The past four years have seen the flowering of energy efficiency in the commercial and industrial sectors, with new technology, new financial models and old-fashioned bottom-line cost-cutting pressures driving the trend. But what’s the big picture that emerges from this broad shift toward cleaner, greener buildings?

Last week, nationwide energy management firm Ecova released a white paper that helps answer some of those questions. Ecova, a subsidiary of Spokane, Wash.-based utility Avista, manages about $20 billion a year in energy bills for Fortune 500 companies and others, with a client base that adds up to about 8 percent of the country’s power demand, making its big data repository a pretty good benchmark for what’s going on in the energy management sector.

Here are some highlights from the report, which covers changes between 2008 and 2012, along with charts that help explain where the trend lines are headed. Consider it yet another set of data to compare to the trends being reported by government agencies and industry groups, as well as a guide to some of the emerging concerns that face efficiency projects as they move past the low-hanging fruit to more challenging, next-step improvements.

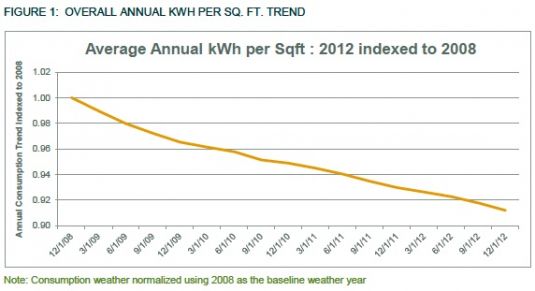

Efficiency comes to those who care about it. Between 2008 and 2012, Ecova’s clients managed to reduce their energy consumption by about 8 percent on average -- a figure that accounts for changes in weather, building usage and occupancy, and other variables, Kathy Montgomery, Ecova’s vice president of client value management and report author, said in a Tuesday interview.

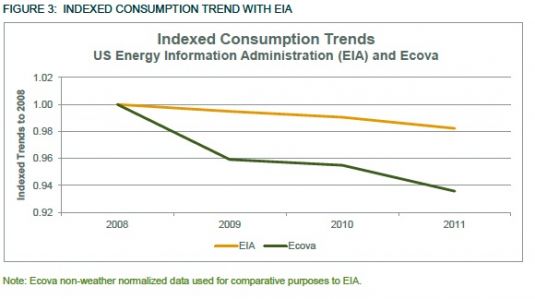

That’s quite a bit better than some of the national figures available to gauge how much more efficient building in general are getting, she noted. In particular, the U.S. Energy Information Administration (EIA), in its tally of efficiency gains for building owners participating in utility efficiency rebate and incentive programs, measured an average 2 percent reduction in energy use between 2008 and 2011, compared to Ecova client’s corresponding 6 percent improvement over the same timeframe.

However, Ecova’s not claiming all the credit for its clients’ better performance, Montgomery said. While it has certainly helped its customers achieve these gains, the very fact that they’ve hired a company like Ecova to help meant they were already more focused on the issue than the average building owner, she said.

Other data points support that common-sense idea, she noted, such as the fact that clients who manage and measure their energy consumption more than once a month tend to make two times as many improvements in energy efficiency overall. Overall, Ecova’s report names a combination of factors for its clients improved performance, including “intensive cost-cutting efforts undertaken by Ecova’s clients, some backed by technology to support utility-sponsored demand reduction programs, often as part of a larger strategic initiative around energy and sustainability management that Ecova has helped to execute.”

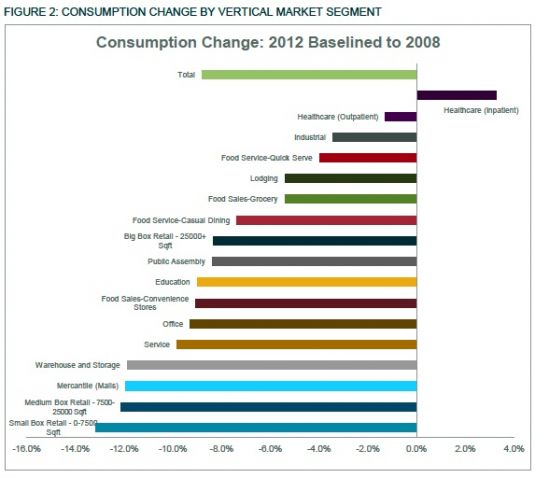

Results vary based on what business you’re in. Not all buildings have the same opportunities or financial incentives for improving efficiency, of course. Ecova’s report breaks down efficiency gains by industry sector from 2008 to 2012, and finds a wide spread of showings, from double-digit gains for small and medium-size retail establishments, to an actual decrease in energy efficiency for health care inpatient facilities (i.e., hospitals).

There are lots of reasons for these discrepancies, Montgomery said. For example, while big-box retailers have long invested in building energy management systems, those technologies have until recently been too expensive and complicated for smaller retailers to deploy, she said. But new technologies that simplify energy management for smaller buildings closing the gap, as we’ve covered here at Greentech Media, with many smaller retailers now able to achieve the two-years-or-less return on investment that’s a typical target for most commercial building energy efficiency projects, she said.

Hospitals, on the other hand, have a very hard time reducing energy use, for various reasons, including already high energy usage, an imperative to save lives rather than seek out cost-cutting measures, and a longer average payback for energy-efficiency investments. At the same time, “Healthcare organizations face significant revenue gaps created by shrinking budgets, declining tax bases, aging facilities, and growing energy costs,” which means that, “by improving energy efficiency, hospitals can generate a new source of capital for investment in facilities, for expansion, or to increase the bottom line.”

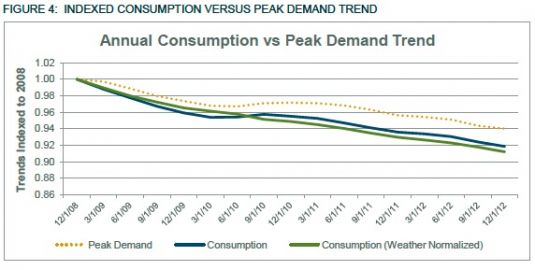

Peak energy demand and load factor are looming challenges. Ecova’s data analysis didn’t just look at overall efficiency gains -- it also studied reductions in peak power use. Overall, from 2008 to 2012, Ecova clients saw a 6 percent reduction in peak power use, a bit less than their overall efficiency gains.

This broad peak power use reduction, however, masks the fact that in a number of industries, clients are “reducing their consumption without impacting peak demand by a comparable factor,” the report states. That’s a problem in many energy markets, because certain businesses that reduce overall energy use, without reducing their peak use at the same time, can actually see a negative effect on their energy costs, due to something called “load factor.”

Load Factor (percent) = [(Total kWh) / (# Days in Bill Cycle x 24 hrs. /day)] / [Peak kW Demand]

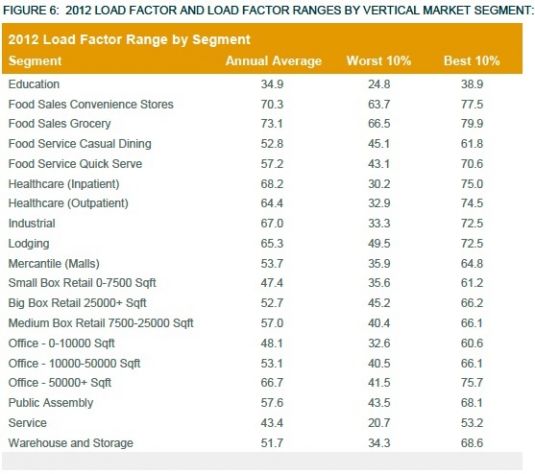

In simple terms, load factor is a ratio of peak power use to average power use, expressed in percentage terms. Depending on what industry you’re in, the load factor ratios can range from 75 percent to 80 percent in grocery stores, cold storage warehouses and other buildings that have always-on power needs, to as low as 40 percent or so for schools, offices or service industries that turn off most of their power use after hours, and tend to use most of their power during only a few hours of the day.

When load factor gets worse as a result of general efficiency improvements -- that is, lowering overall energy use without also reducing peak energy use -- bad things can happen, Montgomery said. Some of Ecova’s retail clients, for example, have seen the energy efficiency gains they’ve achieved erased completely by the increase in demand charges (in regulated energy markets) or capacity obligation charges (in deregulated, competitive energy markets) that come from load factor erosion, she noted.

“Of course, if you’ve done these rebate programs” expecting costs to decline, and then find out load factor erosion has negated those gains, ”you’ve got your CFO asking you, 'What’s going on?'” While industrial clients and others used to calculating energy costs as a core operations cost may be able to manage these complicated unintended consequences, most clients aren’t experts on utility pricing regimes and programs that determine just how big of a deal load factor can become. It doesn’t help that the calculations change from state to state, utility to utility, and industry to industry, based on multiple regulatory factors, she said.

There are things that companies can do to reduce their demand charges at the same time they’re gaining efficiency overall, she said, like shifting work schedules and times at which power-hungry processes occur during the day, or installing equipment to predict and prevent peak power usage from exceeding utility-set limits, she said.

These tend to be much more complicated and intrusive changes to the way buildings are run, which makes them harder to justify than simpler overall efficiency improvements. But with improved efficiency ironically driving load factors lower, and potentially increasing costs in unanticipated ways, “It’s definitely something we’re working with our clients to get them to pay more attention to,” she said.