This is the first piece in a four-part series, offering insights and perspectives from GTM Research's latest Smart Grid report, Electric Vehicles 2011: Technology, Economics, and Market. To see the report's co-author speak on this report at The Networked EV, register today!

Myth #1: Commercial fleets will drive market adoption

Commercial fleets are touted by many as the low-hanging fruit on the route to EV ubiquity. Indeed, fleets possess a number of characteristics that make them prime candidates for electric vehicles, such as route predictability, high utilization rates, and central charging. In addition, fleet managers often look at asset purchases from a total-cost-of-ownership perspective, in which EVs compare most favorably against their conventional counterparts.

So how do these benefits translate into sales potential? In 2009, American fleet owners registered 910,000 new passenger cars and 884,000 new Class 1-5 trucks, increasing the U.S. commercial fleet to 4.8 million passenger cars and 6.1 million trucks. In its most optimistic scenario, the Electrification Coalition estimates that by 2015, as much as six percent to seven percent of fleet segment sales could be plug-in vehicles, equivalent to annual sales of approximately 130,000 units in 2015 and cumulative sales of more than 200,000 in the period 2011-2015 [1]. To put this in perspective, there are currently 246 million light-duty vehicles registered in the United States, and annual sales between 1994 and 2008 averaged 13 million to 15 million vehicles per year. As these numbers highlight, the fleet market may play an important role in the early adoption phase, but is unlikely to be a major source of sustained demand in the future. In other words, car companies seeking large shares of the EV market must win the hearts (and wallets) of consumers, not fleet managers.

Myth #2: The automotive industry will be more fragmented in the future

Electrification has opened a long-closed window for startups to compete in the automotive industry. Companies like Tesla Motors, Fisker Automotive, and Coda Automotive are highly publicized and celebrated upstarts with substantial financial backing and, in the case of Tesla, even successful IPOs. Significant startup activity can also be observed in other sectors of the EV ecosystem, most notably in charging and batteries.

Amidst all the buzz and venture capital enthusiasm, it must not be forgotten that developing, manufacturing, and marketing cars is a time- and capital-intensive pursuit. Importantly, successfully selling cars requires more than a good product. It requires sales and service architectures, reliable warranties, and a strong balance sheet. A case in point is Think Global, which declared bankruptcy due to capital shortages in June 2011 for the fourth time in company history (yet has since been rescued again). Independents have already changed the landscape, but in order to survive and prosper, they will have to get very big, very fast to avoid getting absorbed into a larger player or being driven out of business over the coming years. After all, the automotive industry is about automated production and economies of scale, and small-volume production will only be viable for the most competitive niche players.

Myth #3: Battery switching is the key to resolving range anxiety and reducing cost penalties

Battery switching is a widely promoted solution to alleviate range anxiety, i.e., the fear of getting stranded in an EV without the possibility of recharging. At battery switch stations, vehicles position themselves over a pit with a servo-controlled lift. The battery is dropped down to below-road level, replaced by another fully charged battery, and conveyed to a warehouse for recharging. With battery switching, refueling an EV takes minutes and therefore achieves the convenience of conventional cars. In addition, battery switching enables the decoupling of the battery and the vehicle, eliminating the higher upfront capital costs that EVs currently incur over traditional cars. Vehicle owners would simply enter into a leasing contract with an EV service provider, buying a fixed number of miles over a defined period of time (much like a cell phone contract).

For these reasons, battery switching looks extremely intriguing. The technical and economic challenges, however, are substantial. First, switching stations must be able to handle different battery sizes and shapes as well as different vehicle chassis, adding considerable engineering complexity. This problem is prohibitive so long as there is an absence of industry standards. Second, compatibility also needs to be established across countries (especially in Europe) to ensure cross-border mobility. This requires coordination among charging providers (and potentially utilities) in different jurisdictions. Third, batteries are high-tech devices that are expensive and easy to damage, and which degrade over time. This raises important issues for the commercial arrangement for ownership and safety assurance of the batteries. Fourth, battery switching systems require large amounts of capital for excess battery capacity and switch stations.

A recent study by the University of California, Berkeley puts the battery switching infrastructure required to support 81 million EV drivers by 2030 at $328 billion over the next two decades, amounting to 1.0 percent to 1.5 percent of total U.S. investment [2]. Whether or not such levels of capital expenditure are indeed possible remains highly uncertain. Finally, as battery costs come down over time, taking the battery out of the vehicle for cost reasons loses some of its appeal. This holds true even if the immense technical and behavioral obstacles can be overcome. Therefore, we believe that battery switching will be severely challenged in most regions, and that it is likely to become available in only a few select markets.

Myth #4: The electric vehicle fleet will form a distributed energy storage system

The idea that a distributed fleet of EVs could act as a standby energy storage network is compelling. In the event of a major reduction in power supply, the smart grid would send a message to EVs being charged in that region and instruct them to reverse the power flow. This concept is also known as vehicle-to-grid (V2G).

From technical and commercial points of view, V2G is surprisingly hard to integrate. First, the connection of a small-scale generation source into a distribution network designed for one-way power flow from a central power station requires a redesign of the protection system. Second, drivers will ask for roaming contracts that provide them with compensation for the energy supplied. The administrative requirements of such a system are substantial. Third, even with such contracts in place, drivers would still have to install bi-directional chargers, and utilities would require software to control the process in real time.

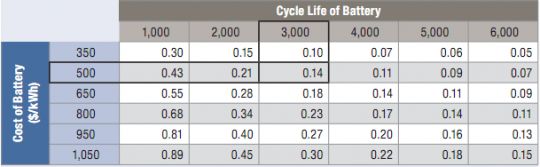

Finally, and perhaps most importantly, frequent cycling has significant impact on battery performance and lifespan. The cost of using V2G power flow is therefore the cost of the electricity with which the battery was charged in the first place plus the marginal depreciation expense per cycle, for which battery owners must be compensated. The table below estimates the cost per cycle at different battery prices and cycle lives. Current batteries cost approximately $500/kWh and last for 3,000 cycles. At these levels, the depreciation charge alone amounts to $0.14/kWh. Add to this the standard residential power price of $0.11/kWh to get to a cost per cycle of $0.25/kWh. The levelized cost of electricity provided by a peaker plant in the United States does regularly exceed $0.14/kWh, but usually only for a limited time. Hence, the value of distributed energy storage comes mainly from the batteries’ ability to provide dispatchable power when it is needed, rather than energy for a prolonged period of time. It remains to be seen how valuable such standby services might be to utilities and how they can be contractually organized with vehicle owners.

Figure: Cycle cost estimate for a 24 kWh battery (USD/kWh)

Source: GTM Research

[1] Electrification Coalition, 2010, Fleet Electrification Roadmap.

[2] Becker, Thomas A., Sidhu, Ikhlag and Tenderich, Burghardt. Electric Vehicles in the United States: A New Model with Forecasts to 2030. Center for Entrepreneurship and Technology, University of California at Berkeley. 2009. p. 36.