two devices not traditionally within its purview: electric vehicle chargers and solar inverters. Both represent important grid-edge endpoints that need to be integrated into the broader smart grid enterprise.

Take the Clipper Creek EV charger on display, which combines revenue-grade metrology with multiple wireless communications and a web display for use by fleet owners or homeowners. The EV charger includes Wi-Fi hotspot access for drivers to obtain charging data from their smartphone, tablet or laptop, as well as ZigBee for connecting to the nearby smart meter’s home area network, John Knuth of Itron told me.

That allows the charger to contact the local smart meter for energy consumption and pricing, among other data points, he said. It also allows the utility to measure the impact of multiple home EV chargers on its local distribution transformers, or even to pass down requests or commands to stop charging to prevent grid emergencies, Tim Wolf, marketing director at Itron, noted.

Itron and Clipper Creek will soon be shipping these devices to buyers, Wolf said. An early test customer is Tennessee Valley Authority, the federal power agency, which is using them to manage its electric vehicle fleet, Knuth said. In fact, Itron’s Web interface added a bucket truck icon to the list of typical vehicles it links to for TVA’s pilot, he said.

The other device is a proof-of-concept solar inverter from Fronius that integrates Itron’s “embedded sensing technology to further the value proposition” for a household solar PV system, Knuth said. While Itron already makes cellular-linked solar meters for PV installers to monitor their systems, this new meter-linked inverter is aimed at providing both homeowners and utilities with solar system insight, he said.

Homeowners can see what share of household power their solar system generates throughout the day, and how that affects their energy bills over time, Stephen Johnson Jr., consumer energy management product line manager, noted. Utilities, for their part, gain a way to monitor customer rooftop solar PV systems that now exist as little more than blank spots on their grid maps. That kind of insight will be critical for utilities like Southern California Edison and San Diego Gas & Electric, both of which use Itron meters, as they move toward meeting the new solar net metering and “smart inverter” regulations in their home state.

Connecting the energy-smart home to grid operators, energy markets

Homes have long been a tantalizing, yet elusive, resource for utilities and grid operators. While smart thermostats, load control devices and even smart appliances can be programmed to turn down on utility command, they’re also under the final control of the homeowner, who may or may not agree to meet the terms of that power-down commitment. Grid operators and energy markets don’t like that kind of uncertainty.

Turning home energy assets into dispatchable grid resources, by contrast, requires real-time communications links to verify exactly how much energy reduction is being achieved on a second-by-second basis. It’s a more expensive and complicated process, but it could yield the ability for thousands of homes to be called upon, much like power plants are today.

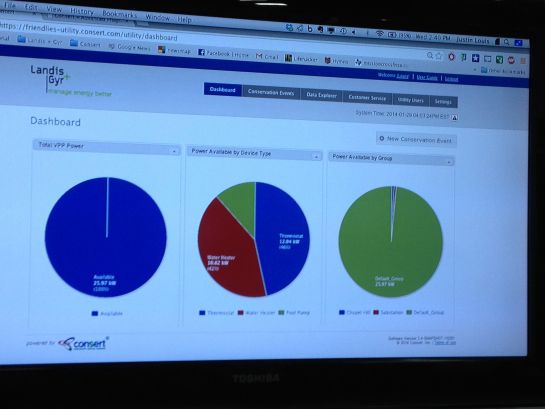

That’s what Consert, the startup acquired by Toshiba’s Landis+Gyr last year, is hoping to prove with San Antonio municipal utility CPS Energy. Consert has linked about 17,000 homes in the city with its cellular-connected energy management systems, which then use ZigBee to control air conditioners and water heaters, with feedback on just how much collective capacity is at the utility's fingertips updated every two seconds, Landis+Gyr’s Justin Louis said.

Consert now has 40 megawatts to 50 megawatts of energy reduction capacity across that fleet of homes, and the company has been able to tap it to help CPS manage grid emergencies this winter, Louis said. Now, with Texas grid operator ERCOT opening certain fast-reacting, grid-critical ancillary services to aggregated loads, that resource will soon be able to bid into this more lucrative energy market program, he added.

It’s among the first mass residential load control programs to attempt this feat, but it won’t be the last, if Open Access Technology International (OATI) has its way. The Minneapolis-based company, a long-time provider of software for transmission grid operations and energy markets, was showing off a new product, called GridControl, meant to connect distributed resources like rooftop solar PV and controllable loads into larger grid operations systems.

Ali Ipakchi, OATI’s vice president of smart grid and green power, described GridControl as “the missing link to tie demand-side distributed resources with the bulk operations” run by grid operators. The link extends from its GridPort hardware that connects to field devices via a variety of protocols, and back to the company’s private cloud computing platform.

While OATI hasn’t said which utility or vendor customers may be using GridControl, one candidate could be Burbank Water & Power. The California municipal utility is working with OATI, Schneider Electric and other partners on a system to integrate renewable generation forecasts and real-time updates into its day-ahead and real-time power purchasing decisions.

“They’ve got renewable obligations, with its variability, and a number of other resources, like storage and other things,” Ipakchi said of Burbank’s utility. “How do you calculate the ramping and response characteristics of these aggregated resources? Those are the kind of things we’re doing, from the demand side, up to the bulk power side.”

The building blocks of the smart grid are stacking up

Finally, it’s worth noting the cross-pollination of vendor devices showing up in each other’s booths at this year's DistribuTECH. Let’s start with Cisco’s booth, where the company’s new IOx platform for opening its grid routers to third-party applications based on Linux is drawing partners from across the globe.

This image includes meters from partner Itron in both North American round (ANSI) and European-Asian rectangular (IEC) form factors, as well as meters from Singapore’s EDMI and several Brazilian companies, including Ecil Energia, M2M Telemetria and Nansen. It’s an interesting indication of potential new target markets for Cisco, which launched its Center of Innovation for smart city work in Rio de Janeiro last year, but hasn’t made specific announcements of smart grid projects in Brazil.

Another device in Cisco’s booth was a distribution power line sensor from Sentient Energy. The Burlingame, Calif.-based startup has largely been associated with long-time partner Silver Spring Networks, and is one of that company’s partners on its newly launched SilverLink Sensor Network. But it’s also connecting via Cisco’s and Landis+Gyr’s wireless mesh, and last week announced it works on cellular CDMA and GSM networks as well -- making it one of many grid sensor companies seeking as many networks as possible to push its particular technology to market.

Then there’s the increasingly complex and expanding world of smart thermostat makers, middleware providers, and utility integration platforms working together to deliver utility-to-home energy connectivity. Now we can add data analytics engines to that mix.

A quick walk past analytics startup AutoGrid’s booth revealed partners like home wireless gateway maker Universal Devices, building and utility technology middleware provider Candi Controls, smart thermostat provider ecobee, and others now connecting to its demand response optimization platform. No doubt, utility service providers like AutoGrid will have their work cut out for them in attempting to capture home energy management market share from telecommunications providers, home security and automation services, and new entrants like Google and Nest.