Greentech Media just wrapped up its Grid Edge World Forum 2016 conference in San Jose, Calif., featuring more than 1,000 attendees sharing information and insight into the epochal changes overtaking the utility industry. Technology is driving this change, starting with the rise of net-metered rooftop solar, and expanding to include behind-the-meter batteries, plug-in electric vehicles, net-zero-energy homes and buildings, and microgrids, all of which are putting energy into the hands of utility customers for the first time.

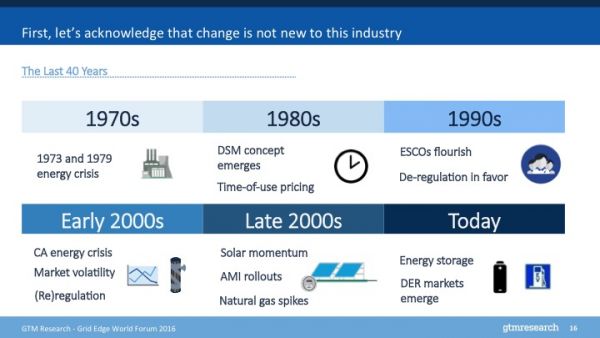

While these technologies are racing ahead, the economic models and regulatory constructs to integrate them into the existing electricity infrastructure are struggling to keep up. That’s not to say that the utility industry has never had to adapt to new conditions, Steve Propper, director of grid edge for GTM Research, pointed out in his Tuesday keynote address.

“Change is not new to this industry,” he said. Those changes include the energy crises of the 1970s and early 2000s, the rise (and fall) of energy deregulation over the past 20 years, the emergence of demand-side management for large-scale energy users and energy efficiency for mass-market customers, and of course, the rise of renewable energy at both utility and distributed scale over the past decade.

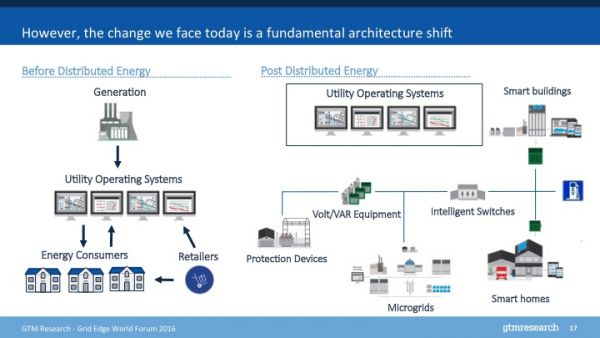

“But what we fundamentally believe is that we are now at a point at which the entire electric system architecture is changing, and we are defining a new future,” he said. That’s because the century-old utility model of transmission and distribution of power from central generators to relatively passive and predictable customers is being challenged.

“Energy consumers are now becoming suppliers,” he said. “All of these have to be somehow or another integrated to the grid through intelligent switches and other utility equipment that needs to be secured and verified and understood and measured. You have microgrids that are popping up, some of which are grid-connected, some of which are looking potentially to island. And you have utility operating systems looking to be...the navigator of all these new assets.”

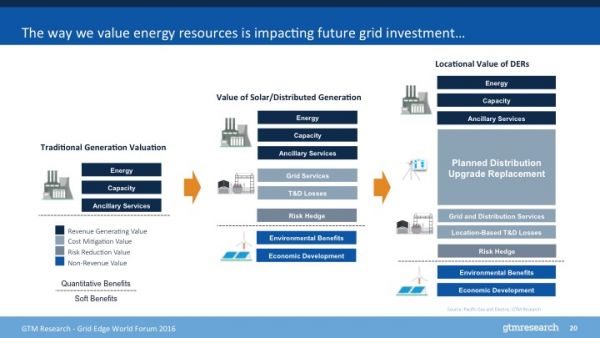

That can be tough for utilities dealing with flat energy demand, as well as rising costs to maintain grid reliability amidst increasing disruptions from intermittent wind and solar power and more extreme weather events. It’s made more complicated by the need to value these new grid-edge resources as much more than merely a competing source of electrons.

This shift is occurring in net-metering policy struggles around the country, as regulators strive to assign the proper “value of solar” to replace the simplistic question of whether rooftop PV should be compensated at retail or wholesale rates. Almost every state in the country took some kind of policy action regarding distributed solar power last year, and more than half have active policy or regulatory agendas specifically addressing distributed energy-grid integration, he noted -- a big change from just a few years ago.

Going even further, vanguard states like California and New York are seeking to incorporate the positive and negative effects of distributed energy into how utilities plan for their long-range distribution grid investments, “Where we see this moving is toward a locational or performance-based value of distributed energy resources.”

“Gone are the days of valuing energy from a commodity perspective,” he said. “Where energy is located, where generation is located, and how that’s contributing both to the stability of the grid, as well as the ability to serve customers, is changing to a decentralized way of valuing that -- and that’s something we find very interesting and exciting.”

All of this is “having an inherent impact on utility business models,” he noted. “Distributed energy resources are shifting value from rates of return on capital to more network and performance-based incentives,” models meant to reward utilities that can make more cost-effective use of these new technologies, or penalize those that don’t.

At the same time, grid-edge technologies are threatening to usurp what has been, at least in vertically integrated markets, the utility’s lock on their customers, he noted. “There’s an opportunity here from the utility perspective and the third-party services provider perspective, to look beyond just kilowatt-hour sales, and create value streams for energy that were never there before,” he said.

“You could see a world in which, for certain customers in certain areas, you could place a premium on reliability, or offer additional services as relates to renewable energy or distributed energy availability.”

To make the right choices in how to align distributed energy with business models, utilities will need data, he said -- and while they’re collecting a lot of it themselves, they can’t rely on their own data resources alone to succeed.

“Technology advancements are also giving customers more power and choice,” he said. “We are moving beyond the meter to the internet of things. You have things coming on-line such as smart thermostats, networked appliances, new services, that with or without a meter, are coming to market, and offering the same opportunity to understand customer usage, grid performance, and the opportunity to upsell and cross-sell new energy products and new services.”